SunTrust 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

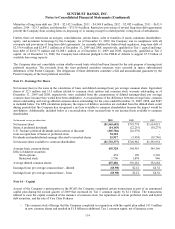

As of December 31, 2009, the Company’s gross cumulative UTBs amounted to $160.6 million, of which $121.0 million (net of

federal tax benefit) would affect the Company’s effective tax rate, if recognized. As of December 31, 2008, the Company’s

gross cumulative UTBs amounted to $301.4 million. The reduction in UTBs was primarily attributable to the settlement of

examinations by certain taxing authorities and the related payments and reversal of the liability. Additionally, the Company

recognized a gross liability of $39.3 million and $70.9 million for interest related to its UTBs as of December 31, 2009 and

December 31, 2008, respectively. Interest related to UTBs was income of $17.8 million for the year ended December 31, 2009,

compared to expense of $22.4 million, for the same period in 2008. The Company continually evaluates the UTBs associated

with its uncertain tax positions. It is reasonably possible that the total UTBs could decrease during the next 12 months by up to

$15 million due to completion of tax authority examinations and the expiration of statutes of limitations.

The Company files consolidated and separate income tax returns in the United States federal jurisdiction and in various state

jurisdictions. As of December 31, 2009, the Company’s federal returns through 2004 have been examined by the IRS and all

issues have been resolved. An IRS examination of the Company’s 2005 and 2006 federal income tax returns is currently in

progress, but it is nearing completion with only one issue unresolved. Generally, the state jurisdictions in which the Company

files income tax returns are subject to examination for a period from three to seven years after returns are filed.

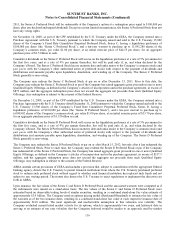

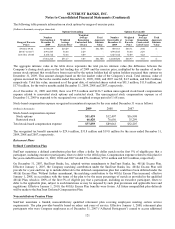

The following table provides a rollforward of the Company’s UTBs from January 1 to December 31:

2009 2008

Federal and

State UTBs

Federal and

State UTBs

(Dollars in thousands)

Balance at January 1 $301,369 $323,654

Increases in UTBs related to prior years 7,910 12,295

Decreases in UTBs related to prior years -(24,622)

Increases in UTBs related to the current year -20,617

Decreases in UTBs related to the current year (37) -

Decreases in UTBs related to settlements (146,271) (17,258)

Decreases in UTBs related to lapse of the applicable statutes of limitations (2,764) (2,752)

Increases (decreases) in UTBs related to acquired entities in prior years, offset to goodwill 386 (10,565)

Balance at December 31 $160,593 $301,369

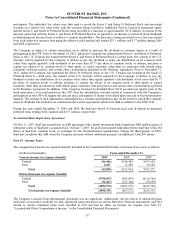

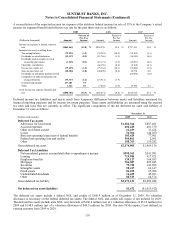

Note 16 - Employee Benefit Plans

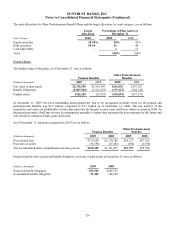

SunTrust sponsors various short and LTI plans for eligible employees. The Company delivers LTIs through various incentive

programs, including stock options, restricted stock, and a LTI cash plan. Prior to 2008, some LTIs were delivered through the

PUP, a cash basis LTI plan with a three year time horizon. Effective January 1, 2008, the PUP was terminated, and

outstanding performance units under the PUP were replaced with a one-time grant of restricted stock. The LTI cash plan

became effective in 2008, and awards under the LTI cash plan cliff vest over a period of three years from the date of the

award and are paid in cash. The MIP is the Company’s short-term cash incentive plan for key employees that provides for

potential annual cash awards based on the attainment of the Company’s earnings and/or the achievement of business unit and

individual performance objectives. Compensation expense related to programs that have cash payouts for the years ended

December 31, 2009, 2008 and 2007 totaled $28.3 million, $47.5 million and $48.5 million, respectively.

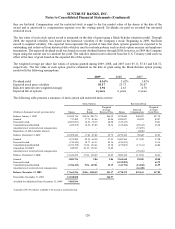

Stock Based Compensation

The Company provides stock-based awards through the SunTrust Banks Inc. 2009 Stock Plan under which the Compensation

Committee of the Board of Directors (the “Committee”) has the authority to grant stock options and restricted stock, of

which some may have performance features, to key employees of the Company. Under the 2009 Stock Plan, a total of

9.3 million shares of common stock is authorized and reserved for issuance, of which no more than 4.8 million shares may be

issued as restricted stock. Stock options are granted at a price which is no less than the fair market value of a share of

SunTrust common stock on the grant date and may be either tax-qualified incentive stock options or non-qualified stock

options. Stock options typically vest after three years and generally have a maximum contractual life of ten years and upon

option exercise, shares are issued to employees from treasury stock.

Shares of restricted stock may be granted to employees and directors and typically cliff vest after three years. Restricted

stock grants may be subject to one or more criteria, including employment, performance or other conditions as established by

the Committee at the time of grant. Any shares of restricted stock that are forfeited will again become available for issuance

under the Stock Plan. An employee or director has the right to vote the shares of restricted stock after grant unless and until

119