SunTrust 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

2009 ANNUAL REPORT

Table of contents

-

Page 1

SUNTRUST BANKS, INC. 2009 ANNUAL REPORT -

Page 2

...822 ATMs are located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. In addition, SunTrust provides clients with a full selection of technology-based banking channels including online, 24-hour customer services centers, and... -

Page 3

... on reducing leverage, SunTrust supported its clients and communities through the extension of approximately $90 billion in new loan originations, commitments and renewals of commercial and consumer loans during the year. The operating environment for banks is also cloudy in terms of the legislative... -

Page 4

... of unsecured loans to consumers and small businesses. Our loan portfolio is well diversiï¬ed by borrower type, purpose, and collateral. The largest concentration is in consumer loans and lines of credit secured by residential real estate. This product concentration, coupled with our Florida market... -

Page 5

...the securities portfolio and on the sale of mortgage, student, and corporate loans. More recently, we have been focused on the liability side of the balance sheet given the increase in deposits and liquidity. For example, we have actively managed down higher cost deposits including brokered deposits... -

Page 6

... Beall's, Inc. Bradenton, Florida 2, 4 Deer Run Investments, LLC Atlanta, Georgia J. HICKS LANIER 2, 5 Chairman of the Board and Chief Executive Ofï¬cer Oxford Industries, Inc. Atlanta, Georgia A. D. CORRELL 1, 3, 4 Chairman Atlanta Equity Investors, LLC Atlanta, Georgia G. GILMER MINOR, III... -

Page 7

... Corporate Executive Vice President Chief Financial Ofï¬cer and Corporate and Investment Banking Executive 21 years of service C.T. HILL Chairman, President, and Chief Executive Ofï¬cer, Mid-Atlantic Banking Group Retail Line of Business Executive 40 years of service SUNTRUST 2009 ANNUAL REPORT -

Page 8

... North Florida Region · SunTrust Bank, North Florida · SunTrust Bank, Ocala · SunTrust Bank, Tallahassee · SunTrust Bank, Pensacola · SunTrust Bank, Panama City South Florida Region · SunTrust Bank, South Florida KEY CITY Atlanta, GA Atlanta, GA Atlanta, GA Gainesville, GA Athens, GA Rome, GA... -

Page 9

... Western Virginia Region · SunTrust Bank, Roanoke · SunTrust Bank, Charleston · SunTrust Bank, Charlottesville · SunTrust Bank, Harrisonburg · SunTrust Bank, Lynchburg · SunTrust Bank, Martinsville · SunTrust Bank, New River Valley · SunTrust Bank, Staunton SUNTRUST 2009 ANNUAL REPORT -

Page 10

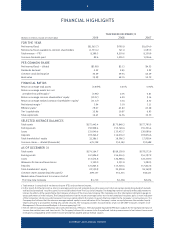

... 2007 $1,634.0 1,593.0 8,250.9 1,026.6 FOR THE YEAR Net income/(loss) Net income/(loss) available to common shareholders Total revenue - FTE 1 Common dividends paid PER COMMON SHARE Net income/(loss) - diluted Dividends declared Common stock closing price Book value ($3.98) 0.22 20.29 35.29 $2.12... -

Page 11

... FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009 or ' TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 001-08918 SUNTRUST BANKS, INC. (Exact... -

Page 12

.... Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accountant Fees and Services. Changes... -

Page 13

...- SunTrust Banks, Inc. CP - Commercial paper. CPP - Capital Purchase Program. CRA - Community Reinvestment Act of 1977. CRC - Corporate Risk Committee. CRO - Chief Risk Officer. CSA - Credit support annex. DDA - Demand deposit account. DGP - Debt Guarantee Program. DIF - Deposit Insurance Fund. EESA... -

Page 14

... Mortgage Association. FVO - Fair Value Option. GB&T - GB&T Bancshares, Inc. GenSpring - GenSpring Family Offices LLC. GLB Act - Gramm-Leach-Bliley Act. GNMA - Government National Mortgage Association. IIS - Institutional Investment Solutions. IPO - Initial public offering. IRLCs - Interest rate... -

Page 15

... funds. Moody's - Moody's Investors Service. MSRs - Mortgage servicing rights. MVE - Market value of equity. NAICS - North American Industry Classification System. NCF - National Commerce Financial Corporation. NOL - Net operating loss. NSF - Non-sufficient funds. NYSE - New York Stock Exchange... -

Page 16

...Capital - SunTrust Community Capital, LLC. TAF - Term Auction Facility. TAGP - Transaction Account Guarantee Program. TARP - Troubled Asset Relief Program. TDR - Troubled debt restructuring. The Agreements - Equity forward agreements. The Program - ABCP MMMF Liquidity Facility Program. Three Pillars... -

Page 17

... trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, capital market services, and credit-related insurance. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the... -

Page 18

... on operations, management and capital distributions, depending on the category in which an institution is classified. Failure to meet the capital guidelines could also subject a banking institution to capital raising requirements. An "undercapitalized" bank must develop a capital restoration plan... -

Page 19

... 31, 2013. The Company's banking subsidiary pays an insurance premium into the DIF based on the quarterly average daily deposit liabilities net of certain exclusions held at the Company's banking subsidiary. The FDIC uses a risk-based premium system that assesses higher rates on those institutions 3 -

Page 20

... capped NOW accounts, regardless of dollar amount via its TAGP. As of October 31, 2009, banks are no longer eligible to issue additional debt under the TLGP and the Company has opted not to participate in the TAGP beyond December 31, 2009. FDIC regulations require that management report annually on... -

Page 21

... Fee would be collected by the Internal Revenue Service and would be approximately fifteen basis points, or 0.15%, of an amount calculated by subtracting a covered institution's Tier 1 capital and FDIC-assessed deposits (and/or an adjustment for insurance liabilities covered by state guarantee funds... -

