SunTrust 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

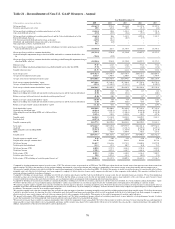

Total noninterest expense increased $33.3 million, or 1.2%, from the same period in 2007. The transfer of middle market to

CIB decreased expenses approximately $24.9 million. In addition, the continuing positive impact of expense savings

initiatives, lower amortization of intangibles and impairments, was offset by higher credit-related expenses including

operating losses due to fraud, other real estate, and collections, as well as continued investments in the branch distribution

network.

Corporate and Investment Banking

Corporate and Investment Banking’s net income for the twelve months ended December 31, 2008 was $188.4 million, an

increase of $130.1 million, or 223.2%, compared to the same period in 2007. Lower market valuation trading losses in

structured products were partially offset by an increase in provision for credit losses, lower merchant banking gains, and

higher incentive-based compensation.

Net interest income was $339.5 million for the twelve months ended December 31, 2008, an increase of $95.6 million, or

39.2%, from prior year. Average loan balances increased $4.9 billion, or 29.6%, while the corresponding net interest income

increased $62.8 million, or 40.2%. The migration of middle market clients from Retail and Commercial to CIB accounted for

approximately $1.8 billion of the increase in average loan balances and increased net interest income $25.8 million. The

remainder of CIB’s average loans increased $3.1 billion, or 19.5%, driven by increased corporate banking loans and lease

financing. The corresponding net interest income increased $37.0 million, or 25.5%, due to higher commercial loans and

improved spreads. Total average consumer and commercial deposits increased $3.0 billion, or 87.0%, primarily in higher

cost interest-bearing deposits. Deposit-related net interest income increased $18.9 million, or 28.6%, driven by the lower

credit for funds on demand deposits partially offset by the increased volumes in higher cost deposit products.

Provision for credit losses was $55.3 million, an increase of $17.5 million, or 46.5%, over the prior year, resulting from

increased charge-offs of middle market clients partially offset by lower charge-offs in corporate banking.

Noninterest income increased $179.8 million, or 47.1%, primarily due to lower market valuation trading losses in structured

products. In addition, increases in direct finance, loan syndications, credit-related fees, and fixed income sales and trading

were partially offset by a reduction in merchant banking gains and lower revenues in structured leasing and derivatives.

Noninterest expense increased $45.3 million, or 9.1%, partially due to the transfer of the middle market business from Retail

and Commercial to CIB which accounted for approximately $24.9 million of the increase. For the remainder of CIB,

noninterest expense increased $20.4 million, or 4.2%, primarily due to higher incentive-based compensation offset by

consulting and certain other staff expenses.

Household Lending

Household Lending reported a net loss for the twelve months ended December 31, 2008 of $737.5 million, compared to a net

loss of $13.0 million in 2007, an increase of $724.5 million, principally due to higher credit-related costs.

Net interest income declined $16.0 million, or 2.2%. Average loans increased $0.9 billion, or 2.2%, while the resulting net

interest income declined $33.8 million, or 5.8%. Nonaccrual loans accounted for $47.7 million of the net interest income

decline as average nonaccrual loans increased $1.1 billion. Accruing loans declined $0.2 billion, or 0.5%, while net interest

income increased $13.9 million, or 2.3%. The increase in net interest income on accruing loans was influenced by higher

income from consumer loans that was partially offset by lower income resulting from a change in mortgage loan product mix

as declines in construction-perm and Alt-A balances were replaced with lower yielding prime first lien mortgages. Average

LHFS declined $5.5 billion while the resulting net interest income increased $28.6 million primarily due to widening

spreads. Average investment securities were up $0.8 billion while net interest income increased $20.7 million. Funding of

other real estate and MSRs reduced net interest income $18.2 million. Average consumer and commercial deposits increased

$0.1 billion, or 4.7%, although net interest income on deposits and other liabilities decreased $17.2 million primarily due to

lower short-term interest rates.

Provision for credit losses increased $681.1 million to $893.1 million primarily due to higher residential mortgage, home

equity and residential construction net charge-offs.

Total noninterest income increased $82.3 million, or 20.6%, primarily due to reduced net valuation losses, increased

production fee income, and securities gains in excess of MSRs impairment, partially offset by higher repurchase reserves and

lower gains from the sale of MSRs. Total production income increased $83.2 million, or 85.5%, driven by reduced valuation

losses associated with secondary market loans and the recognition of loan origination fees resulting from our election to

record certain mortgage loans at fair value beginning in May 2007. The increase in loan production income was partially

offset by increased reserves for the repurchase of loans. Mortgage loan production of $36.4 billion was down $21.9 billion,

or 37.6%. Mortgage servicing related income declined $426.3 million from $193.6 million in 2007, to a net loss of $232.7

million in 2008. The decline was driven by $370.0 million in impairment of MSRs that were carried at the LOCOM, as well

73