SunTrust 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

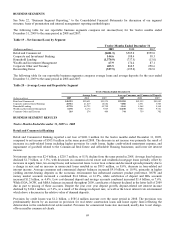

BUSINESS SEGMENTS

See Note 22, “Business Segment Reporting,” to the Consolidated Financial Statements for discussion of our segment

structure, basis of presentation and internal management reporting methodologies.

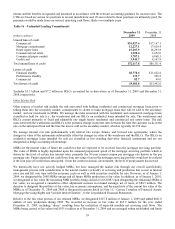

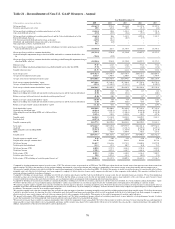

The following table for our reportable business segments compares net income/(loss) for the twelve months ended

December 31, 2009 to the same period in 2008 and 2007:

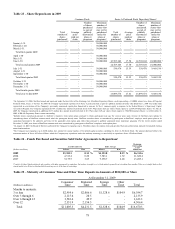

Table 19 – Net Income/(Loss) by Segment

Twelve Months Ended December 31

(Dollars in millions) 2009 2008 2007

Retail and Commercial ($481.3) $505.0 $959.0

Corporate and Investment Banking 144.6 188.4 58.3

Household Lending (1,370.9) (737.5) (13.0)

Wealth and Investment Management 67.9 174.4 87.1

Corporate Other and Treasury 403.5 860.5 250.6

Reconciling Items (327.5) (195.0) 292.0

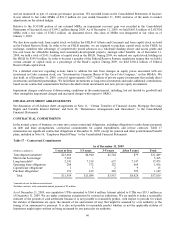

The following table for our reportable business segments compares average loans and average deposits for the year ended

December 31, 2009 to the same period in 2008 and 2007:

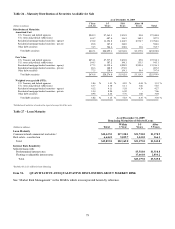

Table 20 – Average Loans and Deposits by Segment

Twelve Months Ended December 31

Average Loans Average Consumer and Commercial Deposits

(Dollars in millions) 2009 2008 2007 2009 2008 2007

Retail and Commercial $48,993 $50,651 $51,274 $91,290 $82,339 $81,889

Corporate and Investment Banking 20,921 21,619 16,682 7,008 6,551 3,503

Household Lending 42,738 44,733 43,790 3,161 2,268 2,168

Wealth and Investment Management 8,198 8,174 7,965 11,030 9,506 9,781

Corporate Other and Treasury 203 274 404 744 759 702

BUSINESS SEGMENT RESULTS

Twelve Months Ended December 31, 2009 vs. 2008

Retail and Commercial Banking

Retail and Commercial Banking reported a net loss of $481.3 million for the twelve months ended December 31, 2009,

compared to net income of $505.0 million in the same period 2008. The decrease in net income was primarily the result of

increases in credit-related losses including higher provision for credit losses, higher credit-related noninterest expense, and

impairment of goodwill related to the Commercial Real Estate and Affordable Housing businesses, and lower net interest

income.

Net interest income was $2.4 billion, a $210.7 million, or 8.1% decline from the same period in 2008. Average loan balances

declined $1.7 billion, or 3.3%, with decreases in commercial real estate and residential mortgage loans partially offset by

increases in equity lines, tax-exempt loans, and nonaccrual loans. Lower loan volume and decreased spreads primarily due to

a change in mix and an increase in nonaccrual loans resulted in an $89.5 million, or 8.6%, decrease in loan-related net

interest income. Average consumer and commercial deposit balances increased $9.0 billion, or 10.9%, primarily in higher

yielding interest-bearing deposits as the economic environment has influenced customer product preference. NOW and

money market accounts increased a combined $6.4 billion, or 16.9%, while certificates of deposit and IRA accounts

increased $1.2 billion, or 4.4%. Low cost demand deposit and savings accounts combined increased $1.4 billion, or 7.6%.

While DDA, NOW, and MMA balances increased throughout 2009, certificates of deposit declined in the latter half of 2009

due in part to pricing of these accounts. Despite the year over year deposit growth, deposit-related net interest income

declined by $104.1 million, or 5.6%, as a result of the change in deposit mix, as well as the lower interest rate environment

which drove a decrease in the relative value of demand deposits.

Provision for credit losses was $1.2 billion, a $585.4 million increase over the same period in 2008. The provision was

predominantly driven by an increase in provision for real estate construction loans and home equity lines reflecting the

deterioration in the residential real estate market. Provision for commercial loans also increased, mostly due to net charge-

offs on smaller commercial clients.

69