Page 22

... branching legislation and certain state legislation. Employees As of December 31, 2009, there were 28,001 full-time equivalent employees within SunTrust. None of the domestic employees within the Company are subject to a collective bargaining agreement. Management considers its employee relations... -

Page 23

... Officer, on its website. These corporate governance materials are also available free of charge in print to shareholders who request them in writing to: SunTrust Banks, Inc., Attention: Investor Relations, P.O. Box 4418, Mail Code GA-ATL-634, Atlanta, Georgia 30302-4418. The Company's Annual Report... -

Page 24

...may increase our costs and limit our ability to pursue business opportunities. For example, participation in the CPP limits (without the consent of the U.S. Treasury) our ability to increase our dividend or to repurchase our common stock for so long as any securities issued under such program remain... -

Page 25

... mortgages and home equity lines of credit and mortgage loans sourced from brokers that are outside our branch bank network. These conditions have resulted in losses, write downs and impairment charges in our mortgage and other lines of business. Continued declines in real estate values, home sales... -

Page 26

... declines in our market capitalization, especially in relation to our book value, could be an indication of potential impairment of goodwill. Clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding. Checking and savings account balances... -

Page 27

... may decide not to use banks to complete their financial transactions, which could affect net income. Technology and other changes now allow parties to complete financial transactions without banks. For example, consumers can pay bills and transfer funds directly without banks. This process could... -

Page 28

...can offer virtually any type of financial service, including banking, securities underwriting, insurance (both agency and underwriting) and merchant banking, and may acquire banks and other financial institutions. This may significantly change the competitive environment in which we conduct business... -

Page 29

...offer a variety of secured loans, including commercial lines of credit, commercial term loans, real estate, construction, home equity, consumer and other loans. Many of our loans are secured by real estate (both residential and commercial) in our market area. A major change in the real estate market... -

Page 30

...counterparties participating in the capital markets, or a downgrade of our debt rating, may adversely affect our capital costs and our ability to raise capital and, in turn, our liquidity. In 2009 and 2010, credit rating agencies downgraded the credit ratings of SunTrust Bank and SunTrust Banks, Inc... -

Page 31

... execute the business strategy and provide high quality service may suffer if we are unable to recruit or retain a sufficient number of qualified employees or if the costs of employee compensation or benefits increase substantially. Further, the Federal Reserve on October 27, 2009 published proposed... -

Page 32

...market risks. We maintain an available for sale securities portfolio and trading assets which include various types of instruments and maturities. In addition, we elected to record selected fixed-rate debt, mortgage loans, securitization warehouses and other trading assets at fair value. The changes... -

Page 33

... 2. PROPERTIES The Company's headquarters is located in Atlanta, Georgia. As of December 31, 2009, SunTrust Bank owned 598 of its 1,683 full-service banking offices and leased the remaining banking offices. (See Note 8, "Premises and Equipment," to the Consolidated Financial Statements for further... -

Page 34

...COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The principal market in which the common stock of the Company is traded is the NYSE. See Item 6 and Table 18 in the MD&A for information on the high and the low sales prices of the SunTrust Banks, Inc. common stock... -

Page 35

... common share Book value per common share Tangible book value per common share1 Market capitalization Market price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered and foreign deposits Total shareholders' equity Average common... -

Page 36

... our loan portfolio despite enhancement of our underwriting policies; depressed market values for our stock may require us to write down goodwill; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks... -

Page 37

... and our headquarters are located in Atlanta, Georgia. Our principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and... -

Page 38

... government agencies, the TLGP was extended into late 2009, billions of MBS were purchased in the open market, trillions of debt obligations were issued, and benchmark interest rates were kept at record low levels throughout the year. As 2009 came to a close, the U.S. government and bank regulators... -

Page 39

... in our small business portfolio, and we expect that we will continue to see stress in asset quality in the commercial portfolio. The $1.7 billion increase in net charge-offs during the year was primarily related to residential mortgages, large corporate borrowers in economically cyclical industries... -

Page 40

... of U.S. Treasury and agency securities by over $7 billion in light of the increased liquidity from higher deposits and lower loan balances. In addition, agency MBS increased by over $1 billion. This increase was related to sales during the year where we had the opportunity to manage the portfolio... -

Page 41

... Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered deposits Foreign deposits Total interest-bearing deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term... -

Page 42

... NOW accounts Money market accounts Savings Consumer time Other time Brokered deposits Foreign deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term borrowings Long-term debt Total interest expense Net change in net interest... -

Page 43

... increase in U.S. Treasury and agency securities. Yields on average earning assets declined 100 basis points from 2008 to 2009 driven by declines in market interest rates. Our loan portfolio yielded 4.66% for the year 2009, down 95 basis points from 2008. A large percentage of our commercial loans... -

Page 44

... charges and fees Trust and investment management income Mortgage production related income Mortgage servicing related income Card fees Investment banking income Retail investment services Trading account profits/(losses) and commissions Gain from ownership in Visa Gain on sale of businesses Net... -

Page 45

... sales, maturities, and write-downs. Additionally, during 2008, we recorded a $177.7 million loss related to our expected repurchase of certain ARS. Capital markets related trading income increased during 2009, compared to the same periods in 2008, due to improved equity derivatives and bond trading... -

Page 46

... Employee benefits Total personnel expense Amortization/impairment of goodwill/intangible assets Outside processing and software Net occupancy expense Regulatory assessments Credit and collection services Other real estate expense Equipment expense Marketing and customer development Mortgage... -

Page 47

... our loss limits within the insurance contracts in 2009. Twin Rivers' loss exposure arises from third party mortgage insurers transferring a portion of their first loss exposure when losses by mortgage origination year exceed certain thresholds. Credit and collection services expense increased $103... -

