SunTrust 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

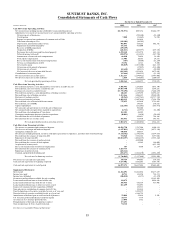

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

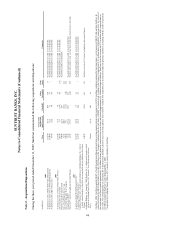

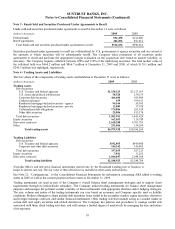

Note 3 - Funds Sold and Securities Purchased Under Agreements to Resell

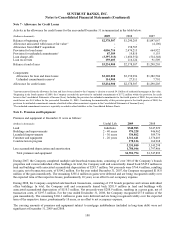

Funds sold and securities purchased under agreements to resell at December 31 were as follows:

(Dollars in thousands) 2009 2008

Federal funds $54,450 $134,000

Resell agreements 462,206 856,614

Total funds sold and securities purchased under agreements to resell $516,656 $990,614

Securities purchased under agreements to resell are collateralized by U.S. government or agency securities and are carried at

the amounts at which securities will be subsequently resold. The Company takes possession of all securities under

agreements to resell and performs the appropriate margin evaluation on the acquisition date based on market volatility, as

necessary. The Company requires collateral between 100% and 110% of the underlying securities. The total market value of

the collateral held was $464.2 million and $866.7 million at December 31, 2009 and 2008, of which $110.1 million and

$246.3 million was repledged, respectively.

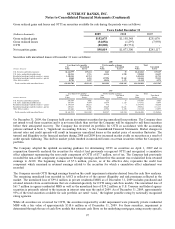

Note 4 - Trading Assets and Liabilities

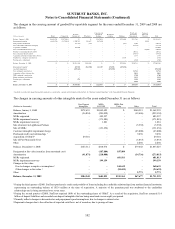

The fair values of the components of trading assets and liabilities at December 31 were as follows:

(Dollars in thousands) 2009 2008

Trading Assets

Debt securities:

U.S. Treasury and federal agencies $1,150,323 $3,127,635

U.S. states and political subdivisions 58,520 159,135

Corporate debt securities 464,684 585,809

Commercial paper 639 399,611

Residential mortgage-backed securities - agency 94,164 58,565

Residential mortgage-backed securities - private 13,889 37,970

Collateralized debt obligations 174,886 261,528

Other debt securities 25,886 813,176

Total debt securities 1,982,991 5,443,429

Equity securities 163,053 116,788

Derivative contracts12,610,288 4,701,783

Other 223,606 134,269

Total trading assets $4,979,938 $10,396,269

Trading Liabilities

Debt securities:

U.S. Treasury and federal agencies $192,893 $440,408

Corporate and other debt securities 144,142 146,805

Total debt securities 337,035 587,213

Equity securities 7,841 13,263

Derivative contracts11,844,047 2,640,308

Total trading liabilities $2,188,923 $3,240,784

1Excludes IRLCs and derivative financial instruments entered into by the Household Lending line of business to

hedge its interest rate risk. The fair value of these derivatives is included in other assets and liabilities.

See Note 21, “Contingencies,” to the Consolidated Financial Statements for information concerning ARS added to trading

assets in 2008 as well as the current position in those assets at December 31, 2009.

Trading instruments are used as part of the Company’s overall balance sheet management strategies and to support client

requirements through its broker/dealer subsidiary. The Company utilized trading instruments for balance sheet management

purposes and manages the potential market volatility of these instruments with appropriate duration and/or hedging strategies.

The size, volume and nature of the trading instruments can vary based on economic and Company specific asset or liability

conditions. Product offerings to clients include debt securities, loans traded in the secondary market, equity securities, derivative

and foreign exchange contracts, and similar financial instruments. Other trading activities include acting as a market maker in

certain debt and equity securities and related derivatives. The Company has policies and procedures to manage market risk

associated with these client trading activities, and will assume a limited degree of market risk by managing the size and nature

of its exposure.

95