SunTrust 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

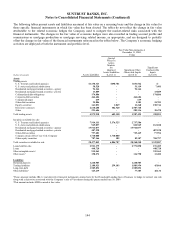

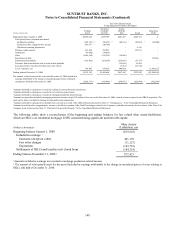

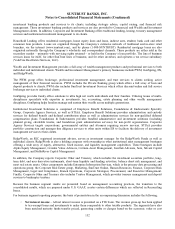

Fair Value Gain/(Loss) for the Year Ended December 31,

2009, for Items Measured at Fair Value Pursuant to Election of the Fair Value Option

(Dollars in thousands)

Trading Account

Profits/(losses) and

Commissions

Mortgage

Production

Related

Income 2

Mortgage

Servicing

Related Income

Total

Changes in

Fair Values

Included in

Current-

Period

Earnings1

Assets

Trading assets $3,165 $- $ - $3,165

Loans held for sale 2,020 625,396 - 627,416

Loans 2,353 (666) - 1,687

Other intangible assets - 17,551 65,944 83,495

Liabilities

Brokered deposits 11,249 - - 11,249

Long-term debt (64,826) - - (64,826)

1Changes in fair value for the year ended December 31, 2009, exclude accrued interest for the periods then ended. Interest income or interest expense on trading assets,

loans, loans held for sale, brokered deposits and long-term debt that have been elected to be carried at fair value are recorded in interest income or interest expense in the

Consolidated Statements of Income/(Loss) based on their contractual coupons. Certain trading assets do not have a contractually stated coupon and, for these securities,

the Company records interest income based on the effective yield calculated upon acquisition of those securities.

2For the year ended December 31, 2009, income related to loans held for sale, includes $664.3 million related to MSRs recognized upon the sale of loans reported at fair

value. For the year ended December 31, 2009, income related to other intangible assets includes $17.5 million of MSRs recognized upon the sale of loans reported at the

lower of cost or market value. These MSRs are included in the table since the Company elected to report MSRs recognized in 2009 using the fair value method.

Previously, MSRs were reported under the amortized cost method.

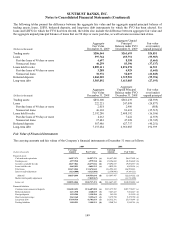

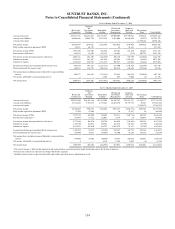

Fair Value Measurements at

December 31, 2008,

Using

(Dollars in thousands) Assets/Liabilities

Quoted

Prices In

Active

Markets

for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets

Trading assets

U.S. Treasury and federal agencies $3,127,635 $142,906 $2,339,469 $645,260

U.S. states and political subdivisions 159,135 - 151,809 7,326

Corporate debt securities 585,809 - 579,159 6,650

Commercial paper 399,611 - 399,611 -

Residential mortgage-backed securities - agencies 58,565 - 58,565 -

Residential mortgage-backed securities - private 37,970 - - 37,970

Collateralized debt obligations 261,528 - - 261,528

Other debt securities 813,176 - 790,231 22,945

Equity securities 116,788 6,415 8,409 101,964

Derivative contracts 4,701,783 - 4,452,236 249,547

Other 134,269 - 76,074 58,195

Total trading assets 10,396,269 149,321 8,855,563 1,391,385

Securities available for sale

U.S. Treasury and federal agencies 486,153 127,123 359,030 -

U.S. states and political subdivisions 1,037,429 - 958,167 79,262

Residential mortgage-backed securities - agencies 14,550,104 - 14,550,104 -

Residential mortgage-backed securities - private 522,151 - - 522,151

Other debt securities 294,185 - 265,772 28,413

Common stock of The Coca-Cola Company 1,358,100 1,358,100 - -

Other equity securities 1,448,415 141 588,495 859,779

Total securities available for sale 19,696,537 1,485,364 16,721,568 1,489,605

Loans held for sale 2,424,432 - 1,936,987 487,445

Loans 270,342 - - 270,342

Other assets 1109,600 775 35,231 73,594

Liabilities

Brokered deposits 587,486 - 587,486 -

Trading liabilities 3,240,784 440,436 2,800,348 -

Other short-term borrowings 399,611 - 399,611 -

Long-term debt 7,155,684 - 3,659,423 3,496,261

Other liabilities 172,911 - 71,738 1,173

1This amount includes IRLCs and derivative financial instruments entered into by the Household Lending line of business to hedge its interest rate risk.

145