Page 48

....6 Commercial Real estate: Residential mortgages Home equity lines Construction Commercial real estate: Owner occupied Investor owned Consumer: Direct Indirect Credit card Total loans Loans held for sale Table 6 - Selected Residential Real Estate Loan Quality Information December 31, 2009 $3,822... -

Page 49

... core mortgage portfolio includes approximately $1.0 billion of commercial purpose loans secured by residential real estate. Prime second lien mortgages were $2.9 billion, or 2.6% of total loans, as of December 31, 2009 with $2.7 billion insured through third party pool-level insurance. We consider... -

Page 50

... in our credit monitoring and management processes to provide early warning for problem loans in the portfolio. For example, we use an expanded liquidity and contingency analysis to provide a thorough view of borrower capacity and their ability to service obligations in a steep market decline. We... -

Page 51

... value 1 Allowance from acquisitions and other activity - net Provision for loan losses Provision for unfunded commitments 4 Charge-offs: Commercial Real estate: Home equity lines Construction Residential mortgages 3 Commercial real estate Consumer loans: Direct Indirect Credit cards Total charge... -

Page 52

... time being reviewed. The multiple factors evaluated include internal risk ratings, net charge-off trends, collateral values and geographic location, borrower FICO scores, delinquency rates, nonperforming and restructured loans, origination channel, product mix, underwriting practices, and economic... -

Page 53

... ($307.7 million) and home equity lines ($251.5 million). We do not originate subprime consumer real estate loans; however lower residential real estate values and recessionary economic conditions have affected borrowers of higher credit quality. Construction net charge-offs increased due to the... -

Page 54

... real estate. Residential mortgages and home equity lines represent 55.6% of total nonaccruals. The increase in nonperforming assets is largely related to the housing correction and related decline in the values of residential real estate. The nonperforming assets are also affected by the time... -

Page 55

... billion at December 31, 2009, an increase of $1.2 billion, or 254.7%, from December 31, 2008. Of these TDRs, 97% are first and second lien residential mortgages and home equity lines of credit, and not commercial or commercial real estate loans. At December 31, 2009, specific reserves included in... -

Page 56

...: debt, residential mortgage loans, brokered deposits, and trading loans. We record changes in these instruments' fair values through earnings and economically hedge and/or trade these assets or liabilities in order to manage the instrument's fair value volatility and economic value. Following is... -

Page 57

... amount of ARS recorded in trading assets at fair value totaled $176.4 million at December 31, 2009 and $133.1 million at December 31, 2008. The majority of these ARS are preferred equity securities, and the remaining securities consist of ABS backed by trust preferred bank debt or student loans. In... -

Page 58

... common stock and $0.1 billion in net unrealized gains on the remainder of the portfolio. The average yield on securities available for sale on a FTE basis for 2009 declined to 4.23% compared to 5.99% in 2008 primarily as a result of the net purchase of lower-yielding MBS issued by federal agencies... -

Page 59

... were valued using third party pricing data, including broker indicative bids, or expected cash flow models. See Note 5, "Securities Available for Sale," to the Consolidated Financial Statements for further discussion. The amount of ARS recorded in the available for sale securities portfolio totaled... -

Page 60

...Securities available for sale Loans held for sale Loans Other intangible assets 1 Other assets 2 Total level 3 assets Total assets Total assets measured at fair value Level 3 assets as a percent of total assets Level 3 assets as a percent of total assets measured at fair value Long-term debt Trading... -

Page 61

... in available for sale securities. ARS include municipal bonds, nonmarketable preferred equity securities, and ABS collateralized by student loans or trust preferred bank obligations. Under a functioning market, ARS could be remarketed with tight interest rate caps to investors targeting short-term... -

Page 62

... that other market participants would use in arriving at the fair value of The Agreements. At December 31, 2009, The Agreements were in a liability position to us of approximately $45.9 million. Loans and Loans Held for Sale Level 3 loans are primarily non-agency residential mortgage loans held for... -

Page 63

...December 31, 2009 for this purpose. We have historically used quotes from a third party pricing service as our primary source for valuation and have deemed such quotes as reasonable estimates of fair value by utilizing broker quotes and/or institutional trading data, when available, as corroborating... -

Page 64

... of Coke in lieu of underwriting fees. These shares have grown in value over the past 90 years and have been classified as available for sale securities, with unrealized gains, net of tax, recorded as a component of shareholders' equity. Because of the low accounting cost basis of these shares, we... -

Page 65

... issued by SunTrust Bank and SunTrust Banks, Inc. (collectively, the "Notes") in a private placement in an aggregate principal amount equal to the Minimum Proceeds. The Notes carry stated maturities of approximately ten years from the effective date and bear interest at one-month LIBOR plus a fixed... -

Page 66

...programs and initiatives like regional pricing, new and retention-oriented money offers, more customer-targeted offers, and advanced analytics that leverage product offerings with customer segmentation. We continued to leverage the "Live Solid. Bank Solid." branding and marketing campaign to improve... -

Page 67

...reduction in unfunded loan commitments and letters of credit during the year. The Board of Governors of the Federal Reserve System, the Federal Reserve Banks, the FDIC and the Office of the Comptroller of the Currency completed, in May 2009, the SCAP review of the potential capital needs through the... -

Page 68

... with sale of the Visa Class B shares resulted in an addition to Tier 1 common equity of $70.1 million. While increasing our total and Tier 1 capital, the results of the common stock offering also diluted our common share count and related book value per share. The 142 million new shares issued in... -

Page 69

... of business to monitor asset quality trends and the appropriateness of credit policies. In addition, total borrower exposure limits are established and concentration risk is monitored. Credit risk is partially mitigated through purchase of credit loss protection via third party insurance and use of... -

