SunTrust 2009 Annual Report Download - page 68

Download and view the complete annual report

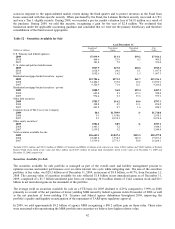

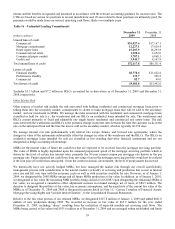

Please find page 68 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equity; $2.1 billion of which was raised in the second quarter. The transactions utilized to increase our Tier 1 common equity

consisted of the issuance of common stock, gains realized upon the purchase of certain of our preferred stock and hybrid debt

securities, and the sale of Visa Class B shares. The common stock offering raised $1.8 billion in Tier 1 common equity, the

purchase of hybrid debt securities created an addition to Tier 1 common equity of $120.8 million, and the gain in connection

with sale of the Visa Class B shares resulted in an addition to Tier 1 common equity of $70.1 million. While increasing our

total and Tier 1 capital, the results of the common stock offering also diluted our common share count and related book value

per share. The 142 million new shares issued in the common offering significantly contributed to the $13.45 decrease from

prior year end, to $35.29, in our book value per common share and the $6.10 decrease from prior year end in our tangible

book value per common share to $22.59 at December 31, 2009.

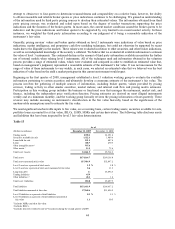

We declared and paid common dividends totaling $82.6 million during the year ended December 31, 2009, or $0.22 per

common share, compared to $1.0 billion, or $2.85 per common share, during 2008. In addition, we declared dividends

payable during the years ended December 31, 2009 and 2008 of $14.1 million and $22.3 million, respectively, on our Series

A preferred stock. Further, during the years ended December 31, 2009 and 2008, we declared dividends payable of $242.7

million and $22.8 million, respectively, to the U.S. Treasury on the Series C and D Preferred Stock issued to the U.S.

Treasury. During the year, we reduced the common share dividend to $0.01 per share, per quarter where it remained as of the

most recent common share dividend declaration in December 2009. It is not likely that we will increase our dividend until we

have returned to profitability and obtained the consent of our applicable regulators as further described below.

In connection with the issuances of the Series A Preferred Stock of SunTrust Banks, Inc., the Fixed to Floating Rate Normal

Preferred Purchase Securities of SunTrust Preferred Capital I, the 6.10% Enhanced Trust Preferred Securities of SunTrust

Capital VIII, and the 7.875% Trust Preferred securities of SunTrust Capital IX (collectively, the “Issued Securities”), we

entered into RCCs. The RCCs limit our ability to repay, redeem or repurchase the Issued Securities (or certain related

securities). We executed each of the RCC in favor of the holders of certain debt securities, who are initially the holders of our

6% Subordinated Notes due 2026. The RCCs are more fully described in Current Reports on Form 8-K filed on

September 12, 2006, November 6, 2006, December 6, 2006, and March 4, 2008.

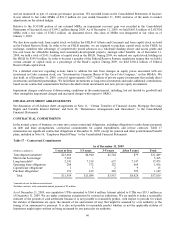

In connection with the issuance of the Series C and D Preferred Stock of SunTrust Banks, Inc. we agreed to certain terms

affecting repurchase, redemption, and repayment of the preferred stock and restriction on payment of common stock

dividends, among other terms. We are subject to certain restrictions on our ability to increase the dividend as a result of

participating in the U.S. Treasury’s CPP. Generally, we may not pay a regular quarterly cash dividend more than $0.77 per

share of common stock prior to November 14, 2011, unless either (i) we have redeemed the Series C and Series D Preferred

Stock, (ii) the U.S. Treasury has transferred the Series C and Series D Preferred Stock to a third party, or (iii) the U.S.

Treasury consents to the payment of such dividends in excess of such amount. Additionally, if we increase our quarterly

dividend above $0.54 per share prior to the tenth anniversary of our participation in the CPP, then the exercise price and the

number of shares to be issued upon exercise of the warrants issued in connection with our participation in the CPP will be

proportionately adjusted. The amount of such adjustment will be determined by a formula and depends in part on the extent

to which we raise our dividend. The formulas are contained in the warrant agreements. There also exists limits on the ability

of the Bank to pay dividends to SunTrust Banks, Inc. (the “Parent Company”). Substantially all of our retained earnings are

undistributed earnings of the Bank, which are restricted by various regulations administered by federal and state bank

regulatory authorities. There was no capacity for payment of cash dividends to the Parent Company under these regulations

at December 31, 2009.

Included with the issuance of the Series C and D preferred stock was issuance of ten-year warrants to the Treasury to

purchase approximately 11.9 million and 6.0 million shares of our common stock at initial exercise prices of $44.15 and

$33.70. The preferred stock and related warrants were issued at a total discount of approximately $132 million, which will be

accreted into U.S. Treasury preferred dividend expense using the effective yield method over a five year period from each

respective issuance date. The terms of the warrants as well as the restrictions related to the issuance of the preferred stock is

more fully described in Current Reports on Form 8-K filed on November 17, 2008 and January 2, 2009.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, we are exposed to various risks. To manage the major risks that we face and to provide

reasonable assurance that key business objectives will be achieved, we have established an enterprise risk governance

process and the SunTrust Enterprise Risk Program. Moreover, we have policies and various risk management processes

designed to effectively identify, monitor and manage risk.

We continually refine and enhance our risk management policies, processes and procedures to maintain effective risk

management and governance, including identification, measurement, monitoring, control, mitigation and reporting of all

material risks. Over the last several years, we have enhanced risk measurement applications and systems capabilities that

provide management information on whether we are being appropriately compensated for the risk profile we have adopted.

We balance our strategic goals, including revenue and profitability objectives, with the risks associated with achieving our

goals. Effective risk management is an important element supporting our business decision making.

52