Telus 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 149

FINANCIAL STATEMENTS & NOTES: 16

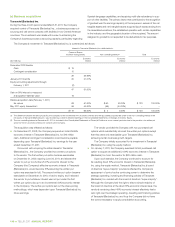

.Subsequently in the first quarter of 2011, Transactel (Barbados) Inc.

achieved the business growth target necessary for the Company

to exercise its second purchased call option. The Company exercised

its second purchased call option and asserted its control effective

February 1, 2011 (the acquisition date). The effects of the second

purchased call option exercise included that the Company:

.accounted for its 51% economic interest in Transactel (Barbados)

Inc. on a consolidated basis (as the vendor no longer had an

effective veto over the strategic operating, investing and financing

policies of Transactel (Barbados) Inc.) and thus included Transactel

(Barbados) Inc.’s results in the Company’s Wireline segment

effective February 1, 2011;

.was required to re-measure its pre-acquisition 51% economic

interest at acquisition-date fair value, resulting in the recognition

of a gain of $16 million (see Note 6) (such gain being net of a

contingent consideration liability estimate of $10 million; concurrent

with preparing the Company’s 2011 financial statements, the

contingent consideration liability was confirmed at $9 million, as

discussed further in Note 19(a), and the gain was thus revised to

$17 million);

.was required to initially measure the non-controlling interest’s 49%

economic interest at acquisition-date fair value, resulting in an

increase of $60 million in the non-controlling interest; and

.recorded, in the second quarter of 2011, a post-acquisition equity

transaction with the vendor for the incremental 44% economic

interest for $51 million cash.

Concurrent with acquiring the incremental 44% economic interest,

the Company provided a written put option to the vendor. This third

written put option becomes exercisable on December 22, 2015, and

allows the vendor to put the remaining 5% economic interest to the

Company (the Company’s effective interest in Transactel (Barbados) Inc.

would become 100%). The written put option sets out that the pricing

methodology is to use an independent party using common practice

valuation techniques. Also concurrently, the vendor has provided the

Company with a purchased call option which substantially mirrors the

third written put option.

TELUS-branded wireless dealership businesses

During the year ended December 31, 2011, the Company acquired 100%

ownership of certain TELUS-branded wireless dealership businesses

for $81 million cash ($81 million net of cash acquired). There was no

contingent consideration in the transactions. The investments were made

with a view to enhancing the Company’s distribution of wireless products

and customer services across Western Canada.

The primary factor that contributed to the recognition of goodwill was

the earnings capacity of the acquired businesses in excess of the net

tangible assets and net intangible assets acquired (such excess arising

from the acquired workforce and the benefits of acquiring established

businesses in multiple locations). Approximately $16 million assigned to

goodwill during the year ended December 31, 2011, may be deductible

for tax purposes.

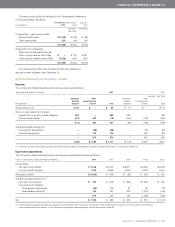

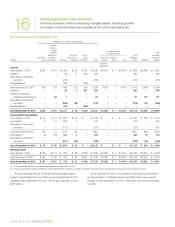

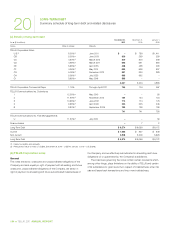

Acquisition-date fair values

The acquisition-date fair values assigned to assets acquired and liabilities

assumed are as set out in the following table.

TELUS-branded

wireless

Transactel dealership

(Barbados) Inc. businesses

As at (millions) February 1, 2011 Various 2011

Assets

Current assets

Accounts receivable(1) $ß 25 $ß 2

Other 5 1

30 3

Non-current assets

Property, plant and equipment 12 6

Intangible assets

Intangible assets subject to amortization(2)

Customer contracts, related customer

relationships and leasehold interests 21 39

Software 1 –

22 39

Deferred income taxes – 2

Total non-current assets 34 47

Total identifiable assets acquired 64 50

Liabilities

Current liabilities 13 5

Non-current liabilities

Other long-term liabilities – 1

Deferred income taxes – 1

Total non-current liabilities – 2

Total liabilities assumed 13 7

Net identifiable assets acquired 51 43

Goodwill 72 38

Net assets acquired $ß123 $ß81

Acquisition effected by way of:

Cash consideration $ß – $ß81

Re-measured pre-acquisition 51% interest

at acquisition-date fair value(3) 63 n.a.

63 81

Non-controlling interest measured at fair value(4) 60 n.a.

$ß123 $ß81

(1) The fair value of the accounts receivable is equal to the gross contractual amounts

receivable and reflects the best estimates at the acquisition dates of the contractual

cash flows expected to be collected.

(2) The customer contracts and the related customer relationships and the software

acquired in conjunction with Transactel (Barbados) Inc. are being amortized over periods

of six years and three years, respectively. The customer contracts, related customer

relationships and leasehold interests acquired in conjunction with the TELUS-branded

wireless dealership businesses are being amortized over a period of six years.

(3) Re-measurement of the Company’s previously held 51% economic interest resulted

in the recognition of an acquisition-date gain of $16 which is included in the Consolidated

Statements of Income and Other Comprehensive Income as a component of Other

operating income (see Note 6). The previously held 51% economic interest was com-

prised of an initial 29.99% acquired December 22, 2008, and a 21.01% economic

interest obtained January 7, 2011.

The acquisition-date fair value of the Company’s 51% interest included the

recognition of $10 for contingent consideration, which was contractually based upon

a multiple of an estimate of Transactel (Barbados) Inc. fiscal 2011 earnings in excess

of a threshold amount.

Concurrent with preparing the Company’s 2011 financial statements, the con-

tingent consideration liability was confirmed at $9, as discussed further in Note 19(a),

and the gain was thus revised to $17.

(4) The remaining non-controlling interest, representing a 49% economic interest, had a

fair value of $60 as of February 1, 2011 (acquisition-date fair value). The non-controlling

interest fair value (the recorded amount of which is based upon net assets acquired)

was determined by discounted cash flows. The fair value estimate is based upon: a

going-concern basis; market participant synergies; a perpetuity terminal value based

on sustaining cash flows; and costs (taxes) associated with future repatriation of funds.