Page 70

... managers also report indirectly to the Chief Operational Risk Officer and are responsible for execution of the Operational Risk Management program within their areas. Market Risk Management Market risk refers to potential losses arising from changes in interest rates, foreign exchange rates, equity... -

Page 71

... economic and financial reporting perspectives related to a 100 basis point shock is primarily due to the significant decline in our higher cost fixed rate funding and brokered deposits year over year as well as a reduction in floating rate assets. We also perform valuation analysis, which is used... -

Page 72

... of business, we assume a limited degree of market risk in hedging strategies. We have developed policies and procedures to manage market risk associated with trading, capital markets and foreign exchange activities using a VAR approach that determines total exposure arising from interest rate risk... -

Page 73

... of credit backing the tendered VRDOs. The Bank's contingency funding plans anticipated this potential use of liquidity, and the Bank secured ample liquidity for the VRDO program as the funded loans came on to our balance sheet. As the year came to a close, this use of Bank liquidity declined as... -

Page 74

... long-term debt agreements and the lines of credit prevent us from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, and minimum shareholders... -

Page 75

... have managed the market risk through our overall asset/liability management process with consideration to the natural counter-cyclicality of servicing and production that occurs as interest rates rise and fall over time with the economic cycle as well as with securities available for sale. However... -

Page 76

... required to purchase capital stock in the FHLB. In exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost loans for affordable housing and community-development projects, amongst other benefits. As of December 31, 2009, we held... -

Page 77

.... Key judgments used in determining the allowance for credit losses include internal risk ratings, market and collateral values, discount rates, loss rates, and our view of current economic conditions. General allowances are established for loans and leases grouped into pools that have similar... -

Page 78

... of Retail, Commercial, Commercial Real Estate, Mortgage, Corporate and Investment Banking, Wealth and Investment Management, and Affordable Housing. We changed our business segments in 2009. Among other changes, we combined the Consumer Lending business unit with the Mortgage reporting unit and... -

Page 79

... new business initiatives, client service and retention standards, market share changes, anticipated loan and deposit growth, forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term growth rate used in determining the terminal value... -

Page 80

... from transactions over the last year and a half. These multiples allow us to estimate an aggregate purchase value and implied premium based on current market conditions and the estimated net asset fair value for SunTrust. The estimated fair value of the reporting unit is highly sensitive to changes... -

Page 81

... the new Personal Pension Account. Discount Rate The discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is determined by matching the expected cash flows of each plan to a yield curve based on long-term, high quality fixed income debt... -

Page 82

... do not tend to change significantly over time, so the range of assumptions, and their impact on pension cost, is generally limited. We annually review the assumptions used based on historical and expected future experience. The interest crediting rate applied to each Personal Pension Account was an... -

Page 83

... common share Book value per common share Tangible book value per common share 2 Market capitalization Market Price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered and foreign deposits Total shareholders' equity Average common... -

Page 84

...increased incentives related to improved financial performance in certain lines of business. The fourth quarter of 2009 also included $23.5 million in net losses related to early termination fees for FHLB advances repaid during the quarter, net of gains on the early extinguishment of other long-term... -

Page 85

... in loan-related net interest income. Average consumer and commercial deposit balances increased $9.0 billion, or 10.9%, primarily in higher yielding interest-bearing deposits as the economic environment has influenced customer product preference. NOW and money market accounts increased a combined... -

Page 86

..., fixed income sales and trading, and syndications. The strong performance in capital markets was partially offset by higher write-downs on private equity investments, equipment write downs on terminated leases and market volatility on credit hedges related to the corporate loan book. Total... -

Page 87

... impairment charge recorded in first quarter of 2009. Credit-related expense including other real estate, credit service, and collection costs also increased $125.4 million, or 61.0%. The increases were partially offset by a $373.7 million decrease in operating losses primarily due to a change... -

Page 88

... increase was most pronounced in home equity lines reflecting deterioration in the residential real estate market, while provision for credit losses on real estate construction and commercial loans, primarily to commercial clients with annual revenues of less than $5 million, also increased. Total... -

Page 89

... by lower charge-offs in corporate banking. Noninterest income increased $179.8 million, or 47.1%, primarily due to lower market valuation trading losses in structured products. In addition, increases in direct finance, loan syndications, credit-related fees, and fixed income sales and trading were... -

Page 90

... home equity, personal credit line, and consumer mortgage net charge-offs. Total noninterest income increased $136.2 million, or 16.8%, compared to the twelve months ended December 31, 2007 driven by a decrease in market valuation losses. Additionally, gains on the sale of non-strategic businesses... -

Page 91

... businesses. Securities gains increased $431.4 million primarily due to the sale of Coke common stock, partially offset by market value losses related to certain ABS that were estimated to be other-thantemporarily impaired. Trading gains and losses increased $40.2 million as gains on our long-term... -

Page 92

... primarily client relationship and client transaction driven and is more indicative of normalized operations. 8We present net income/(loss) available to common shareholders that excludes the impairment charge on goodwill. We believe this measure is useful to investors, because removing the non-cash... -

Page 93

... primarily client relationship and client transaction driven and is more indicative of normalized operations. 8We present net income/(loss) available to common shareholders that excludes the impairment charge on goodwill. We believe this measure is useful to investors, because removing the non-cash... -

Page 94

... stock option plan rather than pursuant to publicly announced share repurchase programs. For the twelve months ended December 31, 2009, zero shares of SunTrust common stock were surrendered by participants in SunTrust's employee stock option plans. 3On August 14, 2007, the Board of Directors... -

Page 95

... of Securities Available for Sale 1 Year or Less As of December 31, 2009 1-5 5-10 After 10 Years Years Years (Dollars in millions) Total Distribution of Maturities: Amortized Cost U.S. Treasury and federal agencies U.S. states and political subdivisions Residential mortgage-backed securities... -

