SunTrust 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

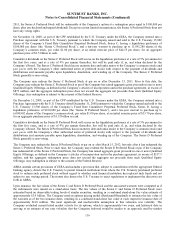

2011, the Series A Preferred Stock will be redeemable at the Company’s option at a redemption price equal to $100,000 per

share, plus any declared and unpaid dividends. Except in certain limited circumstances, the Series A Preferred Stock does not

have any voting rights.

On November 14, 2008, as part of the CPP established by the U.S. Treasury under the EESA, the Company entered into a

Purchase Agreement with the U.S. Treasury pursuant to which the Company issued and sold to the U.S. Treasury 35,000

shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series C, having a liquidation preference of

$100,000 per share (the “Series C Preferred Stock”), and a ten-year warrant to purchase up to 11,891,280 shares of the

Company’s common stock, par value $1.00 per share, at an initial exercise price of $44.15 per share, for an aggregate

purchase price of $3.5 billion in cash.

Cumulative dividends on the Series C Preferred Stock will accrue on the liquidation preference at a rate of 5% per annum for

the first five years, and at a rate of 9% per annum thereafter, but will be paid only if, as, and when declared by the

Company’s Board. The Series C Preferred Stock has no maturity date and ranks senior to the Company’s common stock (and

pari passu with the Company’s other authorized series of preferred stock) with respect to the payment of dividends and

distributions and amounts payable upon liquidation, dissolution, and winding up of the Company. The Series C Preferred

Stock generally is non-voting.

The Company may redeem the Series C Preferred Stock at par on or after December 15, 2011. Prior to this date, the

Company may redeem the Series C Preferred Stock at par if the Company has raised aggregate gross proceeds in one or more

Qualified Equity Offerings, as defined in the Company’s articles of incorporation and in the purchase agreement, in excess of

$875 million, and the aggregate redemption price does not exceed the aggregate net proceeds from such Qualified Equity

Offerings. Any redemption is subject to the consent of the Federal Reserve.

On December 31, 2008, as part of the CPP established by the U.S. Treasury under the EESA, the Company entered into a

Purchase Agreement with the U.S. Treasury dated December 31, 2008 pursuant to which the Company issued and sold to the

U.S. Treasury 13,500 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series D, having a

liquidation preference of $100,000 per share (the “Series D Preferred Stock”), and a ten-year warrant to purchase up to

6,008,902 shares of the Company’s common stock, par value $1.00 per share, at an initial exercise price of $33.70 per share,

for an aggregate purchase price of $1.35 billion in cash.

Cumulative dividends on the Series D Preferred Stock will accrue on the liquidation preference at a rate of 5% per annum for

the first five years, and at a rate of 9% per annum thereafter, but will be paid only if, as, and when declared by the

Company’s Board. The Series D Preferred Stock has no maturity date and ranks senior to the Company’s common stock (and

pari passu with the Company’s other authorized series of preferred stock) with respect to the payment of dividends and

distributions and amounts payable upon liquidation, dissolution, and winding up of the Company. The Series D Preferred

Stock generally is non-voting.

The Company may redeem the Series D Preferred Stock at par on or after March 15, 2012, but only after it has redeemed the

Series C Preferred Stock. Prior to such time, the Company may redeem the Series D Preferred Stock at par if the Company

has redeemed all of the Series C Preferred Stock, the Company has raised aggregate gross proceeds in one or more Qualified

Equity Offerings, as defined in the Company’s articles of incorporation and in the purchase agreement, in excess of $337.5

million, and the aggregate redemption price does not exceed the aggregate net proceeds from such Qualified Equity

Offerings. Any redemption is subject to the consent of the Federal Reserve.

ARRA amends certain provisions of EESA and includes a provision that, subject to consultation with the appropriate Federal

banking agency, directs the U.S. Treasury to permit financial institutions from whom the U.S. Treasury purchased preferred

stock to redeem such preferred stock without regard to whether such financial institution has replaced such funds and not

subject to any waiting period. The statute also directs the U.S. Treasury to enact regulations to implement the directives set

forth in ARRA.

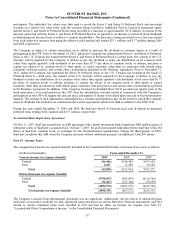

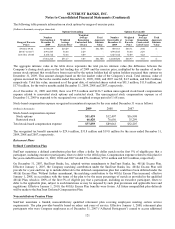

Upon issuance, the fair values of the Series C and Series D Preferred Stock and the associated warrants were computed as if

the instruments were issued on a stand-alone basis. The fair values of the Series C and Series D Preferred Stock were

estimated based on observable trading levels of similar securities, resulting in a combined stand-alone fair value estimate of

approximately $3.9 billion. The Company used an options pricing model (Bjerksund-Stensland) to estimate the fair value of

the warrants as of the two issuance dates, resulting in a combined stand-alone fair value at each respective issuance date of

approximately $110 million. The most significant and unobservable assumption in this valuation was volatility. The

Company evaluated current listed market activity for its options, which is approximately two years, and historical data in

arriving at an estimate of ten year volatility that the Company believed would be similar to an approach used by market

116