SunTrust 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

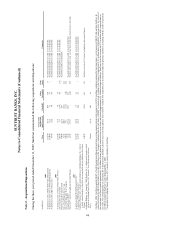

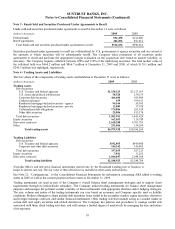

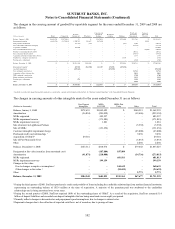

Note 5 - Securities Available for Sale

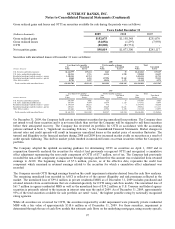

Securities available for sale at December 31 were as follows:

2009

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and federal agencies $7,939,917 $13,423 $39,229 $7,914,111

U.S. states and political subdivisions 927,887 27,799 10,629 945,057

Residential mortgage-backed securities - agency 15,704,594 273,207 61,724 15,916,077

Residential mortgage-backed securities - private 500,651 6,002 99,425 407,228

Other debt securities 785,728 16,253 4,578 797,403

Common stock of The Coca-Cola Company 69 1,709,931 - 1,710,000

Other equity securities1786,248 918 - 787,166

Total securities available for sale $26,645,094 $2,047,533 $215,585 $28,477,042

2008

(Dollars in thousands)

Amortized

Cost Unrealized Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and federal agencies $464,566 $21,889 $302 $486,153

U.S. states and political subdivisions 1,018,906 24,621 6,098 1,037,429

Residential mortgage-backed securities - agency 14,424,531 135,803 10,230 14,550,104

Residential mortgage-backed securities - private 629,174 8,304 115,327 522,151

Other debt securities 302,800 4,444 13,059 294,185

Common stock of The Coca-Cola Company 69 1,358,031 - 1,358,100

Other equity securities11,443,161 5,254 - 1,448,415

Total securities available for sale $18,283,207 $1,558,346 $145,016 $19,696,537

1Includes $343.3 million and $493.2 million of FHLB of Cincinnati and FHLB of Atlanta stock stated at par value, $360.4 million and $360.9 million

of Federal Reserve Bank stock stated at par value and $82.2 million and $588.5 million of mutual fund investments stated at fair value as of

December 31, 2009 and December 31, 2008, respectively.

The increase in U.S. Treasury and federal agency securities was due to the net purchase of lower-yielding U.S. Treasury and

federal agency securities throughout 2009, which improved the quality and liquidity of the portfolio in anticipation of the

repayment of TARP upon regulatory approval.

In 2009, we sold approximately $9.2 billion of agency MBS recognizing a $90.2 million gain on those sales. These sales

were associated with repositioning the MBS portfolio into securities we believe have higher relative value.

See Note 21, “Contingencies”, to the Consolidated Financial Statements for information concerning ARS classified as

securities available for sale.

Securities available for sale that were pledged to secure public deposits, trusts, and other funds had fair values of $9.0 billion

and $6.2 billion as December 31, 2009 and 2008, respectively.

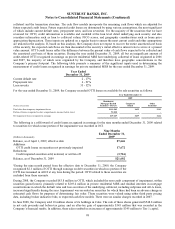

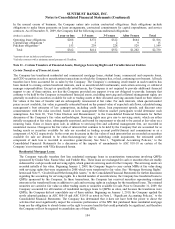

The amortized cost and fair value of investments in debt securities at December 31, 2009 by estimated average life are shown

below. Actual cash flows may differ from estimated average lives and contractual maturities because borrowers may have the

right to call or prepay obligations with or without call or prepayment penalties.

(Dollars in thousands)

1 Year

or Less

1-5

Years

5-10

Years

After 10

Years Total

Distribution of Maturities:

Amortized Cost

Residential mortgage-backed securities - agency $172,218 $11,396,795 $1,160,850 $2,974,731 $15,704,594

All other debt securities 494,881 8,702,265 755,996 201,041 10,154,183

Total debt securities $667,099 $20,099,060 $1,916,846 $3,175,772 $25,858,777

Fair Value

Residential mortgage-backed securities - agency $177,313 $11,592,575 $1,220,845 $2,925,344 $15,916,077

All other debt securities 499,473 8,683,395 691,947 188,984 10,063,799

Total debt securities $676,786 $20,275,970 $1,912,792 $3,114,328 $25,979,876

96