Page 96

... DATA Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of SunTrust Banks, Inc. We have audited the accompanying consolidated balance sheets of SunTrust Banks, Inc. and subsidiaries (the Company) as of December 31, 2009 and 2008, and the related... -

Page 97

... have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of SunTrust Banks, Inc. and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of income/(loss), shareholders' equity... -

Page 98

...Employee benefits Amortization/impairment of goodwill/intangible assets Outside processing and software Net occupancy expense Regulatory assessments Credit and collection services Other real estate expense Equipment expense Marketing and customer development Operating losses Mortgage reinsurance Net... -

Page 99

... and commercial deposits Total consumer and commercial deposits Brokered deposits (CDs at fair value: $1,260,505 as of December 31, 2009; $587,486 as of December 31, 2008) Foreign deposits Total deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings... -

Page 100

..., net of tax Change related to employee benefit plans Total comprehensive income Change in noncontrolling interest Common stock dividends, $2.92 per share Series A preferred stock dividends, $6,055 per share Exercise of stock options and stock compensation expense Acquisition of treasury stock... -

Page 101

...to loans held for sale Loans transferred from loans held for sale to loans Loans transferred from loans to other real estate owned Issuance of common stock for acquisition of GB&T Noncash gain on contribution of common stock of Coke Unsettled purchases of securities available for sale as of year-end... -

Page 102

... with its headquarters in Atlanta, Georgia. SunTrust's principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the... -

Page 103

...residential mortgage loans, commercial loans, and student loans to a held for sale classification at the lower of cost or fair value. At the time of transfer, any credit losses are recorded as a reduction in the allowance for loan losses. Subsequent credit losses as well as incremental interest rate... -

Page 104

...management's evaluation of the size and current risk characteristics of the loan portfolio. Such evaluation considers numerous factors, including, but not limited to net charge-off trends, internal risk ratings, changes in internal risk ratings, loss forecasts, collateral values, geographic location... -

Page 105

... the improvements' estimated useful lives or the lease term, depending on whether the lease meets the transfer of ownership or bargain-purchase option criterion. Certain leases are capitalized as assets for financial reporting purposes. Such capitalized assets are amortized, using the straight-line... -

Page 106

...servicing fees, refer to Note 11, "Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities," to the Consolidated Financial Statements. Other Real Estate Owned Assets acquired through, or in lieu of, loan foreclosure are held for sale and are initially recorded... -

Page 107

... its VAR approach that monitors total exposure daily and seeks to manage the exposure on an overall basis. Derivatives are used as a risk management tool to hedge the Company's exposure to changes in interest rates or other identified market risks. The Company accounts for some of these derivatives... -

Page 108

...defined contribution plan, the amortization of restricted stock, stock option awards, and costs of other employee benefits. Foreign Currency Transactions Foreign denominated assets and liabilities resulting from foreign currency transactions are valued using period end foreign exchange rates and the... -

Page 109

...-making rights and own VIs that could potentially be significant to these VIEs. The primary balance sheet impacts from consolidating Three Pillars and the CLO on January 1, 2010, will be increases in loans and leases, the related allowance for loan losses, LHFS, long-term debt, and other short-term... -

Page 110

...AMA Holdings, Inc.") called minority member owned interests in GenSpring Family Offices, LLC (formerly "Asset Management Advisors, LLC") - 1On May 1, 2008, SunTrust acquired GB&T, a North Georgia-based financial institution serving commercial and retail customers, for $154.6 million, including cash... -

Page 111

.... Product offerings to clients include debt securities, loans traded in the secondary market, equity securities, derivative and foreign exchange contracts, and similar financial instruments. Other trading activities include acting as a market maker in certain debt and equity securities and related... -

Page 112

... - agency Residential mortgage-backed securities - private Other debt securities Common stock of The Coca-Cola Company Other equity securities1 Total securities available for sale 1Includes $343.3 million and $493.2 million of FHLB of Cincinnati and FHLB of Atlanta stock stated at par value, $360... -

Page 113

... the total securities available for sale portfolio are rated "AAA," the highest possible rating by nationally recognized rating agencies. While all securities are reviewed for OTTI, the securities impacted by credit impairment were primarily private residential MBS with a fair value of approximately... -

Page 114

... $19,149 Corporate Bonds $639 $639 Other Securities $212 $212 Current default rate Prepayment rate Loss severity For the year ended December 31, 2009, the Company recorded OTTI losses on available for sale securities as follows: (Dollars in thousands) Total other than temporary impairment losses... -

Page 115

... at December 31 is shown in the following table: (Dollars in millions) Commercial Real estate: Residential mortgages Home equity lines Construction Commercial real estate: Owner occupied Investor owned Consumer: Direct Indirect Credit card Total loans 2009 $32,494.1 30,789.8 15,952.5 6,646.8 8,915... -

Page 116

... at fair value 1 Allowance from GB&T acquisition Provision for loan losses Provision for unfunded commitments2 Loan charge-offs Loan recoveries Balance at end of year Components: Allowance for loan and lease losses Unfunded commitments reserve3 Allowance for credit losses 1Amount 2009 $2,378,507... -

Page 117

... current market conditions in developing short and long-term growth expectations and discount rates. The estimated fair value of each reporting unit as of September 30, 2009 exceeded its respective carrying value; therefore, the Company determined there was no impairment of goodwill. The improvement... -

Page 118

... by reportable segment for the years ended December 31, 2009 and 2008 are as follows: (Dollars in thousands) Retail Commercial Retail & Commercial Wholesale Corporate and Investment Banking Household Lending Mortgage Wealth and Investment Management Corporate Other and Treasury Total... -

