SunTrust 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

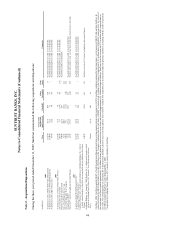

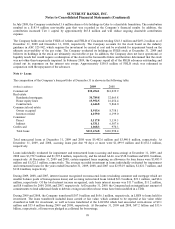

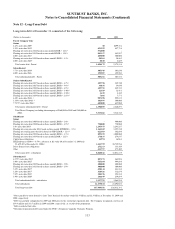

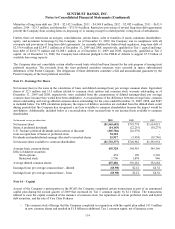

In the normal course of business, the Company enters into certain contractual obligations. Such obligations include

obligations to make future payments on lease arrangements, contractual commitments for capital expenditures, and service

contracts. As of December 31, 2009, the Company had the following in unconditional obligations:

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating lease obligations $208 $372 $322 $664 $1,566

Capital lease obligations 1132915

Purchase obligations 2153 239 228 529 1,149

Total $362 $614 $552 $1,202 $2,730

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

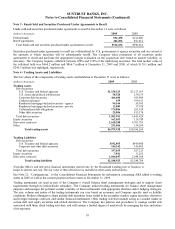

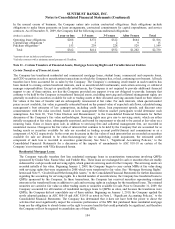

Note 11 - Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities

Certain Transfers of Financial Assets

The Company has transferred residential and commercial mortgage loans, student loans, commercial and corporate loans,

and CDO securities in sale or securitization transactions in which the Company has, or had, continuing involvement. All such

transfers have been accounted for as sales by the Company. The Company’s continuing involvement in such transfers has

been limited to owning certain beneficial interests, such as securitized debt instruments, and certain servicing or collateral

manager responsibilities. Except as specifically noted herein, the Company is not required to provide additional financial

support to any of these entities, nor has the Company provided any support it was not obligated to provide. Interests that

continue to be held by the Company in transferred financial assets, excluding servicing and collateral management rights, are

generally recorded as securities available for sale or trading assets at their allocated carrying amounts based on their relative

fair values at the time of transfer and are subsequently remeasured at fair value. For such interests, when quoted market

prices are not available, fair value is generally estimated based on the present value of expected cash flows, calculated using

management’s best estimates of key assumptions, including credit losses, loan prepayment speeds, and discount rates

commensurate with the risks involved, based on how management believes market participants would determine such

assumptions. See Note 20, “Fair Value Election and Measurement,” to the Consolidated Financial Statements for further

discussion of the Company’s fair value methodologies. Servicing rights may give rise to servicing assets, which are either

initially recognized at fair value, subsequently amortized, and tested for impairment or elected to be carried at fair value on a

recurring basis. Gains or losses upon sale, in addition to servicing fees and collateral management fees, are recorded in

noninterest income. Changes in the fair value of interests that continue to be held by the Company that are accounted for as

trading assets or securities available for sale are recorded in trading account profits/(losses) and commissions or as a

component of AOCI, respectively. In the event any decreases in the fair value of such interests that are recorded as securities

available for sale are deemed to be other-than-temporary due to underlying credit impairment, the estimated credit

component of such loss is recorded in securities gains/(losses). See Note 1, “Significant Accounting Policies,” to the

Consolidated Financial Statements for a discussion of the impacts of amendments to ASC 810-10 on certain of the

Company’s involvement with VIEs discussed herein.

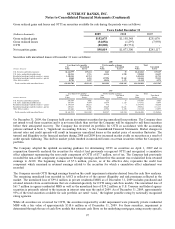

Residential Mortgage Loans

The Company typically transfers first lien residential mortgage loans in securitization transactions involving QSPEs

sponsored by Ginnie Mae, Fannie Mae, and Freddie Mac. These loans are exchanged for cash or securities that are readily

redeemed for cash proceeds and servicing rights, which generate servicing assets for the Company. The servicing assets are

recorded initially at fair value. Beginning January 1, 2009, the Company began to carry certain MSRs at fair value along

with servicing rights that were originated in 2008 which were transferred to fair value. See “Mortgage Servicing Rights”

herein and Note 9, “Goodwill and Other Intangible Assets,” to the Consolidated Financial Statements for further discussion

regarding the accounting for servicing rights. In a limited number of securitizations, the Company has transferred loans to

QSPEs sponsored by the Company. In these transactions, the Company has received securities representing retained

interests in the transferred loans in addition to cash and servicing rights in exchange for the transferred loans. The retained

securities are carried at fair value as either trading assets or securities available for sale. Prior to December 31, 2009, the

Company accounted for all transfers of residential mortgage loans to QSPEs as sales, and because the transferees were

QSPEs, the Company did not consolidate any of these entities. Beginning on January 1, 2010, the Company applied the

newly adopted guidance in ASC 860-10 and ASC 810-10 as noted in Note 1, “Significant Accounting Policies,” to the

Consolidated Financial Statements. The Company has determined that it does not have both the power to direct the

activities that most significantly impact the economic performance of the SPE that purchased these residential mortgage

loans nor the obligation to absorb losses or the right to receive benefits that could potentially be significant, and therefore

the Company will not be required to consolidate any of these SPEs.

104