SunTrust 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

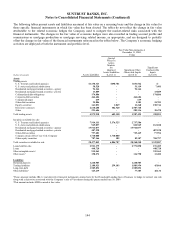

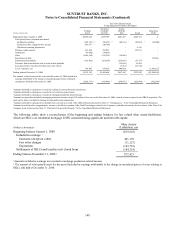

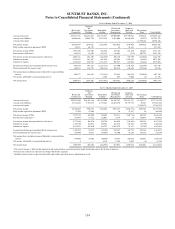

The following tables present assets and liabilities measured at fair value on a recurring basis and the change in fair value for

those specific financial instruments in which fair value has been elected. The tables do not reflect the change in fair value

attributable to the related economic hedges the Company used to mitigate the market-related risks associated with the

financial instruments. The changes in the fair value of economic hedges were also recorded in trading account profits and

commissions or mortgage production or mortgage servicing related income, as appropriate, and are designed to partially

offset the change in fair value of the financial instruments referenced in the tables below. The Company’s economic hedging

activities are deployed at both the instrument and portfolio level.

Fair Value Measurements at

December 31, 2009,

Using

(Dollars in thousands) Assets/Liabilities

Quoted

Prices In

Active

Markets

for

Identical

Assets/Liabilities

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets

Trading assets

U.S. Treasury and federal agencies $1,150,323 $498,781 $651,542 $-

U.S. states and political subdivisions 58,520 - 51,119 7,401

Residential mortgage-backed securities - agency 94,164 - 94,164 -

Residential mortgage-backed securities - private 13,889 - - 13,889

Collateralized debt obligations 174,886 - - 174,886

Corporate debt securities 464,684 - 464,684 -

Commercial paper 639 - 639 -

Other debt securities 25,886 - 1,183 24,703

Equity securities 163,053 1,049 11,260 150,744

Derivative contracts 2,610,288 102,520 2,507,768 -

Other 223,606 - 205,136 18,470

Total trading assets 4,979,938 602,350 3,987,495 390,093

Securities available for sale

U.S. Treasury and federal agencies 7,914,111 5,176,525 2,737,586 -

U.S. states and political subdivisions 945,057 - 812,949 132,108

Residential mortgage-backed securities - agency 15,916,077 - 15,916,077 -

Residential mortgage-backed securities - private 407,228 - - 407,228

Other debt securities 797,403 - 719,449 77,954

Common stock of The Coca-Cola Company 1,710,000 1,710,000 - -

Other equity securities 787,166 182 82,187 704,797

Total securities available for sale 28,477,042 6,886,707 20,268,248 1,322,087

Loans held for sale 2,923,375 - 2,771,890 151,485

Loans 448,720 - - 448,720

Other intangible assets 2935,561 - - 935,561

Other assets 1150,272 - 136,790 13,482

Liabilities

Brokered deposits 1,260,505 - 1,260,505 -

Trading liabilities 2,188,923 259,103 1,883,954 45,866

Long-term debt 3,585,892 - 3,585,892 -

Other liabilities 1125,239 - 77,105 48,134

1These amounts include IRLCs and derivative financial instruments entered into by the Household Lending line of business to hedge its interest rate risk

along with a derivative associated with the Company’s sale of Visa shares during the quarter ended June 30, 2009.

2This amount includes MSRs carried at fair value.

144