SunTrust 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair value is the price that could be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants. Estimating fair value requires that we make a number of significant judgments. Where observable

market prices for identical assets or liabilities are not available, we identify what we believe to be similar assets or liabilities.

If observable market prices are unavailable or impracticable to obtain for any such similar assets or liabilities, then fair value

is estimated using modeling techniques, such as discounted cash flow analyses. These modeling techniques incorporate our

assessments regarding assumptions that market participants would use in pricing the asset or the liability, including market-

based assumptions, such as interest rates, as well as assumptions about the risks inherent in a particular valuation technique,

the effect of a restriction on the sale or use of an asset, market liquidity, and the risk of nonperformance. In certain cases, our

assessments with respect to assumptions that market participants would make may be inherently difficult to determine and

the use of different assumptions could result in material changes to these fair value measurements. Various processes and

controls have been adopted to determine that appropriate methodologies, techniques and assumptions are used in the

development of fair value estimates. These processes include independent price verification, model validation, and

corroborating prices from third-parties when possible. The use of significant, unobservable inputs in our models is described

in Note 20, “Fair Value Election and Measurement,” to the Consolidated Financial Statements.

In certain instances, we use discount rates in our determination of the fair value of certain assets and liabilities such as

retirement and other postretirement benefit obligations, MSRs, and certain financial instruments. Discount rates used are

those considered to be commensurate with the risks involved. A change in these discount rates could increase or decrease the

values of those assets and liabilities. The fair value of MSRs is based on discounted cash flow analyses. We provide

disclosure of the key economic assumptions used to measure MSRs and residual interests and a sensitivity analysis to

adverse changes to these assumptions in Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing Rights and

Variable Interest Entities,” to the Consolidated Financial Statements. A detailed discussion of key variables, including the

discount rate, used in the determination of retirement and other postretirement obligations is contained in the “Pension

Accounting” section below.

In estimating the fair values for investment securities and most derivative financial instruments, we believe that observable

market prices are the best evidence of exit price. If such market prices are not available on the exact securities that we own,

fair values are based on the market prices of similar instruments, third-party broker quotes or are estimated using industry-

standard or proprietary models whose inputs may be unobservable. The distressed market conditions associated with this

economic recession have impacted our ability to obtain market pricing data for certain of our investments. Even when market

pricing has been available, the reduced trading activity resulting from current market conditions has challenged the

observability of these quotations. When fair values are estimated based on internal models, we will consider relevant market

indices that correlate to the underlying collateral, along with assumptions such as liquidity discounts, interest rates,

prepayment speeds, default rates, loss severity rates, and discount rates.

The fair values of loans held for investment recorded at fair value and LHFS are based on observable current market prices in

the secondary loan market in which loans trade, as either whole loans or as ABS. When securities prices are obtained in the

secondary loan market, we will translate these prices into whole loan prices by incorporating adjustments for estimated credit

enhancement costs, loan servicing fees, and various other transformation costs, when material. The fair value of a loan is

impacted by the nature of the asset and the market liquidity. When estimating fair value for loans that do not trade in an

active market, we will make assumptions about prepayment speeds, default rates, loss severity rates, and liquidity discounts.

Absent comparable current market data, we believe that the fair value derived from these various approaches is a reasonable

approximation of the prices that we would receive upon sale of the loans.

The fair values of OREO and other repossessed assets are typically determined based on recent appraisals by third parties and

other market information, less estimated selling costs. Estimates of fair value are also required when performing an

impairment analysis of goodwill, intangible assets and long-lived assets. For long-lived assets, including intangible assets

subject to amortization, an impairment loss is recognized if the carrying amount of the asset is not recoverable and exceeds

its fair value. In determining the fair value, management uses models which require assumptions about growth rates, the life

of the asset, and/or the market value of the assets. We test long-lived assets for impairment whenever events or changes in

circumstances indicate that our carrying amount may not be recoverable.

Goodwill

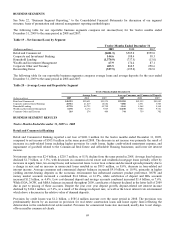

In 2008, our reporting units were comprised of Retail, Commercial, Commercial Real Estate, Mortgage, Corporate and

Investment Banking, Wealth and Investment Management, and Affordable Housing. We changed our business segments in

2009. Among other changes, we combined the Consumer Lending business unit with the Mortgage reporting unit and

renamed the combined unit as Household Lending; previously Consumer Lending was included in the Retail reporting unit.

See Note 22, “Business Segment Reporting” to the Consolidated Financial Statements for a discussion regarding the changes

to our reportable segments.

62