SunTrust 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Residential mortgage loans securitized through Ginnie Mae, Fannie Mae, and Freddie Mac have been excluded from the

tables above since the Company does not retain any beneficial interests or other continuing involvement in the loans other

than servicing responsibilities on behalf of Ginnie Mae, Fannie Mae, and Freddie Mac, and repurchase contingencies under

standard representations and warranties made with respect to the transferred mortgage loans. The total amount of loans

serviced by the Company as a result of such securitization transactions totaled $127.8 billion and $106.6 billion at

December 31, 2009 and December 31, 2008, respectively. Related servicing fees received by the Company during 2009,

2008, and 2007 were $333.4 million, $293.9 million and $263.2 million, respectively.

Mortgage Servicing Rights

In addition to other interests that continue to be held by the Company in the form of securities, the Company also retains

MSRs from certain of its sales or securitizations of residential mortgage loans. MSRs on residential mortgage loans are the

only servicing assets capitalized by the Company. The Company maintains two classes of MSRs: MSRs related to loans

originated and sold after January 1, 2008, which are reported at fair value and MSRs related to loans sold before January 1,

2008, which are reported at amortized cost, net of any allowance for impairment losses. Any impacts of this activity are

reflected in the Company’s Consolidated Statements of Income/(Loss) in mortgage servicing-related income. See Note 9,

“Goodwill and Other Intangible Assets”, to the Consolidated Financial Statements for the rollforward of MSRs.

Income earned by the Company on its MSRs is derived primarily from contractually specified mortgage servicing fees and

late fees, net of curtailment costs. Such income earned for the years ended December 31, 2009, 2008, and 2007 was $353.7

million, $354.3 million, and $337.7 million, respectively. These amounts are reported in mortgage servicing-related income

in the Consolidated Statements of Income/(Loss).

As of December 31, 2009 and December 31, 2008, the total unpaid principal balance of mortgage loans serviced was $178.9

billion and $162.0 billion, respectively. Included in these amounts were $146.7 billion and $130.5 billion as of December 31,

2009 and December 31, 2008, respectively, of loans serviced for third parties. As of December 31, 2009 and December 31,

2008, the Company had established MSRs valuation allowances of $6.7 million and $370.0 million, respectively. No

permanent impairment losses were recorded against the allowance, with respect to MSRs carried at amortized cost, during

the years ended December 31, 2009 and December 31, 2008.

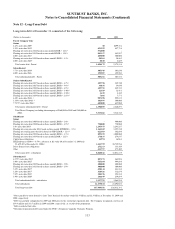

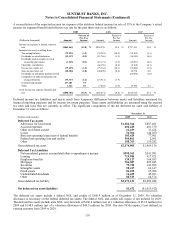

A summary of the key characteristics, inputs, and economic assumptions used to estimate the fair value of the Company’s

MSRs and the sensitivity of the December 31, 2009 and December 31, 2008 fair values to immediate 10% and 20% adverse

changes in those assumptions follows.

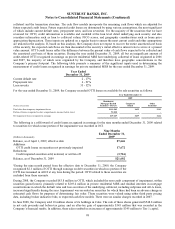

(Dollars in millions)

2009

Fair Value

2009

Lower of Cost

or Market

Total

2008

Lower of Cost

or Market

Fair value of retained MSRs $935.6 $748.5 $815.6

Prepayment rate assumption (annual) 10.0% 16.9% 32.8%

Decline in fair value of 10% adverse change $30.2 $30.1 $61.2

Decline in fair value of 20% adverse change 57.9 57.7 113.8

Discount rate (annual) 10.3% 11.7% 9.3%

Decline in fair value of 10% adverse change $39.1 $26.6 $17.9

Decline in fair value of 20% adverse change 75.2 51.3 35.0

Weighted-average life (in years) 7.50 4.84 2.50

Weighted-average coupon 5.24 6.11 6.15

The above sensitivities are hypothetical and should be used with caution. As the amounts indicate, changes in fair value

based on variations in assumptions generally cannot be extrapolated because the relationship of the change in assumption to

the change in fair value may not be linear. Also, in this table, the effect of a variation in a particular assumption on the fair

value of the retained interest is calculated without changing any other assumption. In reality, changes in one factor may result

in changes in another, which might magnify or counteract the sensitivities.

Variable Interest Entities

In addition to the Company’s involvement with certain VIEs, which is discussed herein under “Certain Transfers of Financial

Assets”, the Company also has involvement with VIEs from other business activities.

108