Page 119

...connection with an acquisition. While the overall acquired business was performing satisfactorily, the attrition level of the legacy clients had increased resulting in the impairment of this intangible asset. See Note 11, "Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable... -

Page 120

... servicing and collateral management rights, are generally recorded as securities available for sale or trading assets at their allocated carrying amounts based on their relative fair values at the time of transfer and are subsequently remeasured at fair value. For such interests, when quoted market... -

Page 121

... commercial leveraged loans and bonds, certain of which were transferred by the Company to the VIEs. In addition to retaining certain securities issued by the VIEs, the Company also acts as manager or servicer for these VIEs. At December 31, 2009 and December 31, 2008, the Company's direct exposure... -

Page 122

... Mortgage Loans $93,674 4,908 Commercial Mortgage Loans $Year Ended December 31, 2009 Commercial and Corporate Loans Student Loans $1,861 11,090 $7,601 709 (Dollars in thousands) CDO Securities $2,799 - Consolidated $105,935 16,707 Cash flows on interests held Servicing or management fees Year... -

Page 123

...Net Charge-offs 2009 2008 $572.4 1,902.6 527.2 152.1 83.4 $3,237.7 27.9 44.2 0.4 $3,310.2 $194.6 950.5 215.2 172.4 31.6 $1,564.3 24.7 0.3 $1,589.3 Type of loan: Commercial Residential mortgage and home equity Commercial real estate and construction Consumer Credit card Total loan portfolio Managed... -

Page 124

... at fair value and MSRs related to loans sold before January 1, 2008, which are reported at amortized cost, net of any allowance for impairment losses. Any impacts of this activity are reflected in the Company's Consolidated Statements of Income/(Loss) in mortgage servicing-related income. See... -

Page 125

... Funding, LLC SunTrust assists in providing liquidity to select corporate clients by directing them to a multi-seller CP conduit, Three Pillars. Three Pillars provides financing for direct purchases of financial assets originated and serviced by SunTrust's corporate clients by issuing highly rated... -

Page 126

... party investors. Subsequent to the S&P downgrade, the Company successfully completed its capital plan under the "stress test", which included a successful common equity raise and tender offer for certain of its preferred stock and hybrid debt instruments. Additionally, in June 2009, Three Pillars... -

Page 127

... expense within the Commercial line of business. Total impairment charges recorded within the Commercial line of business in 2009 and 2008 totaled $46.8 million and $19.9 million, respectively. For some partnerships, SunTrust operates strictly as a general partner or the indemnifying party and, as... -

Page 128

... does not directly invest in these funds, its exposure to loss is limited to the investment advisor and other administrative fees it earns. Payment on these fees is received from the individual investor accounts. The total unconsolidated assets of these funds as of December 31, 2009 and December... -

Page 129

...%2 Floating rate notes due 2014 based on one month LIBOR + 1.25% Capital lease obligations FHLB advances (0.00%-8.79%; advances at fair value $0 at December 31, 2009 and $3,659,423 at December 31, 2008)2 Direct finance lease obligations Other Total senior debt-subsidiaries Subordinated 6.375% notes... -

Page 130

...several long-term debt agreements prevent the Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders' equity, and... -

Page 131

...the capital plan involved the sale of Visa Class B shares resulting in an increase in Tier 1 common equity of $70.1 million, net of tax. • The Company is subject to various regulatory capital requirements which involve quantitative measures of the Company's assets. As of December 31, (Dollars in... -

Page 132

... the EESA, the Company entered into a Purchase Agreement with the U.S. Treasury dated December 31, 2008 pursuant to which the Company issued and sold to the U.S. Treasury 13,500 shares of the Company's Fixed Rate Cumulative Perpetual Preferred Stock, Series D, having a liquidation preference of $100... -

Page 133

... Series D Preferred Stock is recognized as an increase to preferred stock dividends in determining net income/(loss) available to common shareholders. The discount is being amortized over a five-year period from each respective issuance date using the effective yield method and totaled $23.1 million... -

Page 134

... Other real estate owned Loans State net operating losses (net of federal benefit) Federal net operating loss and credits Other Gross deferred tax asset Deferred Tax Liabilities Net unrealized gains in accumulated other comprehensive income Leasing Employee benefits Mortgage Securities Intangible... -

Page 135

... the SunTrust Banks Inc. 2009 Stock Plan under which the Compensation Committee of the Board of Directors (the "Committee") has the authority to grant stock options and restricted stock, of which some may have performance features, to key employees of the Company. Under the 2009 Stock Plan, a total... -

Page 136

... value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions: 2009 4.16% 83.17 1.94 6 years 2008 5.62% 25.73 2.63 6 years 2007 3.01% 20.07 4.70 6 years Dividend yield Expected stock price volatility Risk-free interest rate... -

Page 137

... Compensation Plan. Noncontributory Pension Plans SunTrust maintains a funded, noncontributory qualified retirement plan covering employees meeting certain service requirements. The plan provides benefits based on salary and years of service. Effective January 1, 2008, retirement plan participants... -

Page 138

... of each plan to a yield curve based on long-term, high quality fixed income debt instruments available as of the measurement date. A string of benefit payments projected to be paid by the plan for the next 100 years is developed based on the most recent census data, plan provisions and assumptions... -

Page 139

... amounts contributed to pay participants' plan benefits or added to plan assets in 2009 and 2008, respectively. SERPs are not funded through plan assets. The basis for determining the overall expected long-term rate of return on plan assets considers past experience, current market conditions and... -

Page 140

... on third party data received as of the balance sheet date. Level 1 assets such as equity securities, mutual funds, and REITS are instruments that are traded in active markets and are valued based on identical instruments. Fixed income securities and common and collective trust funds are classified... -

