SunTrust 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

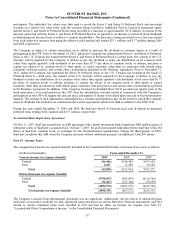

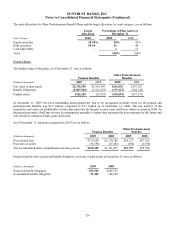

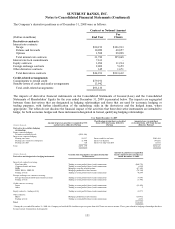

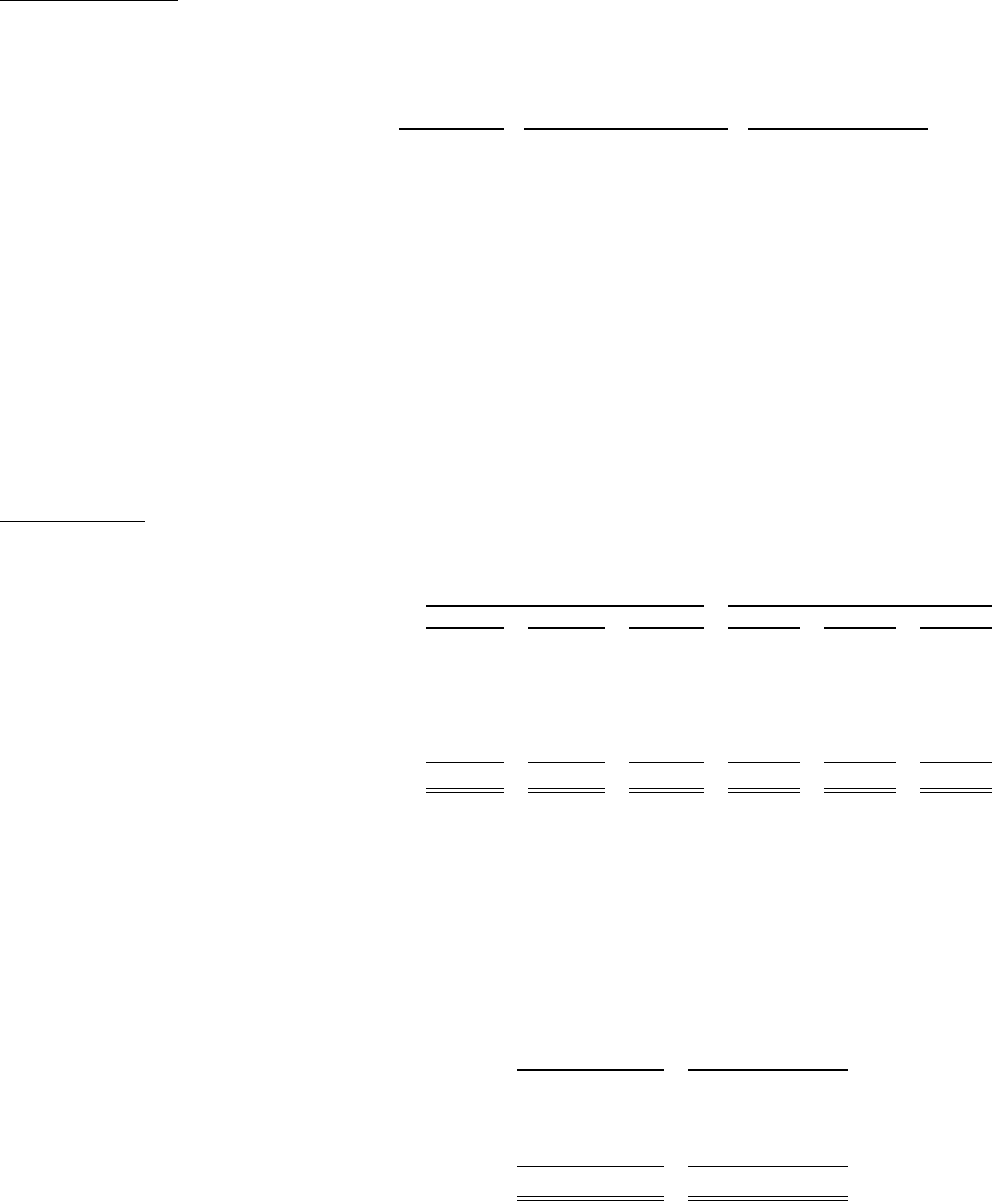

Expected Cash Flows

Information about the expected cash flows for the Pension Benefit and Other Postretirement Benefit plans is as follows:

