Telus 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 143

FINANCIAL STATEMENTS & NOTES: 14

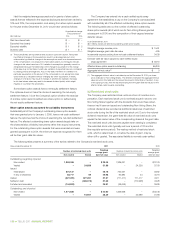

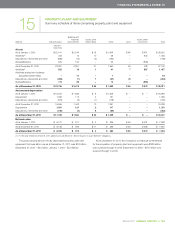

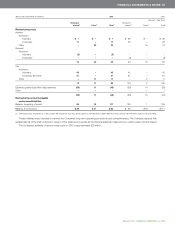

Asset allocations

Information concerning the Company’s defined benefit plans’ target asset allocations and actual asset allocations is as follows:

Pension benefit plans Other benefit plans

Target Percentage of plan assets Target Percentage of plan assets

allocation at end of year allocation at end of year

2012 2 0 11 2010 2012 2 0 11 2010

Equity securities 45–60% 56% 56% – – –

Debt securities 35–45% 37% 38% – – –

Real estate 4–8% 7% 6% – – –

Other 0–2% – – 100% 100% 100%

100% 100% 100% 100%

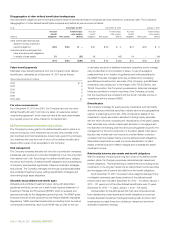

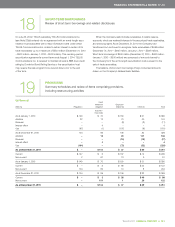

(e) Employer contributions

The determination of the minimum funding amounts for substantially all

of the Company’s registered defined benefit pension plans is governed

by the Pension Benefits Standards Act, 1985, which requires that, in

addition to current service costs being funded, both going-concern and

solvency valuations be performed on a specified periodic basis.

.Any excess of plan assets over plan liabilities determined in the

going-concern valuation reduces the Company’s minimum funding

requirement of current service costs, but may not reduce the

requirement to an amount less than the employees’ contributions.

The going-concern valuation generally determines the excess

(if any) of a plan’s assets over its liabilities, determined on a projected

benefit basis.

.As of the date of these consolidated financial statements, the solvency

valuation generally requires that a plan’s liabilities, determined on

the basis that the plan is terminated on the valuation date, in excess

of its assets (if any) be funded, at a minimum, in equal annual

amounts over a period not exceeding five years.

The best estimates of fiscal 2012 employer contributions to the

Company’s defined benefit plans are approximately $172 million (including

a discretionary contribution of $100 million made in January 2012) for

defined benefit pension plans and $NIL for other defined benefit plans.

These estimates (other than for the discretionary contribution of $100 mil-

lion made in January 2012) are based upon the mid-year 2011 annual

funding reports that were prepared by actuaries using December 31, 2010,

actuarial valuations. The funding reports are based on the pension plans’

fiscal years, which are calendar years. The next annual funding valuations

are expected to be prepared mid-year 2012.

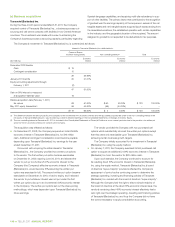

(f) Assumptions

Management is required to make significant estimates about certain

actuarial and economic assumptions to be used in determining defined

benefit pension costs, accrued benefit obligations and pension plan

assets. These significant estimates are of a long-term nature, which is

consistent with the nature of employee future benefits.

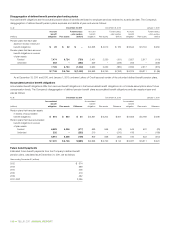

Demographic assumptions

The Company uses the 1994 Uninsured Pensioner Mortality Table (UP94

Table) and with generational projection for future mortality improvements

using Mortality Table Projection Scale AA.

Financial assumptions

The discount rate, which is used to determine the accrued benefit

obligation, is based on the yield on long-term, high-quality fixed term

investments, and is set annually. The expected long-term rate of

return is based upon forecasted returns of the major asset categories

and weighted by the plans’ target asset allocations. Future increases

in compensation are based upon the current benefits policies and

economic forecasts.

