Telus 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

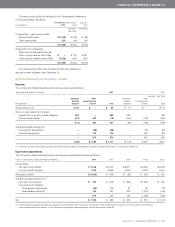

TELUS 2011 ANNUAL REPORT . 141

FINANCIAL STATEMENTS & NOTES: 14

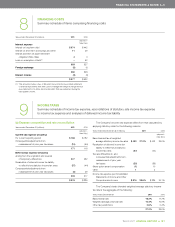

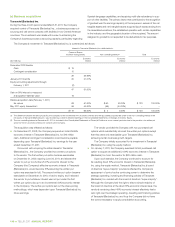

Fair value measurements

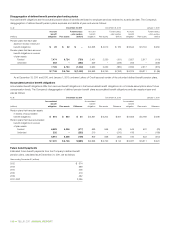

Information about the fair value measurements of the Company’s defined benefit pension plans’ assets, in aggregate, is as follows:

Fair value measurements at reporting date using

Quoted prices in active

Total markets for identical items Other

Dec. 31, Dec. 31, Jan. 1, Dec. 31, Dec. 31, Jan. 1, Dec. 31, Dec. 31, Jan. 1,

As at (millions) 2 0 11 2010 2010 2 0 11 2010 2010 2 0 11 2010 2010

Asset class

Equity securities

Canadian $ß1,998 $ß2,174 $ß1,921 $ß1,632 $ß1,790 $ß1,743 $ 366 $ 384 $ 178

Foreign 1,771 1,589 1,415 1,285 1,122 969 486 467 446

Debt securities

Debt securities issued

by national, provincial

or local governments 1,346 1,357 1,207 946 1,071 1,014 400 286 193

Corporate debt securities 692 558 620 – – – 692 558 620

Asset-backed securities 38 54 45 – – – 38 54 45

Commercial mortgages 253 218 312 – – – 253 218 312

Cash and cash equivalents 213 386 389 1 17 25 212 369 364

Real estate 440 429 393 55 51 45 385 378 348

Other – – 14 – – – – – 14

6,751 6,765 6,316 $ß3,919 $ß4,051 $ß3,796 $ß2,832 $ß2,714 $ß2,520

Effect of asset ceiling limit (5) (5) (5)

$ß6,746 $ß6,760 $ß6,311

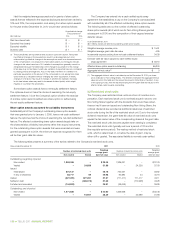

As at December 31, 2011, pension and other benefit trusts adminis-

tered by the Company held shares of TELUS Corporation that had a

fair value of $2 million (December 31, 2010 – $5 million; January 1, 2010

– $5 million). As at December 31, 2010, pension and other benefit trusts

administered by the Company leased real estate to the Company with

a fair value of $31 million (January 1, 2010 – $31 million) (the fair value

of the leased real estate was not determinable by a quoted price in an

active market for an identical item); as at December 31, 2011, pension

and other benefit trusts administered by the Company did not lease real

estate to the Company.

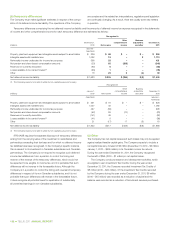

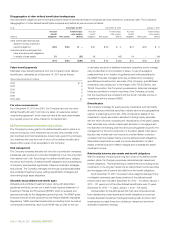

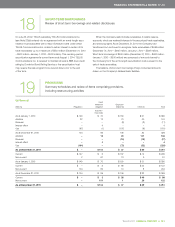

(c) Other defined benefit plans – details

Expense

The Company’s other defined benefit plan expense was as follows:

Years ended December 31 (millions) 2 0 11 2010

(adjusted – Note 25(c))

Employee Other Employee Other

benefits comprehensive benefits comprehensive

Recognized in expense income Total expense income Total

Current service cost $ß 1 $ß – $ß 1 $ß – $ß – $ß –

Return on plan assets net of interest

Interest cost on accrued benefit obligation 2 – 2 5 – 5

Return on plan assets(1) (1) – (1) (1) – (1)

1 – 1 4 – 4

Actuarial loss (gain) arising from:

Demographic assumptions – (2) (2) – 1 1

Financial assumptions – 4 4 – 3 3

– 2 2 – 4 4

Change in the effect of limiting net defined

benefit assets to the asset ceiling – 2 2 – – –

$ß 2 $ß 4 $ß 6 $ß 4 $ß 4 $ß 8

(1) The return on plan assets included in employee benefits expense reflects management’s expected long-term rate of return, as discussed further in (f).