SunTrust 2009 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

investment banking products and services to its clients, including strategic advice, capital raising, and financial risk

management. These investment banking products and services are also provided to Commercial and Wealth and Investment

Management clients. In addition, Corporate and Investment Banking offers traditional lending, leasing, treasury management

services and institutional investment management to its clients.

Household Lending offers residential mortgages, home equity lines and loans, indirect auto, student, bank card and other

consumer loan products. Loans are originated through the Company’s extensive network of traditional and in-store retail

branches, via the internet (www.suntrust.com), and by phone (1-800-SUNTRUST). Residential mortgage loans are also

originated nationally through the Company’s wholesale and correspondent channels. These products are either sold in the

secondary market – primarily with servicing rights retained – or held in the Company’s loan portfolio. The line of business

services loans for itself, for other SunTrust lines of business, and for other investors, and operates a tax service subsidiary

(ValuTree Real Estate Services, LLC).

Wealth and Investment Management provides a full array of wealth management products and professional services to both

individual and institutional clients. Wealth and Investment Management’s primary businesses include PWM, GenSpring, IIS,

and RidgeWorth.

The PWM group offers brokerage, professional investment management, and trust services to clients seeking active

management of their financial resources. PWM includes the Private Banking group which offers a full array of loan and

deposit products to clients. PWM also includes SunTrust Investment Services which offers discount/online and full service

brokerage services to individual clients.

GenSpring provides family office solutions to ultra high net worth individuals and their families. Utilizing teams of multi-

disciplinary specialists with expertise in investments, tax, accounting, estate planning and other wealth management

disciplines, GenSpring helps families manage and sustain their wealth across multiple generations.

Institutional Investment Solutions is comprised of Employee Benefit Solutions, Foundations & Endowments Specialty

Group, Corporate Agency Services, as well as STIAA. Employee Benefit Solutions provides administration and custody

services for defined benefit and defined contribution plans as well as administration services for non-qualified deferred

compensation plans. Foundations & Endowments provides bundled administrative and investment solutions (including

planned giving, charitable trustee, and foundation grant administration services) for non-profit organizations. Corporate

Agency Services targets corporations, governmental entities and attorneys requiring escrow services. STIAA provides

portfolio construction and manager due diligence services to other units within IIS to facilitate the delivery of investment

management services to their clients.

RidgeWorth, an SEC registered investment advisor, serves as investment manager for the RidgeWorth Funds as well as

individual clients. RidgeWorth is also a holding company with ownership in other institutional asset management boutiques

offering a wide array of equity, alternative, fixed income, and liquidity management capabilities. These boutiques include

Alpha Equity Management, Ceredex Value Advisors, Certium Asset Management, IronOak Advisors, Seix, Silvant Capital

Management, and StableRiver Capital Management.

In addition, the Company reports Corporate Other and Treasury, which includes the investment securities portfolio, long-

term debt, end user derivative instruments, short-term liquidity and funding activities, balance sheet risk management, and

most real estate assets. Other components include Enterprise Information Services, which is the primary data processing and

operations group; the Corporate Real Estate group, Marketing, SunTrust Online, Human Resources, Finance, Corporate Risk

Management, Legal and Compliance, Branch Operations, Corporate Strategies, Procurement, and Executive Management.

Finally, Corporate Other and Treasury also includes Trustee Management, which provides treasury management and deposit

services to bankruptcy trustees.

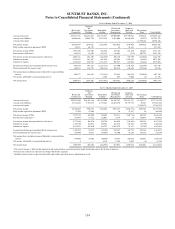

Because the business segment results are presented based on management accounting practices, the transition to the

consolidated results, which are prepared under U.S. GAAP, creates certain differences which are reflected in Reconciling

Items.

For business segment reporting purposes, the basis of presentation in the accompanying discussion includes the following:

•Net interest income – All net interest income is presented on a FTE basis. The revenue gross-up has been applied

to tax-exempt loans and investments to make them comparable to other taxable products. The segments have also

been matched maturity funds transfer priced, generating credits or charges based on the economic value or cost

152