Telus 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 . TELUS 2011 ANNUAL REPORT

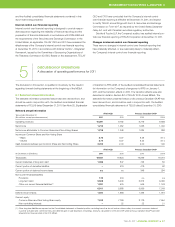

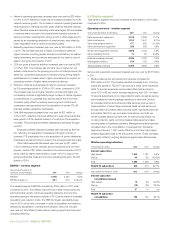

Income taxes

Years ended December 31

($ millions, except tax rates) 2 0 11 2010 Change

Basic blended tax at weighted average

statutory income tax rates 433 402 7.7%

Revaluation of deferred income tax

liability to reflect future statutory

income tax rates (37) (44) n/m

Tax rate differential on, and consequential

adjustments from, reassessments

of prior years’ tax issues (20) (35) n/m

Share option award compensation (1) 10 n/m

Other 1 2 n/m

376 335 12.2%

Blended federal and provincial

statutory tax rates (%) 27.2 29.0 (1.8) pts.

Effective tax rates (%) 23.6 24.1 (0.5) pts.

Basic blended statutory income taxes increased by $31 million in 2011

when compared to 2010 due to the 14% increase in pre-tax income,

partly offset by a lower blended statutory income tax rate. The effective

tax rates were lower than the statutory tax rates due to revaluations

of deferred income tax liabilities; the tax rate differential on, and conse-

quential adjustments from, reassessments of prior years’ tax issues;

and other taxable income differences.

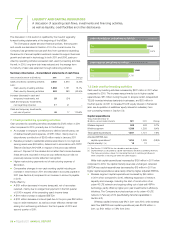

10

09

08

07

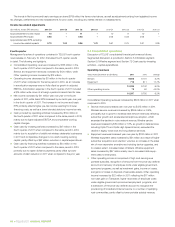

Net income

Income before income taxes

NET INCOME ($ millions)

11 1,215

11

10

10 1,387

1,052

1,591

10

09

BASIC EARNINGS PER COMMON SHARE

AND NON-VOTING SHARE ($)

11 3.76

3.27

10

Net income

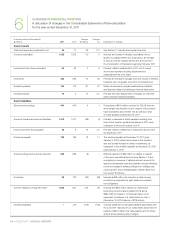

Years ended December 31 ($ millions) 2 0 11 2010 Change

1,215 1,052 15.5%

Net income increased by $163 million in 2011 when compared to 2010.

See summary analysis in Section 1.3.

Other comprehensive income (OCI)

Years ended December 31 ($ millions) 2 0 11 2010 Change

Items that may be subsequently

reclassified to income 10 54 (81.5)%

Item never subsequently reclassified

to income (851) (214) n/m

(841) (160) n/m

OCI items that may be subsequently reclassified to income are comprised

of changes in unrealized fair value of derivatives designated as cash

flow hedges, and foreign currency translation adjustments arising from

translating financial statements of foreign operations.

The OCI item never subsequently reclassified to income is in respect

of after-tax actuarial gains and losses on defined benefit plans, which

are likely to fluctuate from period to period.

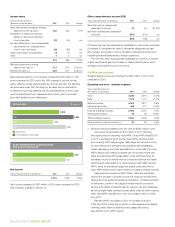

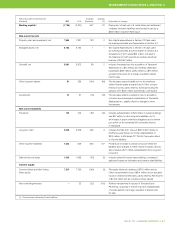

5.4 Wireless segment

Wireless segment revenues increased by $455 million in 2011 when

compared to 2010.

Operating revenues – wireless segment

Years ended December 31

($ in millions, except ratios) 2 0 11 2010 Change

Voice 3,326 3,470 (4.1)%

Data 1,678 1,141 47.1%

Network revenue 5,004 4,611 8.5%

Equipment and other 458 401 14.2%

External operating revenues 5,462 5,012 9.0%

Intersegment revenue 38 33 15.2%

Total operating revenues 5,500 5,045 9.0%

Data revenue to network revenue (%) 34 25 9 pts.

.Network revenue increased year over year by $393 million in 2011.

Voice revenue decreased by $144 million in 2011 reflecting

the ongoing trend of declining voice ARPU. Voice ARPU was $39.20

in 2011, a decrease of $4.05 (9.4%). Voice ARPU declines reflect

an increasing shift towards higher data usage as customers move

to more data-centric rate plans and substitute text messaging,

instant messaging and voice applications for voice calls. The voice

ARPU decline also reflects increased use of included-minute rate

plans

as subscribers shift usage patterns and optimize pricing, an

increasing

volume of mobile Internet connection devices and tablet

subscriptions where there is no voice revenue, lower MikeTM service

ARPU, lower long distance usage and greater penetration of the

lower ARPU Koodo brand, partly offset by increased roaming volumes.

Data revenue increased by $537 million, reflecting subscriber

growth and strength in smartphone service revenues and text mes-

saging driven by greater smartphone penetration, increased adoption

of data plans, growth in the usage of mobile Internet connection

devices and tablets, increased rates for pay-per-use text messaging,

as well as higher data roaming volumes partly offset by lower roaming

rates. Data ARPU was $19.90 in 2011, an increase of $5.51 or 38%

from 2010.

Blended ARPU was $59.10 in 2011, an increase of $1.46 or

2.5% from 2010, mainly due to growth in data usage and increased

roaming, partly offset by declining voice usage and pricing.

See Section 5.2 for ARPU trends.