Telus 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 83

MANAGEMENT’S DISCUSSION & ANALYSIS: 10

Board risk governance and oversight

TELUS continued to strengthen its risk governance and oversight practices in 2011. The Board terms of reference and Board committee mandates were

updated to emphasize and enhance Board risk oversight responsibilities.

All risks on the enterprise key risk profile are assigned for oversight to one or more Board committees.

Board committees provide risk updates to the full Board at least once annually for risks overseen through their respective terms of reference.

Risk owners are included in the quarterly level two risk assessment updates and are asked to validate the key risk name,

ranking and definition, and provide updates on mitigation approaches.

The Board or Board committees may request risk briefings by TELUS executive risk owners. The Vice-President,

Risk Management and Chief Internal Auditor attends or is copied on a summary of these briefings.

ENTERPRISE RISK GOVERNANCE

The following subsections describe the principal risks and uncertainties that could affect TELUS’ future business results going forward, and TELUS’

associated risk mitigation activities. The significance of these risks is such that they alone or in combination may have material impacts on TELUS’

business operations, reputation, results and valuation.

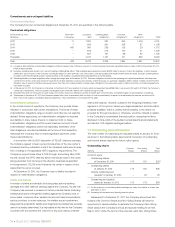

10.1 Competition 10.5 Process risks 10.9 Litigation and legal matters

10.2 Technology 10.6 Financing and debt requirements 10.10 Human-caused and natural threats

10.3 Regulatory matters 10.7 Tax matters 10.11 Economic growth and fluctuations

10.4 Human resources 10.8 Health, safety and environment

10.1 Competition

Customer experience

There is a risk that TELUS will not maintain or increase levels of client

loyalty if the products, services and service experience offered by the

Company do not meet or exceed customer expectations. If TELUS does

not provide a better customer experience than its competitors, the TELUS

brand image could suffer, and business clients and consumers may

change service providers. The Company’s profitability could be negatively

impacted should the costs to acquire and retain customers increase.

Risk mitigation: Enhancing customer experience and earning the loyalty

of clients is a prioritized Company-wide commitment. An organization-

wide initiative that focuses on the customer commenced in 2010. See

Section 3 – Delivering on TELUS’ future friendly brand promise to clients

for examples in 2011. One of the Company’s key corporate priorities

in 2012 is: Deliver on TELUS’ future friendly brand promise by putting

customers first.

Wireless competitive intensity is expected to increase

TELUS anticipates continued pressure on ARPU and costs of acquisition

and retention as competitors continue to subsidize handsets (particu-

larly the generally more expensive smartphones), lower prices for airtime

and wireless data, and offer other incentives to attract

new customers.

In addition to TELUS, eight other facilities-based wire less carriers operated

in Canada in 2011, including four new entrants who acquired advanced

wireless services (AWS) spectrum in 2008. A fifth new entrant is expected

to begin offering services in 2012. (See Section 4.1 Principal markets

addressed and competition.)

Since the AWS spectrum auction in 2008, new entrants have

focused on promotions and rich rate plans to stimulate loading. New

entrant strategies have included price discounting relative to established

carriers, unlimited rate plans or zone-based pricing, and increased

competition at points of distribution. In addition, established competitors

have re-launched or introduced new brands with aggressive acquisition

and retention offers.

Competition from adjunct wireless technologies

is likely to increase

Increased competition is expected through the use of unlicensed

spectrum to deliver higher-speed data services. Shaw Communications,

which had earlier announced plans to launch wireless services in early

2012, stopped construction of a conventional wireless network in Western

Canada in favour of building managed metropolitan area Wi-Fi networks.

Adjunct wireless technologies like fixed WiMAX and Wi-Fi continue

to develop, as several carriers in North America test commercial viability.

In addition, satellite operators such as Xplornet are augmenting their

existing high-speed Internet access (HSIA) capabilities with the launch

of high-throughput satellites, targeting households in rural and remote

locations and claiming future download speeds of up to 25 Mbps.

Risk mitigation in wireless markets: The Company improved its

competitive position with the launch of its HSPA+ wireless network in

2009, commercialization of HSPA+ dual-cell technology in early 2011,

and the launch of 4G LTE services in February 2012 (see Section 10.2

Technology). In aggregate, these higher-speed networks cover more

than 97% of Canada’s population, including network access agreements

with Bell Canada and SaskTel.