SunTrust 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

an acceptable range of values. In those cases, we attempt to consider all information to determine the most appropriate

price within that range. Improvements may be made to our pricing methodologies on an ongoing basis as observable and

relevant information becomes available to us. Sales, trading and settlement activity were scarce in 2009 for many of our

level 3 securities; however, we maintained consistency in our pricing methodology and processes, and incorporated any

relevant changes to the valuation assumptions needed to ensure a supportable fair value for these illiquid securities,

based on market conditions at December 31, 2009.

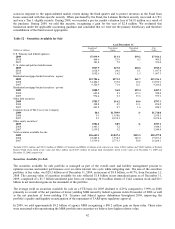

During the year ended December 31, 2009, we recognized through earnings $21.6 million in net losses related to trading

assets and securities available for sale classified as level 3. While we believe we have utilized all pertinent market data

in establishing an appropriate fair value for our securities, current market conditions result in wide price ranges used to

evaluate market value. While it is difficult to accurately predict the ultimate cash value of these securities, we believe

the amount that would be ultimately realized if the securities were held to settlement or maturity will generally be

greater than the current fair value of the securities classified as level 3. This assessment is based on the current

performance of the underlying collateral, which is experiencing elevated losses but generally not to the degree that

correlates to current market values, which is pressured downward in this market due to liquidity issues and other broad

macroeconomic conditions. It is reasonably likely that this market volatility will continue as a result of a variety of

external factors, including but not limited to economic conditions, the sale of assets under government-sponsored

programs, the restructuring of SIVs, and third party sales of securities, some of which could be large-scale.

During the year ended December 31, 2009, our level 3 assets were temporarily increased due to the purchase of

approximately $1.3 billion of Three Pillars CP which was then transferred out of level 3 to level 2 due to increased

market trading levels subsequent to our purchases which ultimately reduced our outstanding amount to zero as of

December 31, 2009. We continued to see a reduction in other level 3 trading assets and securities available for sale as

the net result of purchases, sales, issuances, settlements, maturities, and paydowns. Included in this net reduction were

purchases of level 3 ARS totaling $234.3 million, of which $86.7 million was classified as trading securities and $147.6

million was classified as securities available for sale. No other significant purchases of level 3 trading assets or available

for sale securities were added. We also redeemed stock in the FHLB of approximately $150.8 million which is classified

as level 3 available for sale securities. A modest amount of available for sale securities were transferred into level 3

consisting of municipal bonds for which no observable activity exists. We also transferred U.S. Treasury and federal

agency trading securities out of level 3 consisting of Small Business Administration securities for which the volume and

level of observable trading activity had significantly decreased in prior quarters, but for which we began to observe

limited increases in such activity during the three months ended March 31, 2009 and significant increases in such

activity during the rest of 2009. This level of activity provided us with sufficient market evidence of pricing, such that

we did not have to make any significant adjustments to observed pricing, nor was our pricing based on unobservable

data. As such, this portfolio was transferred out of level 3.

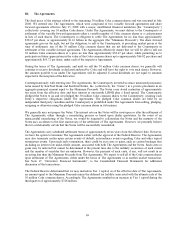

Most derivative instruments are level 1 or level 2 instruments, except for the IRLCs, the Visa litigation related

derivative, discussed below, and The Agreements we entered into related to our investment in Coke common stock,

which are level 3 instruments. Because the value of The Agreements is primarily driven by the embedded equity collars

on the Coke common shares, a Black-Scholes model is the appropriate valuation model. Most of the assumptions are

directly observable from the market, such as the per share market price of Coke common stock, interest rates, and the

dividend rate on Coke common stock. Volatility is a significant assumption and is impacted both by the unusually large

size of the trade and the long tenor until settlement. The Agreements carry scheduled terms of approximately six and a

half and seven years from the effective date, and as such, the observable and active options market on Coke does not

provide for any identical or similar instruments. As a result, we receive estimated market values from a market

participant who is knowledgeable about Coke equity derivatives and is active in the market. Based on inquiries of the

market participant as to their procedures as well as our own valuation assessment procedures, we have satisfied

ourselves that the market participant is using methodologies and assumptions that other market participants would use in

arriving at the fair value of The Agreements. At December 31, 2009, The Agreements were in a liability position to us

of approximately $45.9 million.

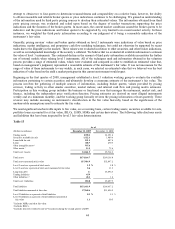

Loans and Loans Held for Sale

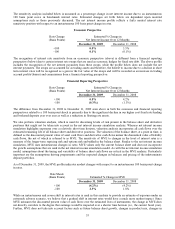

Level 3 loans are primarily non-agency residential mortgage loans held for investment or LHFS for which there is little

to no observable trading in either the new issuance or secondary loan markets as either whole loans or as securities.

Prior to the non-agency residential loan market disruption, which began during the third quarter of 2007 and continues,

we were able to obtain certain observable pricing from either the new issuance or secondary loan market. However, as

the markets deteriorated and certain loans were not actively trading as either whole loans or as securities, we began

employing the same alternative valuation methodologies used to value level 3 residential MBS to fair value the

mortgage loans.

During the years ended December 31, 2009 and 2008, we transferred $307.0 million and $656.1 million, respectively, of

loans that were previously designated as held for sale to held for investment, as they were determined to be no longer

46