SunTrust 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

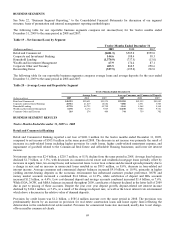

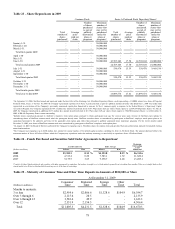

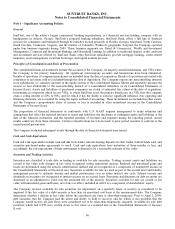

Table 23 – Share Repurchases in 2009

Common Stock Series A Preferred Stock Depositary Shares1

Total

number of

shares

purchased2

Average

price

paid per

share

Number

of shares

purchased

as part of

publicly

announced

plans or

programs

Maximum

number of

shares that

may yet be

purchased

under the

plans or

programs3

Total

number of

shares

purchased

Average

price

paid per

share

Number of

shares

purchased

as part of

publicly

announced

plans or

programs

Maximum

number of

shares that

may yet be

purchased

under the

plans or

programs

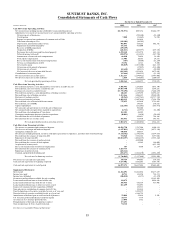

January 1-31 - - - 30,000,000 - - - -

February 1-28 - - - 30,000,000 - - - -

March 1-31 - - - 30,000,000 - - - -

Total first quarter 2009 - - - - - - -

April 1-30 - - - 30,000,000 - - - -

May 1-31 - - - 30,000,000 - - - -

June 1-30 - - - 30,000,000 12,569,104 17.50 12,569,104 10,000,000 4

Total second quarter 2009 - - - 12,569,104 17.50 12,569,104 10,000,000

July 1-31 - - - 30,000,000 530,470 15.39 530,470 9,469,530 4

August 1-31 - - - 30,000,000 - - - -

September 1-30 - - - 30,000,000 - - - -

Total third quarter 2009 - - - 530,470 15.39 530,470 9,469,530

October 1-31 - - - 30,000,000 - - - -

November 1-30 - - - 30,000,000 - - - -

December 1-31 - - - 30,000,000 - - - -

Total fourth quarter 2009 - - - - - - -

Total year-to-date 2009 - - - 13,099,574 17.41 13,099,574 9,469,530

1On September 12, 2006, SunTrust issued and registered under Section 12(b) of the Exchange Act 20 million Depositary Shares, each representing a 1/4,000th interest in a share of Perpetual

Preferred Stock, Series A. On June 30, 2009, the Company repurchased a portion of its Series A preferred stock as part of a publicly announced tender offer dated June 1, 2009. The tender offer

represented an acceleration of the Company’s previously announced capital plan framework to increase its Tier 1 common equity in response to the Federal Reserve’s Supervisory Capital

Assessment Program. The Company repurchased $314.2 million face amount of preferred stock at $17.50 per share ($25 par value), which equates to 12,569,104 Depositary Shares. On July 28,

2009, the Company repurchased an additional $13.3 million face amount of preferred stock at $15.39 per share ($25 par value), which equates to 530,470 Depositary Shares. As of December 31,

2009, 6,900,426 Depositary Shares remain outstanding.

2Includes shares repurchased pursuant to SunTrust’s employee stock option plans, pursuant to which participants may pay the exercise price upon exercise of SunTrust stock options by

surrendering shares of SunTrust common stock which the participant already owns. SunTrust considers shares so surrendered by participants in SunTrust’s employee stock option plans to be

repurchased pursuant to the authority and terms of the applicable stock option plan rather than pursuant to publicly announced share repurchase programs. For the twelve months ended

December 31, 2009, zero shares of SunTrust common stock were surrendered by participants in SunTrust’s employee stock option plans.

3On August 14, 2007, the Board of Directors authorized the Company to repurchase up to 30 million shares of common stock and specified that such authorization replaced (terminated) existing

unused authorizations.

4The Company may repurchase up to $250 million face amount of various tranches of its hybrid capital securities, including its Series A Preferred Stock. The amount disclosed reflects the

maximum number of Series A Preferred Shares which the Company may repurchase under this authority assuming it is used solely to repurchase Series A Preferred Stock.

