SunTrust 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

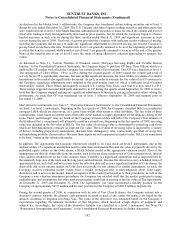

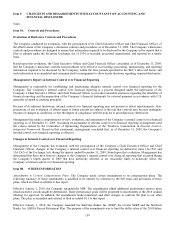

In September 2008, STRH and STIS entered into an “agreement in principle” with FINRA related to the sales and brokering

of ARS by STRH and STIS regardless of whether any claims had been asserted by the investor. This agreement is

non-binding and is subject to the negotiation of a final settlement. At this time there is no final settlement with FINRA, and

FINRA has resumed its investigation. Notwithstanding that fact, the Company announced in November 2008 that it would

move forward with ARS purchases from essentially the same categories of investors who would have been covered by the

original agreement with FINRA. Additionally, the Company has elected to purchase ARS from certain other investors not

addressed by the agreement. As of December 31, 2009, the Company has already purchased approximately $548.2 million of

ARS and is expected to purchase approximately $92.2 million in additional ARS. As of December 31, 2009, the Company

has repurchased approximately 86% of the securities it intended to purchase. The fair value of ARS purchased pursuant to

the pending settlement, net of redemptions and calls, is approximately $176.4 million and $133.1 million in trading securities

and $156.4 million and $48.2 million in available for sale securities, at December 31, 2009 and December 31, 2008,

respectively. The Company has reserved for the remaining probable loss that could be reasonably estimated to be

approximately $33.1 million and $99.4 million at December 31, 2009 and December 31, 2008, respectively. The remaining

loss amount represents the difference between the par amount and the estimated fair value of the remaining ARS that the

Company believes it will likely purchase from investors. This amount may change by the movement in fair market value of

the underlying investment and therefore, can be impacted by changes in the performance of the underlying obligor or

collateral as well as general market conditions. The total gain relating to the ARS agreements recognized during the year

ended December 31, 2009 was approximately $14.6 million, compared to a loss recognized during the year ended

December 31, 2008 of $177.3 million. These amounts are comprised of trading gains or losses on probable future purchases,

trading losses on ARS classified as trading securities that were purchased from investors, securities gains on calls and

redemptions of available for sale securities that were purchased from investors, and estimated fines levied against STRH and

STIS by various federal and state agencies. Due to the pass-through nature of these security purchases, the economic loss has

been included in the Corporate Other and Treasury segment.

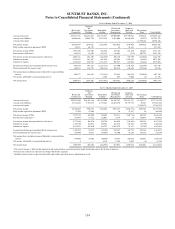

Note 22 - Business Segment Reporting

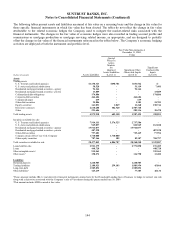

The Company has four business segments used to measure business activities: Retail and Commercial, Corporate and

Investment Banking, Household Lending, and Wealth and Investment Management with the remainder in Corporate Other

and Treasury. Beginning in 2009, the segment reporting structure was adjusted in the following ways:

1. The management of Consumer Lending was combined with Mortgage to create Household Lending. Consumer

Lending, which includes student lending, indirect auto, and other specialty consumer lending units, was previously

a part of Retail and Commercial. This change will enable the Company to provide a strategic framework for all

consumer lending products and will also create operational efficiencies.

2. Commercial Real Estate is now a part of Retail and Commercial as Commercial and Commercial Real Estate

clients have similar needs due to their comparable size and because the management structure is geographically

based. Previously, Commercial Real Estate was combined with Corporate and Investment Banking in Wholesale

Banking.

Retail and Commercial serves consumers and businesses with up to $100 million in annual revenue. Retail and Commercial

provides services to clients through an extensive network of traditional and in-store branches, ATMs, the internet

(www.suntrust.com), and the telephone (1-800-SUNTRUST). Financial products and services offered to consumers include

consumer deposits, home equity lines, consumer lines, and other fee-based products. The business also serves commercial

clients including business banking clients, government/not-for-profit enterprises, as well as commercial and residential

developers and investors. Financial products and services offered to business clients include commercial and commercial real

estate lending, financial risk management, insurance premium financing, treasury and payment solutions including

commercial card services, as well as specialized commercial real estate investments delivered through SunTrust Community

Capital. Retail and Commercial also serves as an entry point and provides services for other lines of business. When client

needs change and expand, Retail and Commercial refers clients to our Wealth and Investment Management, Corporate and

Investment Banking, and the Household Lending lines of business.

Corporate and Investment Banking serves clients in the large and middle corporate and commercial markets. The Corporate

Banking Group generally serves clients with greater than $750 million in annual revenue and is focused on selected industry

sectors: consumer and retail, diversified, energy, financial services and technology, and healthcare. The Middle Market

Group generally serves clients with annual revenue ranging from $100 million to $750 million and is more geographically

focused. Through SunTrust Robinson Humphrey, Corporate and Investment Banking provides an extensive range of

151