Telus 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 . TELUS 2011 ANNUAL REPORT

SNAPSHOT OF OPERATIONS: WIRELINE

growingdemand

The Canadian wireline market is mature, with flat to negative

revenue growth. In 2011, the landscape remained dynamic as

older legacy services such as local and long distance telephony

continued to decline due to migration to wireless, data and

voice over IP (VoIP) services. In addition, cable-TV and other

companies continue to increase the speed and availability

of their data offerings, targeting new markets and increasing

competitive intensity. In response, telecom companies are

pushing further into the TV and entertainment business and

developing and implementing innovative IP-based solutions

for the business market.

TV entertainment continues to be a key area of growth for

telecom companies, with market share gains by IP TV carriers at

the expense of traditional cable-TV and satellite-TV companies.

In addition, new over-the-top competitors, which provide video

services over the Internet for a fee, are emerging as technology

advances, bringing with them the prospect of video cord-cutting

and/or consumer spending reductions.

In the residential market, TELUS’ significant technology

investments in recent years have allowed us to offer customers

a superior home entertainment experience through Optik TV,

delivered over our advanced broadband network. Our service

bundle provides TELUS with key competitive differentiation

and, in 2011, drove very successful Optik TV and High Speed

Internet loading, while also slowing residential network access

line losses. However, aggressive introductory promotions

and discounting on service bundles remain typical as cable-TV

rivals defend their TV and bundled services subscriber base.

Despite the decline in voice services, TELUS is one of the few

established telcos in the world that generated positive wireline

revenue growth in 2011, due to the strong performance of

our Optik services.

In the enterprise segment, migration to IP-based integrated

and managed services continues as a result of the conver-

gence of IT and telecommunications services. For established

telcos, combined IP, voice, data and video solutions create

potential cost efficiencies to partially compensate for margin

pressures caused by the migration from legacy voice and

long distance services.

TELUS is offering a series of business solutions targeting

specific high-value enterprise and public sector segments across

the country. Notably in 2011, TELUS completed a comprehensive

10-year $1 billion telecommunications agreement with the

Government of British Columbia.

Many companies, including cable-TV companies, are also

pursuing opportunities with VoIP services, particularly in the

small and medium business (SMB) market.

TELUS wireline revenue increased by three per cent

in 2011 due to data growth and bundling success that were

partially offset

by reductions in high-margin legacy voice

and long distance

revenues. As a result, the wireline EBITDA

margin decreased by two percentage points to 31 per cent.

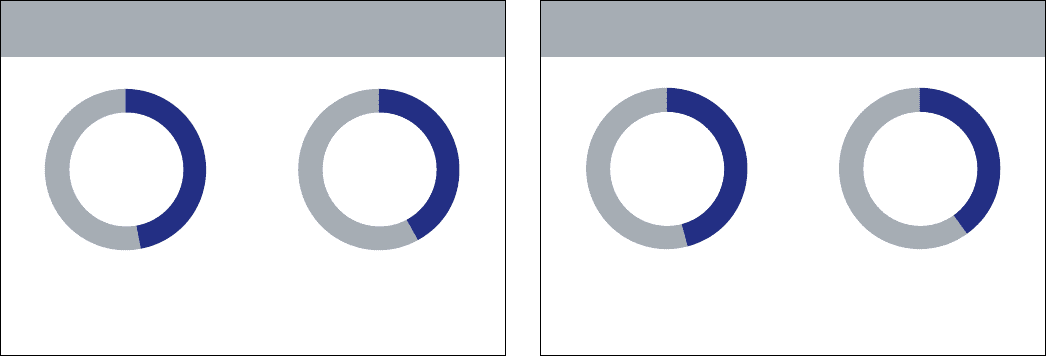

2011 RESULT S – WIRELINE

(share of TELUS consolidated)

revenue (external)

$4.94 billion

EBITDA

$1.59 billion

42%

share

47%

share

2012 TARGETS – WIRELINE1

(share of TELUS consolidated)

2012 TARGETS – WIRELINE1

(share of TELUS consolidated)

1 See Caution regarding forward-looking statements on page 38 of this report.

revenue (external)

$4.95 to $5.1 billion

EBITDA

$1.5 to $1.6 billion

46%

share

40%

share