SunTrust 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shares that may be included as base pay in the benefit calculations of certain officers. The intent is to ensure that Salary

Shares will not result in increased benefits under these plans. These plans, as amended and restated, are filed as exhibits 10.7

and 10.8 to this report.

Effective January 1, 2010, the Company amended its Change in Control Agreements with certain officers. The purpose of the

amendments was to ensure that the Company’s payment of a portion of 2010 base pay in the form of Salary Shares to certain

employees will not result in an increase in benefits under these agreements. These agreements, as amended and restated, are

filed as exhibits 10.12 and 10.13 to this report.

Effective December 31, 2009, the Company merged the SunTrust Banks, Inc. 401(k) Excess Plan into the SunTrust Banks,

Inc. Deferred Compensation Plan and amended and restated the Deferred Compensation Plan effective January 1, 2010. The

purpose of the merger and subsequent amendment was to simplify the administration of executive deferrals and Company

contributions by combining all salary and bonus deferrals into a single plan and to clarify that no deferrals may be based on

2010 Salary Shares. The Deferred Compensation Plan, as amended and restated, is filed as exhibit 10.10 to this report.

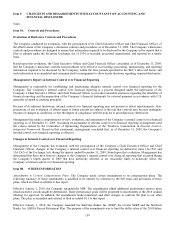

Changes to Long-Term Incentive Structure for Named Executive Officers. Presently, the Company remains subject to the

executive compensation limits under EESA. As a result, the Company is limited to making long-term incentive awards in the

form of long-term restricted stock of the Company in amounts not exceeding one-third of each employee’s annual

compensation. The Committee has elected to make such awards further conditioned on Company performance.

On February 19, 2010, the Compensation Committee of the Board of Directors of the Company (the “Committee”) approved

changes to the long-term incentive structure for the Named Executive Officers and additional executives. The Committee

continued its practice of tying a significant portion of its long-term awards to the Company’s performance, and increased

from 50% to 100% the portion of such awards which will be tied to corporate performance. For 2010, performance will be

based half on relative total shareholder return (TSR) on an annual basis and the remainder on net income available to

common shareholders, return on equity (ROE), and the level of charge-offs.

The Committee has established threshold, target, and maximum performance levels for each of the performance metrics for

fiscal 2010. Accomplishment of these performance levels will determine a number of shares of restricted stock which the

Committee potentially will award to each executive before the end of 2010. However, the actual number of shares to be

awarded will be subject to the Committee’s negative discretion (can only reduce the number of shares that may be awarded).

Further, in no case shall the maximum number of shares awarded exceed the compensation limits under EESA of one-third

of the executive’s total annual compensation.

The Committee will measure achievement of the performance metrics in late December, 2010 and, after considering whether

to exercise negative discretion, will make long-term restricted stock grants to the executives at that time. In accordance with

the requirements of EESA, such grants will vest (100%) only after two years and after the Company’s repayment of TARP.

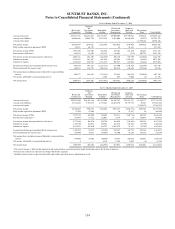

The table below indicates each Named Executive Officer’s potential award at maximum performance.

Named Executive Officer

Potential Award at

Maximum

Performance

James M. Wells III .................................................................. $2,033,650

William H. Rogers, Jr ................................................................ $810,000

Mark A. Chancy .................................................................... $705,000

Thomas E. Freeman ................................................................. $652,500

David F. Dierker .................................................................... $490,000

Part III

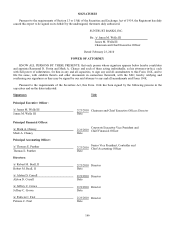

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The information at the captions “Nominees for Directorship,” “Nominees for Terms Expiring in 2011,” “Executive Officers,”

“Section 16(a) Beneficial Ownership Reporting Compliance,” “Corporate Governance and Director Independence,”

“Shareholder Nominations for Election to the Board,” and “Board Committees” in the Registrant’s definitive proxy statement

for its annual meeting of shareholders to be held on April 27, 2010 and to be filed with the Commission is incorporated by

reference into this Item 10.

Item 11. EXECUTIVE COMPENSATION.

The information at the captions “Compensation Policies that Affect Risk Management,” “Executive Compensation”

(“Compensation Discussion and Analysis,” “Compensation Committee Report,” “Summary of Cash and Certain Other

160