SunTrust 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sell portions of the acquired institution as a condition to receiving regulatory approval or we may not obtain regulatory

approval for a proposed acquisition on acceptable terms or at all, in which case we would not be able to complete the

acquisition despite the time and expenses invested in pursuing it.

We depend on the expertise of key personnel. If these individuals leave or change their roles without effective

replacements, operations may suffer.

The success of our business has been, and the continuing success will be, dependent to a large degree on the continued

services of executive officers, especially our Chairman and Chief Executive Officer, James M. Wells III, and other key

personnel who have extensive experience in the industry. We do not carry key person life insurance on any of the executive

officers or other key personnel. If we lose the services of any of these integral personnel and fail to manage a smooth

transition to new personnel, the business could be impacted.

We may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may

increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact

our ability to implement our business strategy.

Our success depends upon the ability to attract and retain highly motivated, well-qualified personnel. We face significant

competition in the recruitment of qualified employees. Pursuant to recently enacted legislation, the U.S. Treasury has

instituted certain restrictions on the compensation of certain senior management positions. It is possible that the U.S.

Treasury may, as it is permitted to do, impose further requirements on us that may inhibit our ability to hire and retain the

most qualified senior personnel. In addition, if we are unable to repay our TARP funds, we will continue to be subject to

significant restrictions on the payment of executive compensation and may be at a disadvantage to our competitors who have

repaid TARP funds in our ability to recruit and retain the most qualified senior personnel. Our ability to execute the business

strategy and provide high quality service may suffer if we are unable to recruit or retain a sufficient number of qualified

employees or if the costs of employee compensation or benefits increase substantially.

Further, the Federal Reserve on October 27, 2009 published proposed guidance on sound incentive compensation policies.

Through this guidance, the Federal Reserve will regulate incentive compensation at financial institutions through its power to

regulate the safety and soundness of the banking system. Such regulation will apply to us even after we repay TARP.

Additionally, on January 12, 2010, the Board of Directors of the FDIC published an ANPR on Employee Compensation. The

ANPR seeks comment on how, and whether, the FDIC’s risk-based deposit insurance assessment system applicable to all

insured banks should be amended to account for risks imposed by employee compensation programs. Citing a “broad

consensus that some compensation structures misalign incentives and induce imprudent risk taking within financial

organizations”, the FDIC is considering establishing criteria to determine whether a financial institution’s employee

compensation programs provide incentives for employees to take excessive risks. The FDIC is concerned that such risk-

taking increases the institution’s risk of failure and thereby could lead to increased losses to the DIF. The ANPR proposal

could apply not only to compensation at the insured depository, but also at its parent and nonbank affiliates. Under the

approach outlined in the ANPR, whether a financial institution’s compensation program either “meets” or “does not meet”

the criteria would be used to adjust the institution’s risk-based assessment rate, thereby acting as an incentive for institutions

that meet the criteria and a disincentive for those that do not. According to the ANPR, the criteria that the FDIC is

considering are not aimed at limiting the amount that insured depository institutions can pay their employees, but rather are

intended to compensate the DIF for risks associated with certain compensation programs.

At this time, we cannot predict the impact of the Federal Reserve’s proposed guidance or the FDIC’s ANPR.

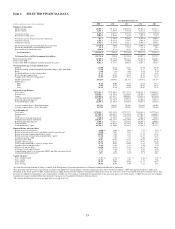

Our accounting policies and processes are critical to how we report our financial condition and results of operations.

They require management to make estimates about matters that are uncertain.

Accounting policies and processes are fundamental to how we record and report the financial condition and results of

operations. Management must exercise judgment in selecting and applying many of these accounting policies and processes

so they comply with U.S. GAAP.

Management has identified certain accounting policies as being critical because they require management’s judgment to

ascertain the valuations of assets, liabilities, commitments, and contingencies. A variety of factors could affect the ultimate

value that is obtained either when earning income, recognizing an expense, recovering an asset, valuing an asset or liability,

or recognizing or reducing a liability. We have established detailed policies and control procedures that are intended to

ensure these critical accounting estimates and judgments are well controlled and applied consistently. In addition, the policies

and procedures are intended to ensure that the process for changing methodologies occurs in an appropriate manner. Because

of the uncertainty surrounding our judgments and the estimates pertaining to these matters, we cannot guarantee that we will

not be required to adjust accounting policies or restate prior period financial statements. See the “Critical Accounting

Policies” in the MD&A and Note 1, “Significant Accounting Policies,” to the Consolidated Financial Statements.

15