(Dollars in thousands)

Pension

Benefits1,2

Other Postretirement

Benefits (excluding

Medicare Subsidy)3

Value to Company

of Expected

Medicare Subsidy

Employer Contributions

2010 (expected) to plan trusts $- $- ($2,400)

2010 (expected) to plan participants 11,909 - -

Expected Benefit Payments

2010 106,371 16,552 (2,400)

2011 120,571 16,722 (758)

2012 123,871 16,532 (756)

2013 133,331 16,185 (752)

2014 142,463 15,849 (742)

2015-2019 834,688 69,245 (3,451)

1At this time, SunTrust anticipates contributions to the Retirement Plan will be permitted (but not required) during 2010 based on the funded status of the

Plan and contribution limitations under the Employee Retirement Income Security Act of 1974 (ERISA).

2The expected benefit payments for the Supplemental Executive Retirement Plan will be paid directly from SunTrust corporate assets.

3The 2010 expected contribution for the Other Postretirement Benefits Plans represents the Medicare Part D subsidy only. Note that expected benefits under

Other Postretirement Benefits Plans are shown net of participant contributions.

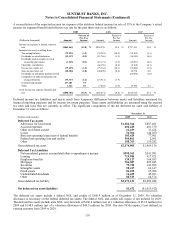

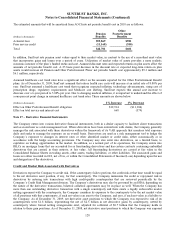

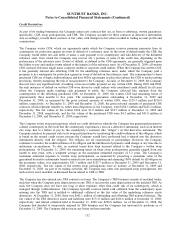

Net Periodic Cost

Components of net periodic benefit cost for the years ended December 31 were as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in thousands) 2009 2008 2007 2009 2008 2007

Service cost $63,858 $77,872 $68,322 $292 $618 $1,241

Interest cost 119,548 117,090 111,920 11,211 11,811 11,337

Expected return on plan assets (149,151) (185,653) (186,356) (7,033) (8,186) (8,194)

Amortization of prior service cost (10,886) (11,166) (10,159) (1,558) (1,558) (1,370)

Recognized net actuarial loss 112,095 22,223 34,849 18,593 12,750 14,286

Amortization of initial transition obligation ----- 280

Other 5,170 3,465 1,811 -- 11,586

Net periodic benefit cost $140,634 $23,831 $20,387 $21,505 $15,435 $29,166

Weighted average assumptions used to determine net cost

Discount rate16.58 %26.28 %15.93 %25.95 % 5.95 % 5.75 %

Expected return on plan assets 8.00 8.25 8.50 5.30 35.30 35.30 3

Rate of compensation increase 4.00/4.50 4.00/4.50 4.50 N/A N/A N/A

1The weighted average shown for 2008 is the weighted average discount rates for the Pension Benefits as of the beginning of the fiscal year.

2Interim remeasurement was required on February 13, 2007 for all plans and again on April 30, 2009 for the SunTrust Pension Plan due to plan changes adopted at that time. The discount rate

as of the remeasurement date was selected based on the economic environment on those dates.

3The weighted average shown for the Other Postretirement Benefit plan is determined on an after-tax basis.

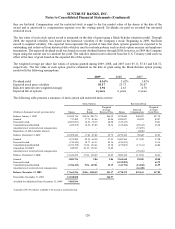

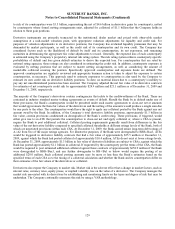

Other changes in plan assets and benefit obligations recognized in OCI during 2009 are as follows:

(Dollars in thousands)

Pension

Benefits

Other

Postretirement

Benefits

Settlements ($5,170) $0

Current year actuarial gain (338,466) (44,796)

Amortization of actuarial loss (112,095) (18,593)

Amortization of prior service credit 10,886 1,558

Total recognized in other comprehensive income, pre-tax ($444,845) ($61,831)

Total recognized in net periodic benefit cost and other

comprehensive income, pre-tax ($304,210) ($40,326)

127