SunTrust 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Federal Reserve, the FDIC, and U.S. government undertook steps during the year to strengthen the capital of financial

institutions, stimulate lending, and inject liquidity into the financial markets. Among the steps taken by the government

agencies, the TLGP was extended into late 2009, billions of MBS were purchased in the open market, trillions of debt

obligations were issued, and benchmark interest rates were kept at record low levels throughout the year. As 2009 came to a

close, the U.S. government and bank regulators were discussing how to reduce their involvement as a financial intermediary

in the markets due to the markets having exhibited some signs of stability. Most notably, the government is assessing when

to discontinue some of its support programs including its ongoing purchases of mortgage-backed assets. This reduction in

support could cause mortgage interest rates to rise which would result in a potential reduction in mortgage originations,

decrease in value of mortgage loans and securities, and an overall slowing of the housing market. Concurrently, the financial

services industry is entering a new phase in its relationship with regulatory authorities as the regulators debate new

regulations and requirements that would affect our business, some in a negative way. See additional discussion of risks

associated with potential new regulations in Item 1, “Business,” under the heading “Government Supervision and

Regulation” and Item 1A., “Risk Factors” in this 10-K.

During 2009, the federal bank regulatory agencies completed a review, called the SCAP, commonly referred to as the “stress

test,” of the capital needs through the end of 2010 of the nineteen largest U.S. bank holding companies. The Federal Reserve

announced the results of the SCAP on May 7, 2009. The Federal Reserve advised us that, based on the SCAP review, we

presently have and are projected to continue to have Tier 1 capital well in excess of the amount required to be well

capitalized through the forecast period under both the baseline scenario and the more adverse-than-expected scenario (“more

adverse”) as estimated by the U.S. Treasury. The SCAP’s more adverse scenario represents a hypothetical scenario that

involves a recession that is longer and more severe than consensus expectations and results in higher than expected credit

losses, but is not a forecast of expected losses or revenues. The Federal Reserve advised us that based on the more adverse

scenario that it required us to adjust the composition of our Tier 1 capital by increasing the Tier 1 common equity portion by

$2.2 billion. The common equity increase prescribed by the Federal Reserve is necessary to maintain Tier 1 common equity

at 4% of risk weighted assets under the more adverse scenario, as specified by a new regulatory standard that was introduced

as part of the stress test. This increase satisfied the regulatory request that we have an increased mix of common equity as a

percentage of Tier 1 capital, to serve as a buffer against higher losses than generally expected, and allow us to remain well

capitalized and able to lend to creditworthy borrowers should such losses materialize. Our 2009 actual credit losses were

significantly less than the projections utilized in the SCAP process.

During the second quarter, in response to the SCAP, we successfully completed our capital plan and initiatives, generating

$2.3 billion of capital and exceeding the target of $2.2 billion established by the Federal Reserve. The transactions utilized to

raise the capital included the issuance of common stock, the repurchase of certain preferred stock and hybrid debt securities,

and the sale of Visa Class B shares. These capital raising transactions increased Tier 1 common equity by $2.1 billion and

were the driving factor in the increase in our Tier 1 common equity ratio to 7.67% at December 31, 2009 compared to 5.83%

at December 31, 2008. During the second quarter, we completed all required capital initiatives and believe that relative to the

more adverse scenario, additional capital will be achieved through lower credit losses than projected by SCAP. As a result of

the successful capital plan and initiatives, we have the ability and desire to repay the U.S. government for funds borrowed in

the form of preferred stock issued by us under the CPP. However, our repayment of TARP funds is predicated on approval

by our primary regulator, the Federal Reserve. See additional discussion of SCAP and the capital plan and initiatives in the

“Capital Resources” section of this MD&A.

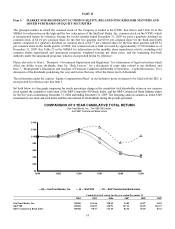

Despite the challenging economic environment, we continue to operate from a position of strength and are focused on

growing revenue, improving expense efficiency, increasing the profitability of the balance sheet, investing for the future, and

prudently managing credit. To this end, we remain acutely focused on clients, improving service quality and front-line

execution, controlling expenses, and managing risk. During the year, revenue was soft, loan demand was down, credit costs

were higher, and asset quality was weak. We are seeing sustained economic weakness that has reduced demand for loans as

clients have focused on capital preservation and debt reduction, while accessing the debt markets in lieu of bank loans.

However, we have also experienced positive operating trends in many of our businesses that included strong deposit growth,

improved funding mix, significant expansion of net interest margin, positive fee income growth in certain areas, continued

strong expense management, and credit trends that improved during the last half of 2009. Specifically, in the last quarter of

2009, we experienced declining net charge-offs and early stage delinquencies, stabilizing nonperforming loans, and a lesser

increase in the ALLL. We believe our strong foundation coupled with our client-focused execution, risk mitigation

capabilities, and the long-term economic prospects of our markets position us to deliver improving financial performance as

the operating environment improves.

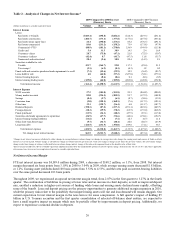

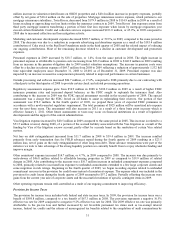

The difficult economic environment during 2009 negatively impacted our financial performance as we realized a net loss

available to common shareholders of $1.7 billion, or $3.98 per common share. The net loss during the year was primarily a

result of goodwill impairment taken during the first quarter and increased provisioning for credit losses during the year. The first

quarter non-cash goodwill impairment charge attributable to common shareholders was $714.8 million, after-tax, or $1.64 per

common share, while the provision for credit losses increased by $993.6 million, after-tax, or $2.28 per common share.

22