Page 141

...invest the assets in accordance with the Employee Retirement Income Security Act of 1974 and related fiduciary standards. The long-term primary investment objectives for the Pension Plans are to provide for a reasonable amount of long-term growth of capital (both principal and income), without undue... -

Page 142

... 35-50% 50-65 Percentage of Plan Assets at December 31 2009 2008 48% 41% 51 44 1 15 100% 100% Asset Category Equity securities Debt securities Cash equivalents Total Funded Status The funded status of the plans, as of December 31, was as follows: Pension Benefits 2009 2008 $2,334,190 $1,919,349... -

Page 143

...) during 2010 based on the funded status of the Plan and contribution limitations under the Employee Retirement Income Security Act of 1974 (ERISA). 2The expected benefit payments for the Supplemental Executive Retirement Plan will be paid directly from SunTrust corporate assets. 3The 2010 expected... -

Page 144

... service credit Total In addition, SunTrust sets pension asset values equal to their market value, in contrast to the use of a smoothed asset value that incorporates gains and losses over a period of years. Utilization of market value of assets provides a more realistic economic measure of the plan... -

Page 145

... is the adverse effect that a change in market factors, such as interest rates, currency rates, equity prices, or implied volatility, has on the value of a derivative. The Company manages the market risk associated with its derivatives by establishing and monitoring limits on the types and degree of... -

Page 146

...hedging: Securities available for sale Interest rate contracts hedging: Floating rate loans Total Derivatives not designated as hedging instruments 6 Interest rate contracts covering: Fixed rate debt Corporate bonds and loans MSRs LHFS, IRLCs, LHFI-FV Trading activity Foreign exchange rate contracts... -

Page 147

... on deposits Interest on long-term debt $503,424 (47,265) (1,333) $454,826 (Dollars in thousands) Derivatives not designated as hedging instruments Interest rate contracts covering: Fixed rate debt Corporate bonds and loans MSRs LHFS, IRLCs, LHFI-FV Trading activity Foreign exchange rate contracts... -

Page 148

... respectively, and the fair values of the purchased CDS were $4.3 million and $45.8 million at December 31, 2009, and December 31, 2008, respectively. The Company writes swap participations, which are credit derivatives whereby the Company has guaranteed payment to a dealer counterparty in the event... -

Page 149

... in another market transaction. Both the sale and the timing of such sale remain probable to occur as designated. At least quarterly, the Company assesses hedge effectiveness and measures hedge ineffectiveness with the effective portion of the changes in fair value of The Agreements recorded in AOCI... -

Page 150

... credit risk associated with certain loans held within its Corporate and Investment Banking and Wealth and Investment Management lines of business. Trading activity, in the tables above, primarily includes interest rate swaps, equity derivatives, CDS, futures, options and foreign currency contracts... -

Page 151

.... Since the Company transferred risk associated with the Litigation losses to a different responsible party, the Company recorded an offset to its net guarantee liability. In July 2009, Visa funded an additional $700 million into their escrow account, triggering a payment by SunTrust to the 135 -

Page 152

...payment obligations related to certain business combination transactions. Payments are calculated using certain post-acquisition performance criteria. Arrangements entered into prior to January 1, 2009, the effective date of the newly issued business combination accounting guidance, are not recorded... -

Page 153

... these arrangements is not determinable. STIS and STRH, broker-dealer affiliates of SunTrust, use a common third party clearing broker to clear and execute their customers' securities transactions and to hold customer accounts. Under their respective agreements, STIS and STRH agree to indemnify the... -

Page 154

... type in relation to loans and credit commitments. The only significant concentration that exists is in loans secured by residential real estate. At December 31, 2009, the Company owned $46.7 billion in residential mortgage loans and home equity lines, representing 41.1% of total loans, $3.8 billion... -

Page 155

...billion of loans, primarily commercial real estate loans. SunTrust elected to account for at fair value, $171.6 million of the acquired loans, which were classified as nonaccrual, in order to eliminate the complexities of accounting for these purchased impaired loans. Upon acquisition, the loans had... -

Page 156

... as securities available for sale or trading securities. Under a functioning ARS market, ARS could be remarketed with interest rate caps to investors targeting short-term investment securities that repriced generally every 7 to 28 days. Unlike other short-term instruments, these ARS do not benefit... -

Page 157

... publicly-issued, fixed rate debt that the Company has elected to carry at fair value is valued by obtaining quotes from a third party pricing service and utilizing broker quotes to corroborate the reasonableness of those marks. In addition, information from market data of recent observable trades... -

Page 158

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) As disclosed in the tabular level 3 rollforwards, the Company also transferred certain trading securities out of level 3 during the year ended December 31, 2009. The U.S. Treasury and federal agency trading securities and ... -

Page 159

... in the fair value of the loans, including interest rates changes and general conditions in the principal markets for the loans. For the publicly-traded fixed rate debt and brokered deposits carried at fair value, the Company estimated credit spreads above U.S. Treasury rates and LIBOR, respectively... -

Page 160

... - agency Residential mortgage-backed securities - private Other debt securities Common stock of The Coca-Cola Company Other equity securities Total securities available for sale Loans held for sale Loans Other intangible assets 2 Other assets 1 Liabilities Brokered deposits Trading liabilities Long... -

Page 161

...,826) Mortgage Production Related Income 2 $625,396 (666) 17,551 - Mortgage Servicing Related Income $65,944 - Assets Trading assets Loans held for sale Loans Other intangible assets Liabilities Brokered deposits Long-term debt 1Changes in fair value for the year ended December 31, 2009, exclude... -

Page 162

... of the Fair Value Option Total Changes in Fair Values Mortgage Included in Trading Account Production CurrentProfits and Related Period Commissions Income Earnings1 (Dollars in thousands) Assets Trading assets Loans held for sale2 Loans Liabilities Brokered deposits Long-term debt 1Changes... -

