SunTrust 2009 Annual Report Download - page 47

Download and view the complete annual report

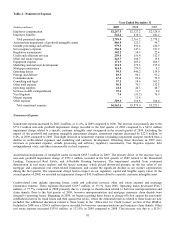

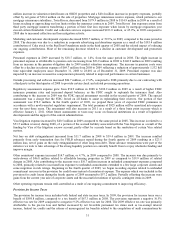

Please find page 47 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.million increase in valuation related losses on OREO properties and a $40.4 million increase in property expenses, partially

offset by net gains of $30.4 million on the sale of properties. Mortgage reinsurance reserve expense, which pertains to our

mortgage reinsurance subsidiary, Twin Rivers, decreased from $179.9 million in 2008 to $114.9 million in 2009 as a result of

losses reaching or approaching our loss limits within the insurance contracts in 2009. Twin Rivers’ loss exposure arises from

third party mortgage insurers transferring a portion of their first loss exposure when losses by mortgage origination year

exceed certain thresholds. Credit and collection services expense increased $103.0 million, or 65.9%, in 2009 compared to

2008 due to increased collection and loss mitigation activity.

Marketing and customer development expense decreased $220.7 million, or 59.3%, in 2009, compared to the same period in

2008. The decrease was due to a reduction in corporate advertising and donations expense as a result of the $183.4 million

contribution of Coke stock to the SunTrust Foundation made in the third quarter of 2008 and the related impact of reducing

our ongoing contributions. Most of the remaining decrease related to a decline in customer development and promotion

expenses.

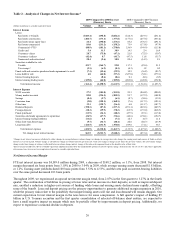

Personnel expenses in 2009 increased by $38.7 million, or 1.4%, from the same period in 2008. The slight increase in

personnel expense is attributable to pension costs increasing from $23.9 million in 2008 to $140.9 million in 2009 resulting

from an increase in the pension obligation due to 2009 market valuation assumptions. The increase in pension costs were

offset by a decline in salaries expense of $69.7 million from 2008 to 2009 reflecting a reduction of approximately 1,332 full

time equivalent employees since December 31, 2008 to 28,001 as of December 31, 2009. Personnel expense was also

impacted by an increase in incentive compensation primarily related to improved performance in certain businesses.

Outside processing and software increased $86.7 million, or 17.6%, compared to 2008 primarily due to our contracting with

a third party in the third quarter of 2008 to provide certain check and related processing operations.

Regulatory assessments expense grew from $54.9 million in 2008 to $302.2 million in 2009 as a result of higher FDIC

insurance premium rates and increased deposit balances, as the FDIC sought to replenish the insurance fund. Also

contributing to the increase in 2009 was the FDIC special assessment recorded in the second quarter of 2009. The special

assessment was a charge that the FDIC levied on all banks to assist in replenishing their reserves. Our portion of that

assessment was $78.2 million. In the fourth quarter of 2009, we prepaid three years of expected FDIC premiums in

accordance with a newly-enacted regulatory requirement. The total premium of $925 million will be amortized into expense

over the next three years. The assessment will also increase in 2011 as a result of a three basis point increase which is

effective January 1, 2011. Other future assessments or taxes may occur on financial institutions as a result of legislative

developments and the support of the current administration.

Visa litigation expense increased by $40.5 million in 2009 compared to the same period in 2008. This increase is related to a

$53.5 million reversal, during 2008, of a portion of the accrued liability associated with the Visa litigation as a result of the

funding by Visa of the litigation escrow account, partly offset by accruals based on the resolution of certain Visa related

matters.

Net loss on debt extinguishment increased from $11.7 million in 2008 to $39.4 million in 2009. The increase resulted

primarily from early termination fees for FHLB advances repaid during the fourth quarter of 2009 resulting in a $23.5

million loss, net of gains on the early extinguishment of other long-term debt. These advance terminations were part of the

initiative we took to take advantage of the strong liquidity position we currently benefit from to repay wholesale funding and

improve margin.

Other noninterest expense increased $14.7 million, or 4.7%, in 2009 compared to 2008. The increase was due primarily to

write-downs of $46.8 million related to affordable housing properties in 2009 as compared to $19.9 million of related

charges in 2008. Also contributing to the increase was a $10.7 million increase in unfunded commitment expenses compared

to 2008, primarily related to increased loss exposure to unfunded commitments extended to a few large corporate clients and

some migration in risk ratings. Beginning in the fourth quarter of 2009, we began recording expense related to unfunded

commitment reserves in the provision for credit losses instead of noninterest expense. The expense which was included in the

provision for credit losses during the fourth quarter of 2009 amounted to $57.2 million. Partially offsetting the increase were

gains from the current year sale of corporate assets and the successful resolution of specific contingent items in 2009.

Other operating expenses remain well controlled as a result of our ongoing commitment to improving efficiency.

Provision for Income Taxes

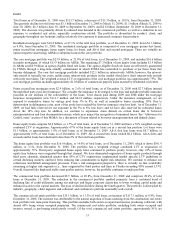

The provision for income taxes includes both federal and state income taxes. In 2009, the provision for income taxes was a

benefit of $898.8 million, compared to a tax benefit of $67.3 million in 2008. The provision represents a negative 36.5%

effective tax rate for 2009 compared to a negative 9.2% effective tax rate for 2008. The 2009 effective tax rate was primarily

attributable to the pre-tax loss and further increased by net favorable permanent tax items such as tax-exempt interest

income, federal tax credits and the release of unrecognized tax benefits related to the completion of audit examinations by

31