SunTrust 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

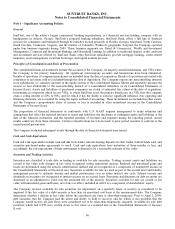

Notes to Consolidated Financial Statements

Note 1 – Significant Accounting Policies

General

SunTrust, one of the nation’s largest commercial banking organizations, is a financial services holding company with its

headquarters in Atlanta, Georgia. SunTrust’s principal banking subsidiary, SunTrust Bank, offers a full line of financial

services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina,

South Carolina, Tennessee, Virginia, and the District of Columbia. Within its geographic footprint, the Company operated

under four business segments during 2009. These business segments are: Retail & Commercial, Wealth and Investment

Management, Corporate and Investment Banking, and Household Lending. In addition to traditional deposit, credit, and trust

and investment services offered by SunTrust Bank, other SunTrust subsidiaries provide mortgage banking, credit-related

insurance, asset management, securities brokerage, and capital markets services.

Principles of Consolidation and Basis of Presentation

The consolidated financial statements include the accounts of the Company, its majority-owned subsidiaries, and VIEs where

the Company is the primary beneficiary. All significant intercompany accounts and transactions have been eliminated.

Results of operations of companies purchased are included from the date of acquisition. Results of operations associated with

companies or net assets sold are included through the date of disposition. The Company reports any noncontrolling interests

in its subsidiaries (i.e. minority interest) in the equity section of the Consolidated Balance Sheets and separately presents the

income or loss attributable to the noncontrolling interest of a consolidated subsidiary in its Consolidated Statements of

Income/(Loss). Assets and liabilities of purchased companies are stated at estimated fair values at the date of acquisition.

Investments in companies which are not VIEs, or where SunTrust is not the primary beneficiary in a VIE, that the Company

owns a voting interest of 20% to 50%, and for which it has the ability to exercise significant influence over operating and

financing decisions, are accounted for using the equity method of accounting. These investments are included in other assets,

and the Company’s proportionate share of income or loss is included in other noninterest income in the Consolidated

Statements of Income/(Loss).

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the

date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual

results could vary from these estimates. Certain reclassifications have been made to prior period amounts to conform to the

current period presentation.

The Company evaluated subsequent events through the date its financial statements were issued.

Cash and Cash Equivalents

Cash and cash equivalents include cash and due from banks, interest-bearing deposits in other banks, federal funds sold, and

securities purchased under agreements to resell. Cash and cash equivalents have maturities of three months or less, and

accordingly, the carrying amount of these instruments is deemed to be a reasonable estimate of fair value.

Securities and Trading Activities

Securities are classified at trade date as trading or available for sale securities. Trading account assets and liabilities are

carried at fair value with changes in fair value recognized within noninterest income. Realized and unrealized gains and

losses are determined using the specific identification method and are recognized as a component of noninterest income in

the Consolidated Statements of Income/(Loss). Securities available for sale are used as part of the overall asset and liability

management process to optimize income and market performance over an entire interest rate cycle. Interest income and

dividends on securities are recognized in interest income on an accrual basis. Premiums and discounts on debt securities are

amortized as an adjustment to yield over the estimated life of the security. Securities available for sale are carried at fair

value with unrealized gains and losses, net of any tax effect, included in AOCI as a component of shareholders’ equity.

The Company reviews available for sale securities for impairment on a quarterly basis. A security is considered to be

impaired if the fair value of a debt security is less than its amortized cost basis at the measurement date. The Company

determines whether a decline in fair value below the amortized cost basis is other-than-temporary. Prior to April 1, 2009,

debt securities that the Company had the intent and ability to hold to recovery and for which it was probable that the

Company would receive all cash flows were considered not to be other-than-temporarily impaired. Available for sale debt

securities which had OTTI were written down to fair value as a realized loss in the Consolidated Statements of Income/

(Loss).

86