SunTrust 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

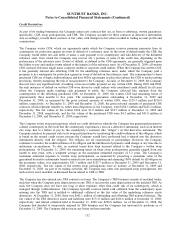

In September 2008, the Federal Reserve instituted the Program that allows eligible depository institutions, bank holding

companies and affiliated broker/dealers to purchase certain ABCP from certain MMMF. These purchases will be made

by the participating institution at a price equal to the MMMF’s amortized cost. The Fed will then make a fixed rate

non-recourse loan to the participating institution that will mature on the same date as the ABCP that was purchased with

a specific draw. As of December 31, 2008, STRH owned $400 million of eligible ABCP at a price of $399.6 million. At

December 31, 2008, this ABCP had a weighted average maturity of 9 days and a risk weighting of 0% for regulatory

capital purposes. Per the terms of the Program, STRH also had outstanding loans from the Federal Reserve in the

amount of $399.6 million. In 2009, all of this ABCP matured, STRH collected 100% of the par amount of this ABCP

from the issuer and repaid the loan to the Federal Reserve. At December 31, 2008, this ABCP was classified within

trading assets and carried at fair value, and the loans from the Federal Reserve were elected to be carried at fair value

and classified within other short-term borrowings. Because of the non-recourse nature of the loan, the Company did not

recognize through earnings any differences in fair value between the loans and the ABCP.

Brokered Deposits

The Company had elected to measure certain CDs at fair value. These debt instruments include embedded derivatives

that are generally based on underlying equity securities or equity indices, but may be based on other underlyings that are

generally not clearly and closely related to the host debt instrument. The Company elected to carry these instruments at

fair value in order to remove the mixed attribute accounting model. This required bifurcation of a single instrument into

a debt component, which would be carried at amortized cost, and a derivative component, which would be carried at fair

value, with such bifurcation being based on the fair value of the derivative component and an allocation of any

remaining proceeds to the host debt instrument. Prior to 2009, the Company had elected to carry substantially all newly-

issued CDs at fair value to economically hedge the embedded features. In 2009, given the continued dislocation in the

credit markets, the Company evaluated, on an instrument by instrument basis, whether a new issuance would be carried

at fair value.

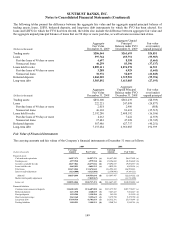

Loans and Loans Held for Sale

In the second quarter of 2007, the Company began recording at fair value certain newly-originated mortgage LHFS

based upon defined product criteria. SunTrust chose to fair value these mortgage LHFS in order to eliminate the

complexities and inherent difficulties of achieving hedge accounting and to better align reported results with the

underlying economic changes in value of the loans and related hedge instruments. This election impacts the timing and

recognition of origination fees and costs, as well as servicing value. Specifically, origination fees and costs, which had

been appropriately deferred and recognized as part of the gain/loss on sale of the loan, are now recognized in earnings at

the time of origination. The servicing value, which had been recorded as MSRs at the time the loan was sold, is now

included in the fair value of the loan and initially recognized at the time the Company enters into IRLCs with borrowers.

The Company began using derivatives to economically hedge changes in servicing value as a result of including the

servicing value in the fair value of the loan. The mark to market adjustments related to LHFS and the associated

economic hedges are captured in mortgage production income.

On May 1, 2008, SunTrust acquired 100% of the outstanding common shares of GB&T. As a result of the acquisition,

SunTrust acquired approximately $1.4 billion of loans, primarily commercial real estate loans. SunTrust elected to

account for at fair value, $171.6 million of the acquired loans, which were classified as nonaccrual, in order to eliminate

the complexities of accounting for these purchased impaired loans. Upon acquisition, the loans had a fair value of

$111.1 million. On December 31, 2009, primarily as a result of paydowns, payoffs and transfers to OREO, the loans had

a fair value of $12.2 million.

Trading Loans

The Company often maintains a portfolio of loans that it trades in the secondary market. The Company elected to carry

certain loans at fair value in order to reflect the active management of these positions. Loans are purchased and recorded

at fair value as part of the Company’s normal loan trading activities. As of December 31, 2009, approximately $286.5

million of trading loans were outstanding.

In addition to loans carried at fair value in connection with the Company’s loan trading business, the Company has also

elected to carry short-term loans made in connection with its total return swap business at fair value. At December 31,

2008, the Company had approximately $603.4 million of such short-term loans carried at fair value, which are included

in trading assets. As of December 31, 2008, the Company had decided to temporarily suspend its TRS business and the

Company has unwound its positions as of December 31, 2009.

139