SunTrust 2009 Annual Report Download - page 64

Download and view the complete annual report

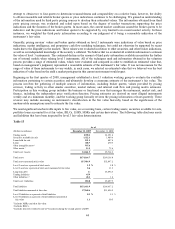

Please find page 64 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overall, the financial impact of the level 3 financial instruments did not have a significant impact on our liquidity or capital.

We acquired $3.5 billion of certain ABS from affiliates during the fourth quarter of 2007 using our existing liquidity

position, and since purchasing the securities, we have received approximately $2.5 billion in cash consideration from

paydowns, settlements, sales, and maturities of these securities. Some fair value assets are pledged for corporate borrowings

or other liquidity purposes. Most of these arrangements provide for advances to be made based on the market value and not

the principal balance of the assets, and therefore whether or not we have elected fair value accounting treatment does not

impact our liquidity. If the fair value of assets posted as collateral declines, we will be required to post more collateral under

our borrowing arrangements which could negatively impact our liquidity position on an overall basis. For purposes of

computing regulatory capital, mark to market adjustments related to our own creditworthiness for debt accounted for at fair

value are excluded from regulatory capital.

INVESTMENT IN COMMON SHARES OF THE COCA-COLA COMPANY

Background

We have owned common shares of Coke since 1919, when one of our predecessor institutions participated in the

underwriting of Coke’s IPO and received common shares of Coke in lieu of underwriting fees. These shares have grown in

value over the past 90 years and have been classified as available for sale securities, with unrealized gains, net of tax,

recorded as a component of shareholders’ equity. Because of the low accounting cost basis of these shares, we have

accumulated significant unrealized gains in shareholders’ equity. As of December 31, 2009, as a result of the transactions

undertaken in 2008 discussed herein, we owned 30 million Coke shares with an accounting cost basis of $69,295 and a fair

market value of approximately $1.7 billion.

We commenced a comprehensive balance sheet review initiative in early 2007 in an effort to improve liquidity and capital

efficiency. As part of this initiative, we began to formally evaluate the capital efficiency of our holdings of Coke common

shares, as we were prohibited from including the market value of our investment in Coke common shares in Tier 1 capital in

accordance with Federal Reserve capital adequacy rules.

Executed Multi-Step Strategy

As we reported in connection with our financial results for the quarter ended June 30, 2007, we sold 4.5 million Coke

common shares, or approximately 9% of our holdings at that time, in an open market sale. At that time, we also announced

publicly that we were evaluating various strategies to address our remaining Coke common shares.

In the second and third quarters of 2008, we completed the following three-part strategy with respect to our remaining

43.6 million common shares of Coke: (i) a market sale of 10 million shares, (ii) a charitable contribution of approximately

3.6 million shares to the SunTrust Foundation and (iii) the execution of The Agreements on 30 million shares. Our primary

objective in executing these transactions was to optimize the benefits we obtained from our long-term holding of this asset,

including the capital treatment by bank regulators.

I. Market Sale

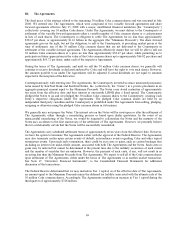

During the second quarter of 2008, we sold 10 million Coke common shares in the market. These sales, which

resulted in an increase of approximately $345.0 million to Tier 1 capital, generated approximately $549.0 million

in net cash proceeds and an after-tax gain of approximately $345.0 million that was recorded in our financial

results for the quarter ended June 30, 2008. This transaction resulted in foregone annual dividend income of

approximately $15.0 million, after-tax, and gave rise to a current tax liability with a marginal rate of just over 37%.

II. Contribution to the SunTrust Foundation

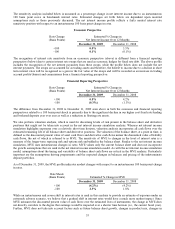

In July 2008, we contributed approximately 3.6 million Coke common shares to the SunTrust Foundation, which

was reflected as a contribution expense of $183.4 million in our financial results for the quarter ended

September 30, 2008. As the gain from this contribution is non-taxable, the only impact to our net income was the

release of the deferred tax liability of approximately $65.8 million (net of valuation allowance). This contribution

increased Tier 1 capital in the third quarter by approximately $65.8 million. This gain and resultant increase to Tier

1 capital were reflected in our third quarter results, as we had not made any commitments or entered into any other

transactions as of June 30, 2008 that would have required us to record this contribution in the second quarter. This

contribution will result in foregone annual dividend income of approximately $5 million, after-tax. We expect this

contribution to act as an endowment for the SunTrust Foundation to make grants to charities operating within our

footprint for years to come and reduce our ongoing charitable contribution expense. This transaction was treated as

a discrete item for income tax provision purposes and significantly lowered the effective tax rate for the third

quarter of 2008.

48