SunTrust 2009 Annual Report Download - page 79

Download and view the complete annual report

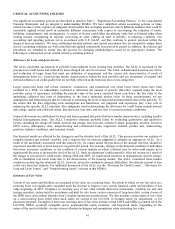

Please find page 79 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We review the goodwill of each reporting unit for impairment on an annual basis, or more often, if events or circumstances

indicate that it is more likely than not that the fair value of the reporting unit is below the carrying value of its equity. The

goodwill impairment analysis estimates the fair value of equity using discounted cash flow analyses which require

assumptions, as well as guideline company and guideline transaction information, where available. The inputs and

assumptions specific to each reporting unit are incorporated in the valuations including projections of future cash flows,

discount rates, the fair value of tangible and intangible assets and liabilities, and applicable valuation multiples based on the

guideline information. We assess the reasonableness of the estimated fair value of the reporting units by giving consideration

to our market capitalization over a reasonable period of time; however, due to the significant and unprecedented volatility in

market capitalization of the financial institution’s sector, supplemental information is applied based on observable multiples

from guideline transactions, adjusting to reflect our specific factors, as well as current market conditions. Based on our latest

annual impairment analysis of goodwill, we believe that the fair value for all reporting units is substantially in excess of the

respective reporting unit’s carrying value, with the exception of Corporate and Investment Banking which had a fair value

that exceeded carrying value by 6%.

Valuation Techniques

In determining the fair value of our reporting units, we primarily use discounted cash flow analyses, which require

assumptions about short and long-term net cash flow growth rates for each reporting unit, as well as discount rates. In

addition, we apply guideline company and guideline transaction information, where available, to aid in the valuation of

certain reporting units. The guideline information is based on publicly available information. A valuation multiple is selected

based on a financial benchmarking analysis that compares the reporting unit’s benchmark result with the guideline

information. In addition to these financial considerations, qualitative factors such as asset quality, growth opportunities, and

overall risk are considered in the ultimate selection of the multiple used to estimate a value on a minority basis. A control

premium of 30% is applied to the minority basis value to arrive at the reporting unit’s estimated fair value on a controlling

basis.

The values separately derived from each valuation technique (i.e., discounted cash flow, guideline company, guideline

transaction, and asset accumulation) are used to develop an overall estimate of a reporting unit’s fair value. The discounted

cash flow approach is generally weighted 70% and the market based approaches are generally weighted 30%. The weightings

may be adjusted based on the degree of relevant market based information. The selection and weighting of the various fair

value techniques may result in a higher or lower fair value. Judgment is applied in determining the selection and weightings

that are most representative of fair value.

Growth Assumptions

Multi-year financial forecasts are developed for each reporting unit by considering several key business drivers such as new

business initiatives, client service and retention standards, market share changes, anticipated loan and deposit growth,

forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term

growth rate used in determining the terminal value of each reporting unit was estimated at 4% in 2009 based on

management’s assessment of the minimum expected terminal growth rate of each reporting unit, as well as broader economic

considerations such as gross domestic product and inflation.

Discount Rate Assumptions

Discount rates are estimated based on the Capital Asset Pricing Model, which considers the risk-free interest rate, market risk

premium, beta, and in some cases, unsystematic risk and size premium adjustments specific to a particular reporting unit. The

sum of the reporting units’ cash flow projections are used to calculate an overall implied internal rate of return. The implied

internal rate of return serves as a baseline for estimating the specific discount rate for each reporting unit. The discount rates

are also calibrated based on the assessment of the risks related to the projected cash flows of each reporting unit. In 2009, the

discount rates ranged from 13% to 27% as a result of the economic environment causing market dislocation and lower

valuation multiples.

Estimated Fair Value and Sensitivities

The estimated fair value of each reporting unit is derived from the valuation techniques described above. The estimated fair

value of each reporting unit is analyzed in relation to numerous market and historical factors, including current economic and

market conditions, recent, historical, and implied stock price volatility, marketplace dynamics such as level of short selling,

company-specific growth opportunities, and an implied control premium. The implied control premium is determined by

comparing the aggregate fair value of the reporting units to our market capitalization, measured over a reasonable period of

time. We assess the reasonableness of the implied control premium in relation to the market and historical factors previously

mentioned, as well as recognizing that the size of the implied control premium is not, independently, a determinative

measure to assess the estimated fair values of the reporting units.

63