SunTrust 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and are monitored as part of various governance processes. We recorded losses in the Consolidated Statements of Income/

(Loss) related to fair value MSRs of $21.9 million for year ended December 31, 2009, inclusive of the mark to market

adjustments on the related hedges.

Relative to the LOCOM portion of our retained MSRs, an impairment recovery gain was recorded in the Consolidated

Statements of Income/(Loss) of $199.2 million during 2009. As of December 31, 2009, we held $603.8 million of LOCOM

MSRs with a fair value of $748.5 million. As discussed above, this class of MSRs was designated at fair value as of

January 1, 2010.

We also have market risk from capital stock we hold in the FHLB of Atlanta and Cincinnati and from capital stock we hold

in the Federal Reserve Bank. In order to be an FHLB member, we are required to purchase capital stock in the FHLB. In

exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and

low-cost loans for affordable housing and community-development projects, amongst other benefits. As of December 31,

2009, we held a total of $343.3 million of capital stock in the FHLB. During 2009, we reduced our capital stock holdings in

the FHLB by $149.9 million. In order to become a member of the Federal Reserve System, regulations require that we hold a

certain amount of capital stock as a percentage of the Bank’s capital. During 2009, we held $360.4 million of Federal

Reserve Bank capital stock.

For a detailed overview regarding actions taken to address the risk from changes in equity prices associated with our

investment in Coke common stock, see “Investment in Common Shares of the Coca-Cola Company,” in this MD&A. We

also hold, as of December 31, 2009, a total of approximately $207.7 million of private equity investments that include direct

investments and limited partnerships. We hold these investments as long-term investments and make additional contributions

based on our contractual commitments but have decided to limit investments into new private equity investments.

Impairment charges could occur if deteriorating conditions in the market persist, including, but not limited to, goodwill and

other intangibles impairment charges and increased charges with respect to OREO.

OFF-BALANCE SHEET ARRANGEMENTS

See discussion of off-balance sheet arrangements in Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing

Rights and Variable Interest Entities” and Note 18, “Reinsurance Arrangements and Guarantees”, to the Consolidated

Financial Statements.

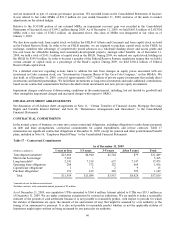

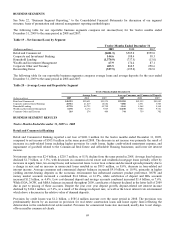

CONTRACTUAL COMMITMENTS

In the normal course of business, we enter into certain contractual obligations, including obligations to make future payments

on debt and lease arrangements, contractual commitments for capital expenditures, and service contracts. Table 17

summarizes our significant contractual obligations at December 31, 2009, except for pension and other postretirement benefit

plans, included in Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements.

Table 17 – Contractual Commitments

As of December 31, 2009

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Time deposit maturities1$23,686 $4,940 $2,744 $79 $31,449

Short-term borrowings15,365 - - - 5,365

Long-term debt12,141 7,530 657 7,147 17,475

Operating lease obligations 208 372 322 664 1,566

Capital lease obligations1132915

Purchase obligations2153 239 228 529 1,149

Total $31,554 $13,084 $3,953 $8,428 $57,019

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

As of December 31, 2009, our cumulative UTBs amounted to $160.6 million. Interest related to UTBs was $39.3 million as

of December 31, 2009. We are under continuous examination by various tax authorities. We are unable to make a reasonable

estimate of the periods of cash settlement because it is not possible to reasonably predict, with respect to periods for which

the statutes of limitations are open, the amount of tax and interest (if any) that might be assessed by a tax authority or the

timing of an assessment or payment. It is also not possible to reasonably predict whether or not the applicable statutes of

limitations might expire without us being examined by any particular tax authority.

60