SunTrust 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

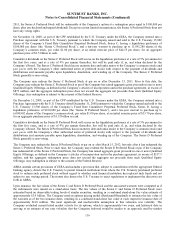

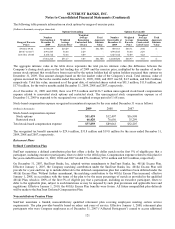

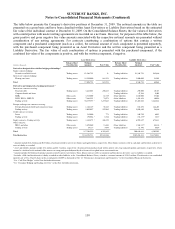

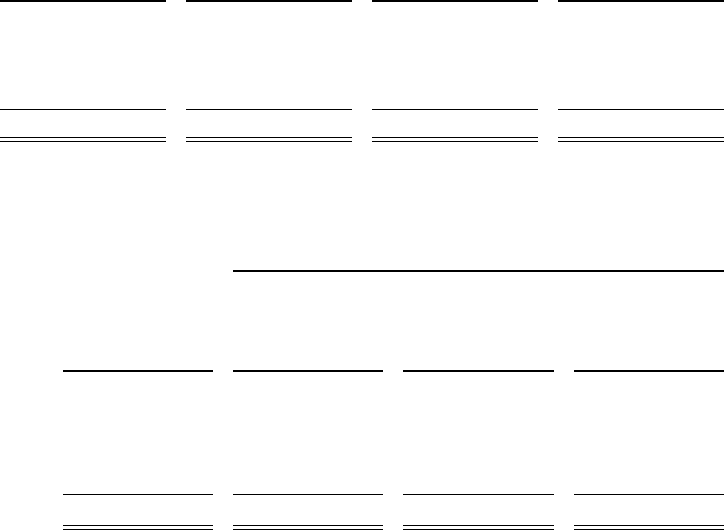

The following table sets forth a summary of changes in the fair value of level 3 plan assets for the year ended December 31,

2009:

(Dollars in thousands)

Fixed Income

Securities - Corporate

Investment Grade

Fixed Income

Securities - Corporate

Non-investment Grade

Fixed Income

Securities - Foreign

Bonds Other

Balance as of January 1, 2009 $- $- $- $-

Purchases/(sales) 69,486 20,385 21,015 (185)

Realized gain/(loss) (29) - - -

Unrealized gain/(loss) 7,280 4,253 2,898 -

Transfers in level 3 5,925 1,184 13,913 1,107

Balance as of December 31, 2009 $82,662 $25,822 $37,826 $922

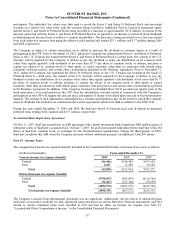

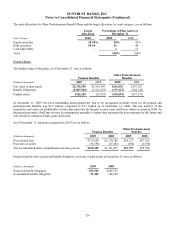

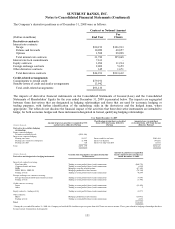

The following table sets forth by level, within the fair value hierarchy, plan assets related to Other Postretirement Benefits at

fair value as of December 31, 2009:

Fair Value Measurements as of December 31, 2009 1

(Dollars in thousands)

Assets Measured

at Fair Value at

December 31,

2009

Quoted Prices In

Active Markets

for Identical

Assets (Level 1)

Significant Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs

(Level 3)

Equity mutual funds

Large cap fund $36,512 $36,512 $- $-

Investment grade tax-exempt bond 25,217 25,217 - -

International fund 7,633 7,633 - -

Common and collective funds 91,632 - 91,632 -

$160,994 $69,362 $91,632 $-

1Schedule does not include accrued income amounting to less than 0.1% of total plan assets.

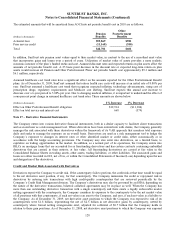

The SunTrust Benefits Plan Committee, which includes several members of senior management, establishes investment

policies and strategies and formally monitors the performance of the funds on a quarterly basis. The Company’s investment

strategy with respect to pension assets is to invest the assets in accordance with the Employee Retirement Income Security

Act of 1974 and related fiduciary standards. The long-term primary investment objectives for the Pension Plans are to

provide for a reasonable amount of long-term growth of capital (both principal and income), without undue exposure to risk

in any single asset class or investment category and to enable the plans to provide their specific benefits to participants

thereof. The objectives are accomplished utilizing a strategy of equities, fixed income and cash equivalents in a mix that is

conducive to participation in a rising market while allowing for protection in a falling market. The portfolio is viewed as

long-term in its entirety, avoiding decisions based solely on short-term concerns and individual investments. The objective in

the allocation of assets is diversification of investments among asset classes that are not similarly affected by economic,

political, or social developments. The diversification does not necessarily depend upon the number of industries or

companies in a portfolio or their particular location, but rather upon the broad nature of such investments and of the factors

that may influence them. To ensure broad diversification in the long-term investment portfolios among the major categories

of investments, asset allocation, as a percent of the total market value of the total long-term portfolio, are set with the target

percentages and ranges presented in the investment policy statement. Rebalancing occurs on a periodic basis to maintain the

target allocation, but normal market activity may result in deviations. At December 31, 2009 and 2008, there was no

SunTrust common stock held in the Pension Plans, nor were there any purchases during 2009 or 2008.

The investment strategy for the Other Postretirement Benefit Plans is maintained separately from the strategy for the Pension

Plans. The Company’s investment strategy is to create a stream of investment returns sufficient to provide for current and

future liabilities at a reasonable level of risk. Assets are diversified among equity and fixed income investments according to

the asset mix approved by the SunTrust Benefits Plan Committee which is presented in the target allocation table. The

pre-tax expected long-term rate of return on these plan assets was 7.25% in 2009 and 7.5% in 2008. The 2010 pre-tax

expected long-term rate of return is 7.00%. At December 31, 2009 and 2008, there was no common stock held in the Other

Postretirement Benefit Plans, nor were there any purchases during 2009 or 2008.

125