SunTrust 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

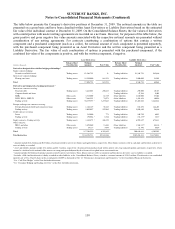

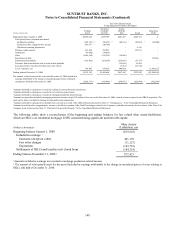

Valuation Methodologies and Fair Value Hierarchy

The primary financial instruments that the Company carries at fair value include securities, derivative instruments, fixed rate

debt, loans and LHFS. Financial instruments that have significantly limited or unobservable trading activity (i.e., inactive

markets), such that the estimates of fair value include significant unobservable inputs, are classified as level 3 instruments.

The fair values were generally based on proprietary models or non-binding broker price indications that estimated the credit

and liquidity risk.

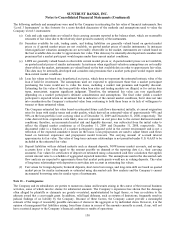

The classification of an instrument as level 3 versus level 2 involves judgment based on a variety of subjective factors. A

market is considered “inactive” based on whether significant decreases in the volume and level of activity for the asset or

liability have been observed. In determining whether a market is inactive, the Company evaluates such factors as the number

of recent transactions in either the primary or secondary markets, whether price quotations are current, the nature of the

market participants, the variability of price quotations, the significance of bid/ask spreads, declines in (or the absence of) new

issuances and the availability of public information. Inactive markets necessitate the use of additional judgment when

valuing financial instruments, such as pricing matrices, cash flow modeling and the selection of an appropriate discount rate.

The assumptions used to estimate the value of an instrument where the market was inactive were based on the Company’s

assessment of the assumptions a market participant would use to value the instrument in an orderly transaction and included

considerations of illiquidity in the current market environment. Where the Company determined that a significant decrease in

the volume and level of activity had occurred, the Company was then required to evaluate whether significant adjustments

were required to market data to arrive at an exit price.

Level 3 Instruments

SunTrust used significant unobservable inputs to fair value certain financial and non-financial instruments as of

December 31, 2009 and December 31, 2008. The general lack of market liquidity necessitates the use of unobservable

inputs in certain cases, as the observability of actual trades and assumptions used by market participants that would

otherwise be available to the Company to use as a basis for estimating the fair values of these instruments has

diminished. It is reasonably likely that current inactive markets will continue as a result of a variety of external factors,

including, but not limited to, economic conditions.

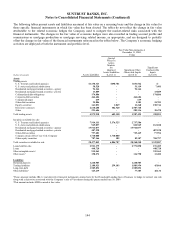

The Company’s level 3 securities available for sale include instruments totaling approximately $1.3 billion at

December 31, 2009, including FHLB and Federal Reserve Bank stock, as well as certain municipal bond securities,

some of which are only redeemable with the issuer at par and cannot be traded in the market. As such, no significant

observable market data for these instruments is available. These nonmarketable securities total approximately $836.9

million at December 31, 2009. Level 3 trading assets total approximately $390.1 million at December 31, 2009. The

remaining level 3 securities, both trading assets and available for sale securities, are predominantly private MBS and

collateral debt obligations, including interests retained from Company-sponsored securitizations or purchased from third

party securitizations and investments in SIVs. The Company also has exposure to bank trust preferred ABS, student loan

ABS, and municipal securities due to its offer to purchase certain ARS as a result of failed auctions. For all level 3

securities, little or no market activity exists for either the security or the underlying collateral and therefore the

significant assumptions used to value the securities are not market observable. Level 3 trading liabilities consist of the

Coke derivative, valued at approximately $45.9 million at December 31, 2009.

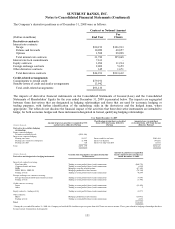

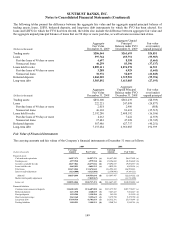

ARS purchased since the auction rate market began failing in February 2008 have been considered level 3 securities due

to the significant decrease in the volume and level of activity in these markets, which has necessitated the use of

significant unobservable inputs into the Company’s valuations. ARS are classified as securities available for sale or

trading securities. Under a functioning ARS market, ARS could be remarketed with interest rate caps to investors

targeting short-term investment securities that repriced generally every 7 to 28 days. Unlike other short-term

instruments, these ARS do not benefit from back-up liquidity lines or letters of credit; therefore, as auctions began to

fail, investors were left with securities that were more akin to longer-term, 20-30 year, illiquid bonds. The combination

of materially increased tenors, capped interest rates and general market illiquidity has had a significant impact on the

risk profiles of these securities and has resulted in the use of valuation techniques and models that rely on significant

inputs that are largely unobservable.

Investments in various ABS such as residual and other retained interests from securitizations, SIVs and private MBS,

which are classified as securities available for sale or trading securities, are valued based on internal models that

incorporate assumptions, such as prepayment speeds, estimated credit losses, and discount rates which are generally not

140