Telus 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 . TELUS 2011 ANNUAL REPORT

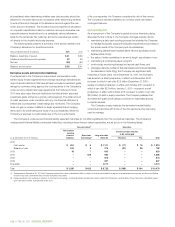

for any changes in the amount or timing of the underlying future cash

flows. The capitalized asset retirement cost is depreciated on the same

basis as the related asset and the discount accretion, as set out in

Note 8, is included in the Consolidated Statements of Income and Other

Comprehensive Income as a component of Financing costs.

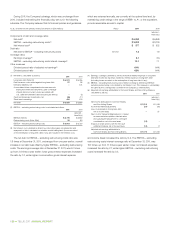

(s) Investments

The Company accounts for its investments in companies over which it

has significant influence using the equity basis of accounting whereby

the investments are initially recorded at cost and subsequently adjusted

to recognize the Company’s share of earnings or losses of the investee

companies and dividends received. The excess of the cost of equity

investments over the underlying book value at the date of acquisition,

except for goodwill, is amortized over the estimated useful lives of

the underlying assets to which it is attributed.

The Company accounts for its other investments as available-for-sale

at their fair values unless the investment securities do not have quoted

market prices in an active market, in which case the Company uses the

cost basis of accounting whereby the investments are initially recorded

at cost and earnings from such investments are recognized only to the

extent received or receivable. The cost of investments sold or amounts

reclassified out of other comprehensive income into earnings are

determined on a specific identification basis.

Unless there is an other than temporary decline in the value of an

available-for-sale investment, the carrying values of available-for-sale

investments are adjusted to estimated fair values with such adjustment

being included in the Consolidated Statements of Income and Other

Comprehensive Income as a component of other comprehensive income.

When there is an other than temporary decline in the value of an invest-

ment, the carrying values of investments accounted for using the

equity, available-for-sale and cost methods are reduced to estimated

fair values with any such reduction being included in the Consolidated

Statements of Income and Other Comprehensive Income as Other

operating income.

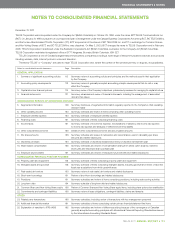

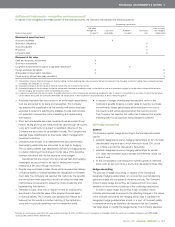

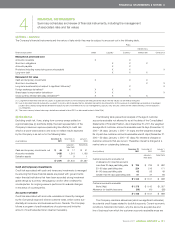

2ACCOUNTING POLICY DEVELOPMENTS

Summary review of generally accepted accounting principle developments

that do, will or may affect the Company

Convergence with International Financial

Reporting Standards as issued by the International

Accounting Standards Board

In 2006, Canada’s Accounting Standards Board ratified a strategic plan

that resulted in Canadian generally accepted accounting principles, as

used by publicly accountable enterprises, being fully converged with

International Financial Reporting Standards as issued by the International

Accounting Standards Board. The Company is required to report using

the converged standards effective for interim and annual financial

statements relating to fiscal years beginning no later than on or after

January 1, 2011, the date which the Company selected for adoption.

Specific disclosures about transitional elections, adjustment of compara-

tive amounts and other related transitional disclosures are set out in

Note 25 of these consolidated financial statements.

(a) Initial application of standards, interpretations

and amendments to standards and interpretations

in the reporting period

In May 2010, the IASB issued Improvements to IFRSs – a collection of

amendments to existing IFRSs and International Accounting Standards

(IASs) – as a part of the annual improvements process. The Company

has applied the amendments since January 1, 2010. The amendments

did not have a material impact on the presentation of the Company’s

results of operations, financial position or cash flows.

In October 2010, the IASB issued IFRS 7, Financial Instruments:

Disclosures (amended 2010), which, in the Company’s instance, pertained

to the disclosure of transferred financial assets (trade receivables) that

are not derecognized. The Company’s current accounting policies

and presentation and disclosure practices are such that they already

comply with the amendments.

In June 2011, the IASB issued IAS 1, Presentation of Financial

Statements (amended 2011), which pertained to presentation of items

of other comprehensive income. The Company’s current accounting

policies and presentation and disclosure practices are such that they

already comply with the amendments.

(b) Standards, interpretations and amendments

to standards not yet effective and not yet applied

Unless otherwise indicated, the following standards are required to be

applied for periods beginning on or after January 1, 2013. Unless otherwise

indicated, based upon current facts and circumstances, the Company

does not expect to be materially affected by the application of the

following standards and is currently determining which date(s) it plans

for initial compliance.

.IFRS 7, Financial Instruments: Disclosures (amended 2011).

.IFRS 9, Financial Instruments, is required to be applied for periods

beginning on or after January 1, 2015.

.Other than for the disclosure requirements therein, the following stan-

dards and amended standards must be initially applied concurrently:

.IFRS 10, Consolidated Financial Statements

.IFRS 11, Joint Arrangements

.IFRS 12, Disclosure of Interests in Other Entities

.IAS 27, Separate Financial Statements (amended 2011)

.IAS 28, Investments in Associates (amended 2011).

.IFRS 13, Fair Value Measurement.

.IAS 12, Income Taxes (amended 2011), is required to be applied

for periods beginning on or after January 1, 2012.

.IAS 32, Financial Instruments (amended 2011), is required to be

applied for periods beginning on or after January 1, 2014.

.IAS 19, Employee Benefits (amended 2011): Relative to the Company’s

current accounting policies and presentation and disclosure prac-

tices, the key difference in the amended standard is that the expected

long-term rate of return on plan assets will no longer be used for

defined benefit plan measurement purposes (and thus will no longer

be a significant estimate). In the determination of net income in

the Company’s instance, the effect is that the defined benefit plan