SunTrust 2009 Annual Report Download - page 18

Download and view the complete annual report

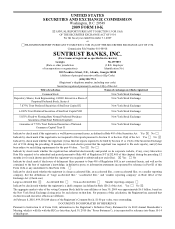

Please find page 18 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approval of the Federal Reserve. Moreover, a bank and its affiliates may not, after the acquisition of another bank, control

more than 10% of the amount of deposits of insured depository institutions in the United States. In addition, certain states

may have limitations on the amount of deposits any bank may hold within that state.

There are a number of obligations and restrictions imposed on bank holding companies and their depository institution

subsidiaries by federal law and regulatory policy that are designed to reduce potential loss exposure to the depositors of such

depository institutions and to the FDIC insurance fund in the event the depository institution becomes in danger of default or

is in default. For example, under a policy of the Federal Reserve with respect to bank holding company operations, a bank

holding company is required to serve as a source of financial strength to its subsidiary depository institutions and commit

resources to support such institutions in circumstances where it might not do so absent such policy. In addition, the “cross-

guarantee” provisions of federal law require insured depository institutions under common control to reimburse the FDIC for

any loss suffered or reasonably anticipated as a result of the default of a commonly controlled insured depository institution

or for any assistance provided by the FDIC to a commonly controlled insured depository institution in danger of default. The

federal banking agencies have broad powers under current federal law to take prompt corrective action to resolve problems

of insured depository institutions. The extent of these powers depends upon whether the institutions in question are “well

capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized” as

such terms are defined under regulations issued by each of the federal banking agencies.

The Federal Reserve and the FDIC have issued substantially similar risk-based and leverage capital guidelines applicable to

United States banking organizations. In addition, these regulatory agencies may from time to time require that a banking

organization maintain capital above the minimum levels, whether because of its financial condition or actual or anticipated

growth. The Federal Reserve risk-based guidelines define a tier-based capital framework. Tier 1 capital includes common

shareholders’ equity, trust preferred securities, minority interests and qualifying preferred stock, less goodwill (net of any

qualifying deferred tax liability) and other adjustments. Tier 2 capital consists of preferred stock not qualifying as Tier 1

capital, mandatorily convertible debt, limited amounts of subordinated debt, other qualifying term debt, the allowance for

credit losses up to a certain amount and a portion of the unrealized gain on equity securities. The sum of Tier 1 and Tier 2

capital represents the Company’s qualifying total capital. Risk-based capital ratios are calculated by dividing Tier 1 and total

capital by risk-weighted assets. Assets and off-balance sheet exposures are assigned to one of four categories of risk-weights,

based primarily on relative credit risk. In addition, the Company, and any bank with significant trading activity, must

incorporate a measure for market risk in their regulatory capital calculations. The leverage ratio is determined by dividing

Tier 1 capital by adjusted average total assets.

FDICIA, among other things, identifies five capital categories for insured depository institutions (“well capitalized,”

“adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” and “critically undercapitalized”) and requires

the respective federal regulatory agencies to implement systems for “prompt corrective action” for insured depository

institutions that do not meet minimum capital requirements within such categories. FDICIA imposes progressively more

restrictive constraints on operations, management and capital distributions, depending on the category in which an institution

is classified. Failure to meet the capital guidelines could also subject a banking institution to capital raising requirements. An

“undercapitalized” bank must develop a capital restoration plan and its parent holding company must guarantee that bank’s

compliance with the plan. The liability of the parent holding company under any such guarantee is limited to the lesser of

five percent of the bank’s assets at the time it became “undercapitalized” or the amount needed to comply with the plan.

Furthermore, in the event of the bankruptcy of the parent holding company, such guarantee would take priority over the

parent’s general unsecured creditors. In addition, FDICIA requires the various regulatory agencies to prescribe certain

non-capital standards for safety and soundness relating generally to operations and management, asset quality, and executive

compensation and permits regulatory action against a financial institution that does not meet such standards.

The various regulatory agencies have adopted substantially similar regulations that define the five capital categories

identified by FDICIA, using the total risk-based capital, Tier 1 risk-based capital and leverage capital ratios as the relevant

capital measures. Such regulations establish various degrees of corrective action to be taken when an institution is considered

undercapitalized. Under the regulations, a “well capitalized” institution must have a Tier 1 risk-based capital ratio of at least

six percent, a total risk-based capital ratio of at least ten percent and a leverage ratio of at least five percent and not be subject

to a capital directive order.

Regulators also must take into consideration: (a) concentrations of credit risk; (b) interest rate risk (when the interest rate

sensitivity of an institution’s assets does not match the sensitivity of its liabilities or its off-balance-sheet position); and

(c) risks from non-traditional activities, as well as an institution’s ability to manage those risks, when determining the

adequacy of an institution’s capital. This evaluation will be made as a part of the institution’s regular safety and soundness

examination. In addition, regulators may choose to examine other factors in order to evaluate the safety and soundness of

financial institutions. For instance, in connection with the Supervisory Capital Assessment Program, our regulators began

focusing on “Tier 1 common equity,” which is the proportion of Tier 1 capital that is common equity. The Tier 1 common

equity ratio continues to be a factor which regulators examine in evaluating the safety and soundness of financial institutions.

2