SunTrust 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

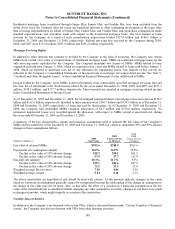

During the month of September 2008, the illiquid markets put a significant strain on the CP market and, as a result of

this temporary disruption, the Company purchased approximately $275.4 million par amount of Three Pillars’ overnight

CP, none of which was outstanding at December 31, 2008. Separate from the temporary disruption in the CP markets in

September 2008, the Company held outstanding Three Pillars’ CP at December 31, 2008 with a par amount of

approximately $400 million, all of which matured on January 9, 2009. None of the Company’s purchases of CP during

2008 altered the Company’s conclusion that it was not the primary beneficiary of Three Pillars.

Three Pillars has historically financed its activities by issuing A-1/P-1 rated CP and had no other form of senior funding

outstanding, other than CP, as of December 31, 2009 or December 31, 2008. However, in the second quarter of 2009,

Three Pillars CP was downgraded to A-2/P-1 due to the downgrade to A-/A2 of the Bank, which provides liquidity and

credit enhancement to Three Pillars. This downgrade was not a reflection of the asset quality of Three Pillars, but did

negatively impact its ability to issue CP to third party investors.

Subsequent to the S&P downgrade, the Company successfully completed its capital plan under the “stress test”, which

included a successful common equity raise and tender offer for certain of its preferred stock and hybrid debt instruments.

Additionally, in June 2009, Three Pillars received an F-1 rating from Fitch and chose to replace S&P’s A-2 rating, which

was simultaneously withdrawn. As such, Three Pillars’ CP now carries an F-1/P-1 rating, which has allowed Three Pillars

to issue approximately 75%, on average, of its CP to investors other than the Company during the quarter ended

December 31, 2009. At December 31, 2009, the Company held no Three Pillars CP. The purchases of CP by the Company

did not alter the allocation of variability within Three Pillars in a manner that was not originally considered, nor was it a

means for the Company to provide non-contractual support to Three Pillars in order to protect any VI holders from losses.

The predominant driver of risk is the credit risk of the underlying assets owned by Three Pillars, and S&P’s downgrade

was not in response to any credit deterioration in these assets. Further, the subordinated note holder remained exposed to

the majority of variability in expected losses in Three Pillars to the same degree it had prior to any purchases of CP by the

Company. The Company’s at-market purchases of CP do not impact the interest rates paid by the clients of Three Pillars,

as they are obligated to pay a pass through rate based on the rate at which Three Pillars issues CP. After evaluating all facts

and circumstances, the Company concluded that the results of the mathematical model that the Company uses to support its

conclusion that it is not the primary beneficiary of Three Pillars had not changed, the design of Three Pillars had not

changed, and the purchases of CP by the Company had not given rise to an implicit VI in Three Pillars that would have

resulted in the Company becoming the primary beneficiary of Three Pillars.

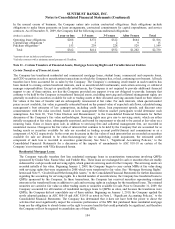

The Company has off-balance sheet commitments in the form of liquidity facilities and other credit enhancements that it

has provided to Three Pillars. These commitments are accounted for as financial guarantees by the Company. The

liquidity commitments are revolving facilities that are sized based on the current commitments provided by Three

Pillars to its customers. The liquidity facilities are generally used if new CP cannot be issued by Three Pillars to repay

maturing CP. However, the liquidity facilities are available in all circumstances, except certain bankruptcy-related

events with respect to Three Pillars. Draws on the facilities are subject to the purchase price (or borrowing base)

formula that, in many cases, excludes defaulted assets to the extent that they exceed available over-collateralization in

the form of non-defaulted assets, and may also provide the liquidity banks with loss protection equal to a portion of the

loss protection provided for in the related securitization agreement. Additionally, there are transaction specific

covenants and triggers that are tied to the performance of the assets of the relevant seller/servicer that may result in a

transaction termination event, which, if continuing, would require funding through the related liquidity facility. Finally,

in a termination event of Three Pillars, such as if its tangible net worth falls below $5,000 for a period in excess of 15

days, Three Pillars would be unable to issue CP, which would likely result in funding through the liquidity facilities.

Draws under the credit enhancement are also available in all circumstances, but are generally used to the extent required

to make payment on any maturing CP if there are insufficient funds from collections of receivables or the use of

liquidity facilities. The required amount of credit enhancement at Three Pillars will vary from time to time as new

receivable pools are purchased or removed from its asset portfolio, but is generally equal to 10% of the aggregate

commitments of Three Pillars.

The total notional amounts of the liquidity facilities and other credit enhancements represent the Company’s maximum

exposure to potential loss, which was $3.8 billion and $371.3 million, respectively, as of December 31, 2009, compared

to $6.1 billion and $597.5 million, respectively, as of December 31, 2008. The Company did not have any liability

recognized on its Consolidated Balance Sheets related to these liquidity facilities and other credit enhancements as of

December 31, 2009 or December 31, 2008, as no amounts had been drawn, nor were any draws probable to occur, such

that a loss should have been accrued. In addition, no losses were recognized by the Company in connection with these

off-balance sheet commitments during the years ended December 31, 2009 or 2008. There are no other contractual

arrangements that the Company plans to enter into with Three Pillars to provide it additional support.

110