Page 163

... Securities available for sale U.S. states and political subdivisions Residential mortgage-backed securities-private Other debt securities Other equity securities Total securities available for sale Loans held for sale Loans Other assets/(liabilities), net Liabilities Trading liabilities Long-term... -

Page 164

... Purchases and issuances Settlements Sales Repurchase of debt Paydowns and maturities Transfers from loans held for sale to loans held in portfolio Loan foreclosures transferred to other real estate owned Level 3 transfers, net Ending balance December 31, 2008 The amount of total losses for the year... -

Page 165

... Trading assets Securities available for sale Loans held for sale Total loans Interest/credit adjustment Subtotal Market risk/liquidity adjustment Loans, net Financial liabilities Consumer and commercial deposits Brokered deposits Foreign deposits Short-term borrowings Long-term debt Trading... -

Page 166

... into account in estimating fair values. (f) Fair values for foreign deposits, brokered deposits, short-term borrowings, and long-term debt are based on quoted market prices for similar instruments or estimated using discounted cash flow analysis and the Company's current incremental borrowing rates... -

Page 167

...offered to business clients include commercial and commercial real estate lending, financial risk management, insurance premium financing, treasury and payment solutions including commercial card services, as well as specialized commercial real estate investments delivered through SunTrust Community... -

Page 168

..., Corporate and Investment Banking offers traditional lending, leasing, treasury management services and institutional investment management to its clients. Household Lending offers residential mortgages, home equity lines and loans, indirect auto, student, bank card and other consumer loan products... -

Page 169

...on various drivers (e.g., number of full-time equivalent employees and volume of loans and deposits). The recoveries for these allocations are in Corporate Other and Treasury. Sales and Referral Credits - Segments may compensate another segment for referring or selling certain products. The majority... -

Page 170

... is fully taxable-equivalent and is presented on a matched maturity funds transfer price basis for the line of business. Provision for credit losses represents net charge-offs for the segments. Includes regular income tax provision/(benefit) and taxable-equivalent income adjustment reversal. 154 -

Page 171

... components of AOCI at December 31 were as follows: (Dollars in thousands) 2009 2008 2007 Unrealized net gain on available for sale securities Unrealized net gain on derivative financial instruments Employee benefit plans Total accumulated other comprehensive income Note 24 - Other Noninterest... -

Page 172

... Interest on loans Trading account losses and commissions Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits Service fees to subsidiaries Other expense Total expense Income/(loss) before income taxes and equity in... -

Page 173

... equivalents Trading assets Securities available for sale Loans to subsidiaries Investment in capital stock of subsidiaries stated on the basis of the Company's equity in subsidiaries' capital accounts: Banking subsidiaries Nonbanking subsidiaries Premises and equipment Goodwill Other assets Total... -

Page 174

... securities Purchases of trading securities Net change in loans to subsidiaries Capital contributions to subsidiaries Other, net Net cash (used in)/provided by investing activities Cash Flows from Financing Activities: Net increase/(decrease) in other short-term borrowings Redemption of real estate... -

Page 175

... the Company in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized, and reported on a timely basis. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded, as of December 31, 2009, that the Company... -

Page 176

... Plan, as amended and restated, is filed as exhibit 10.10 to this report. Changes to Long-Term Incentive Structure for Named Executive Officers. Presently, the Company remains subject to the executive compensation limits under EESA. As a result, the Company is limited to making long-term incentive... -

Page 177

... of Related Party Transactions," "Transactions with Related Persons, Promoters, and Certain Control Persons," and "Corporate Governance and Director Independence" in the Registrant's definitive proxy statement for its annual meeting of shareholders to be held on April 27, 2010 and to be filed with... -

Page 178

... to Exhibit 4.2 to Registrant's Current Report on Form 8-K filed January 2, 2009. Amended and Restated Stock Purchase Contract Agreement, dated as of June 26, 2009, between the Company and SunTrust Preferred Capital I, acting through U.S. Bank National Association, as Property Trustee, incorporated... -

Page 179

....12 to the Registrant's Current Report on Form 8-K filed January 7, 2009. SunTrust Banks, Inc. 1995 Executive Stock Plan, and amendments effective as of August 11, 1998 and January 1, 2009, incorporated by reference to Exhibit 10.16 to Registrant's 1999 Annual Report on Form 10-K (File No. 001-08918... -

Page 180

... Plan for Outside Directors of Crestar Financial Corporation and Crestar Bank, as restated with amendments through January 1, 2009, incorporated by reference to Exhibit 10.312 to the Registrant's Annual Report on Form 10-K filed March 2, 2009. Crestar Financial Corporation Directors' Equity Program... -

Page 181

...Stability Act of 2008. Certification of Chief Financial Officer and Corporate Executive Vice President pursuant to the Emergency Economic Stability Act of 2008. Interactive Data File. (filed herewith) (filed herewith) (filed herewith) Certain instruments defining rights of holders of long-term debt... -

Page 182

... or 15(d) of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SUNTRUST BANKS, INC. By: /s/ James M. Wells III James M. Wells III Chairman and Chief Executive Officer Dated: February 23, 2010... -

Page 183

... Karen Hastie Williams /s/ Dr. Phail Wynn, Jr. Dr. Phail Wynn, Jr. Title 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 2/23/2010 Director Date 167 -

Page 184

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 185

... quotes, news releases, corporate governance practices, and ï¬nancial data, go to www.suntrust.com. CLIENT INFORMATION For assistance with SunTrust products and services, call 1.800.SUNTRUST or visit www.suntrust.com. WEB SITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE COMMISSION FILINGS... -

Page 186

SUNTRUST BANKS, INC., 303 PEACHTREE STREET, ATLANTA, GEORGIA 30308 WWW.SUNTRUST.COM