Telus 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 . TELUS 2011 ANNUAL REPORT

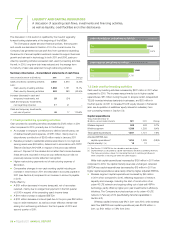

.Network operating expenses increased year over year by $22 million

or 3.4% in 2011, reflecting a lower rate of increase compared to 8.5%

network revenue growth. The increase in network operating expenses

reflects growth in roaming volumes, partly offset by reduced roaming

rates. Revenue-share and licensing costs were largely flat as increases

in revenue-share volumes to third parties and licensing volumes to

service providers, resulting from strong growth in data usage accom-

panied by an increasing penetration of smartphones, were offset by

lower negotiated revenue-share and licensing rates.

.Marketing expenses increased year over year by $24 million or 5.5%

in 2011. The increase was due to higher commissions related to

higher volumes, including greater smartphone activations, as well as

higher advertising and promotions expenses for the back-to-school

season during the third quarter of 2011.

.COA per gross subscriber addition increased year over year by $36

or 10% in 2011. The increase was primarily due to higher per-unit

subsidy costs driven by the growing proportion of smartphones in the

sales mix, competitive pres sures on handset pricing driving deeper

subsidies and, to a lesser extent, higher commissions to support an

increasing number of higher-value smartphone devices.

.Retention costs as a percentage of network revenue increased

by 0.8 percentage points to 12.4% in 2011 when compared to 2010.

The increase was due to higher retention volumes and higher per-

unit subsidy costs as a significantly larger number of clients migrated

to smartphones or upgraded their devices before the end of their

contracts, partly offset by network revenue growth of 8.5% and

commission savings arising from the acquisition of certain TELUS-

branded wireless dealership businesses.

.Total G&A expenses increased year over year by $21 million or

2.3% in 2011, reflecting improved efficiency in supporting subscriber

base growth of 5.1%, despite inclusion of costs from the acquisition

of certain TELUS-branded wireless dealership businesses through-

out 2011.

Employee benefits expense increased year over year by $32 mil-

lion, reflecting compensation increases and a higher number of

domestic FTE employees due to the acquisition of certain dealership

businesses, as well as hiring to support the growing subscriber base.

Other G&A expenses decreased year over year by $11 million

in 2011, reflecting a lower doubtful accounts expense and one-time

supplier credits of $11 million recorded in the second quarter of 2011,

partly offset by higher external labour costs in 2011 to support the

growing subscriber base and one-time operating savings in the first

quarter of 2010.

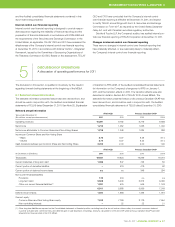

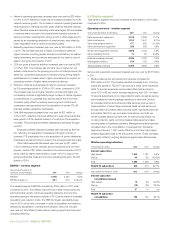

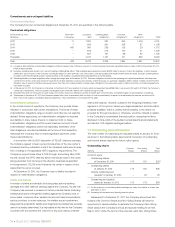

EBITDA – wireless segment

Years ended December 31

($ millions, except margins) 2 0 11 2010 Change

EBITDA 2,186 2,020 8.2%

EBITDA margin (%) 39.7 40.0 (0.3) pts.

The wireless segment EBITDA increased by $166 million in 2011 when

compared to 2010. This reflects improvement in data revenue and post-

paid subscriber growth, improved operating efficiency and one-time

operating savings in the second quarter of 2011, partly offset by increased

acquisition and retention costs. The EBITDA margin was slightly lower

than in 2010, as the rate of increase in costs of acquisition and retention,

affected by acceleration of smartphone adoption rates over the past

year, was not fully offset by data network revenue growth and improved

operating efficiency.

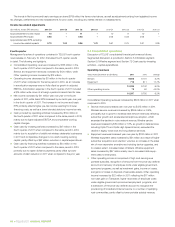

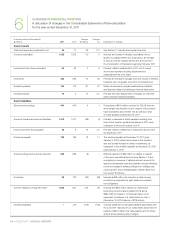

5.5 Wireline segment

Total wireline segment revenues increased by $164 million in 2011 when

compared to 2010.

Operating revenues – wireline segment

Years ended December 31 ($ millions) 2 0 11 2010 Change

Data service and equipment 2,578 2,268 13.7%

Voice local service 1,514 1,647 (8.1)%

Voice long distance service 477 530 (10.0)%

Other services and equipment 296 283 4.6%

Service and equipment revenues 4,865 4,728 2.9%

Other operating income 70 52 34.6%

External operating revenues 4,935 4,780 3.2%

Intersegment revenue 164 155 5.8%

Total operating revenues 5,099 4,935 3.3%

Service and equipment revenues increased year over year by $137 million

in 2011.

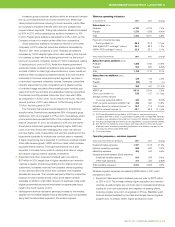

.Wireline data service and equipment revenues increased by

$310 mil lion in 2011. The increase resulted principally from: (i) strong

subscriber growth in TELUS TV services as a result of the enhanced

Optik TV service experience and bundled offers first launched in

June 2010, a $3 per month increase beginning April 2011 for basic

TV service subscribers not on rate protection plans, as well as varying

rate increases for theme package selections in April and October;

(ii) increased Internet and enhanced data services revenue due to

implementation of recent large enterprise deals, as well as the pull-

through effect of bundled offers including Optik High Speed services

that enable TELUS to win and retain subscribers, and a $2 per

month increase beginning April 2011 for Internet sub scribers not

on rate protection plans; and (iii) increased data equipment sales,

including sales to business customers. Managed workplace revenues

increased due to the consolidation of revenues from Transactel

beginning February 1, 2011, partly offset by a one-time high-margin

software application sale in the first quarter of 2010. These increases

were partly offset by ongoing declines in legacy basic data services.

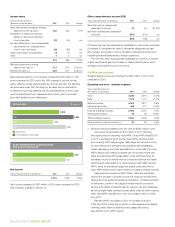

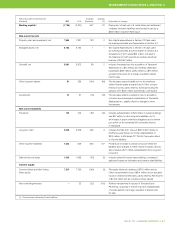

Wireline operating indicators

At December 31 (000s) 2 0 11 2010 Change

Internet subscribers

High-speed 1,242 1,167 6.4%

Dial-up 44 62 (29.0)%

Total 1,286 1,229 4.6%

TELUS TV subscribers 509 314 62.1%

Years ended December 31 (000s) 2 0 11 2010 Change

Internet subscriber

net additions (losses)

High-speed 75 39 92.3%

Dial-up (18) (25) 28.0%

Total 57 14 n/m

TELUS TV subscriber

net additions 196 144 36.1%