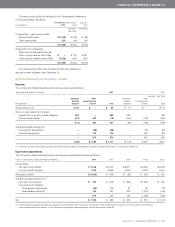

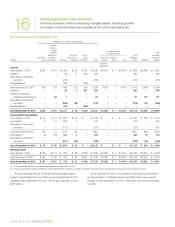

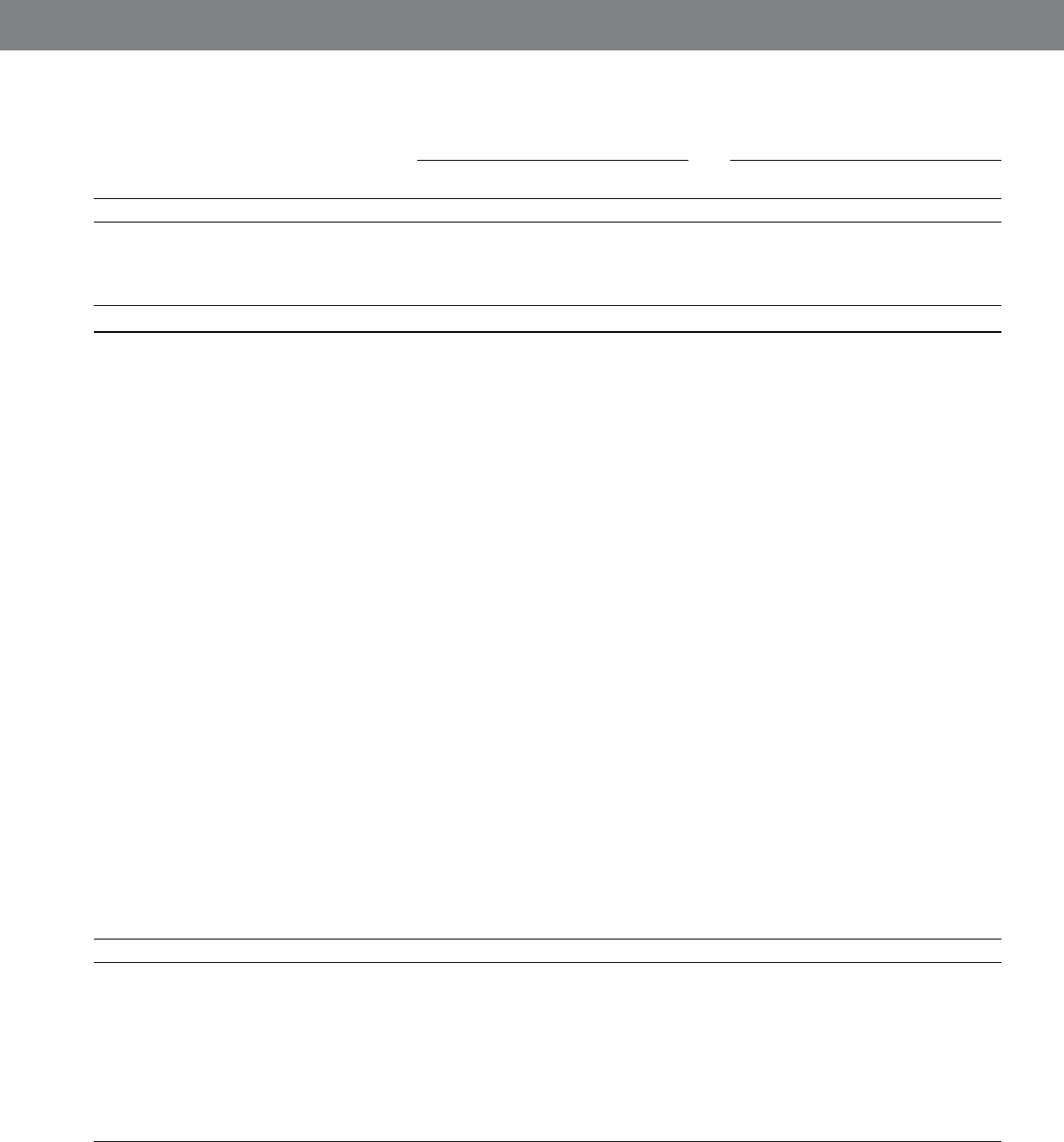

The significant weighted average actuarial assumptions arising from these estimates and adopted in measuring the Company’s accrued benefit

obligations are as follows:

Pension benefit plans Other benefit plans

2 0 11 2010 2 0 11 2010

Discount rate used to determine:

Net benefit costs for the year ended December 31 5.25% 5.85%(2) 4.97% 5.67%(2)

Accrued benefit obligation as at December 31 4.50% 5.25% 4.50% 4.97%

Expected long-term rate of return(1) on plan assets used to determine:

Net benefit costs for the year ended December 31 7.00% 7.25%(2) 2.50% 2.50%(2)

Accrued benefit obligation as at December 31 6.75% 7.00% 2.50% 2.50%

Rate of future increases in compensation used to determine:

Net benefit costs for the year ended December 31 3.00% 3.00%(2) – –

Accrued benefit obligation as at December 31 3.00% 3.00% – –

(1) The expected long-term rate of return is based upon forecasted returns of the major asset categories and weighted by the plans’ target asset allocations (see (d)). Forecasted returns

arise from the Company’s ongoing review of trends, economic conditions, data provided by actuaries and updating of underlying historical information.

(2) The rates used to determine the net benefit costs for the year ended December 31, 2010, are equal to the rates used to determine the accrued benefit obligation as at January 1, 2010.