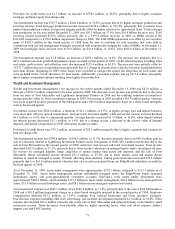

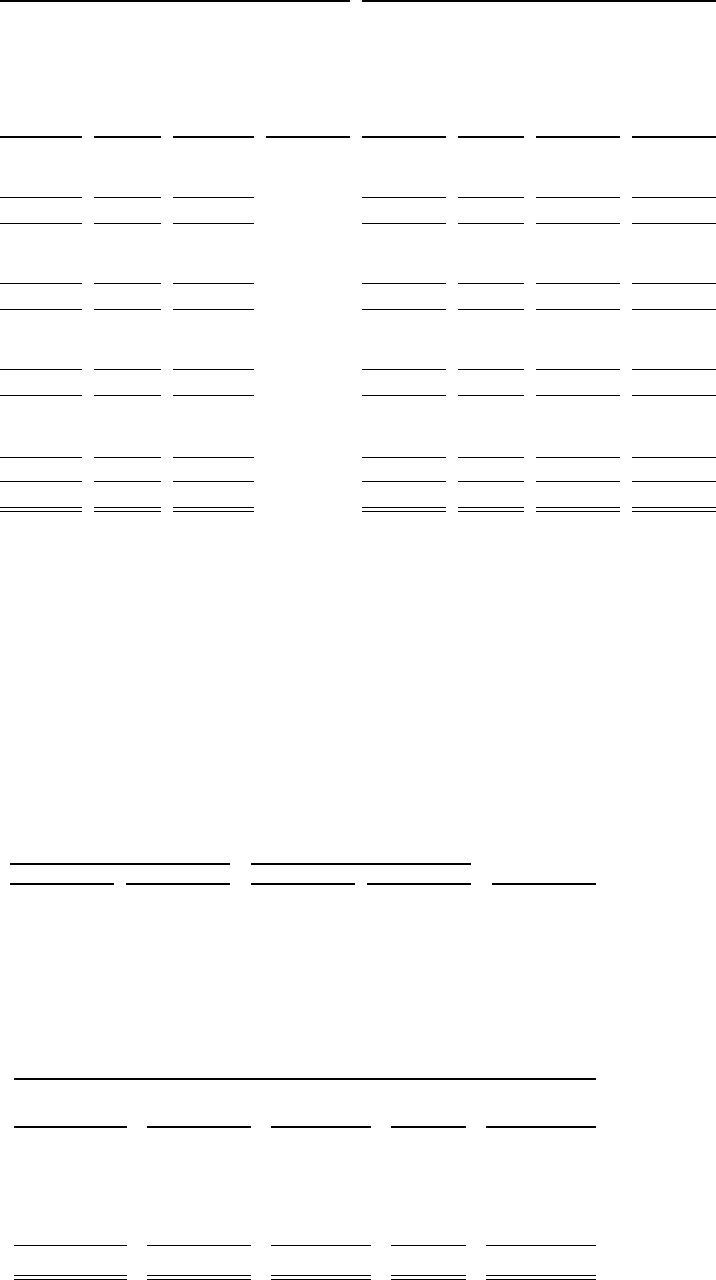

Table 24 – Funds Purchased and Securities Sold Under Agreements to Repurchase1

As of December 31 Daily Average

Maximum

Outstanding

at Any

Month-end(Dollars in millions) Balance Rate Balance Rate

2009 $3,303.1 0.13 % $4,153.0 0.19 % $6,313.6

2008 4,313.4 0.22 7,583.1 1.72 11,820.4

2007 9,179.5 3.69 9,398.7 4.68 13,285.1

1Consists of federal funds purchased and securities sold under agreements to repurchase that mature overnight or at a fixed maturity generally not exceeding three months. Rates on overnight funds reflect

current market rates. Rates on fixed maturity borrowings are set at the time of borrowings.

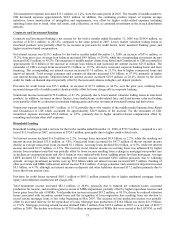

Table 25 – Maturity of Consumer Time and Other Time Deposits in Amounts of $100,000 or More

At December 31, 2009

(Dollars in millions)

Consumer

Time

Brokered

Time

Foreign

Time

Other

Time Total

Months to maturity:

3 or less $2,954.6 $2,006.6 $1,328.6 $104.9 $6,394.7

Over 3 through 6 2,115.4 20.5 - - 2,135.9

Over 6 through 12 3,583.4 49.9 - - 3,633.3

Over 12 2,351.9 2,154.5 - - 4,506.4

Total $11,005.3 $4,231.5 $1,328.6 $104.9 $16,670.3

78