Telus 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 137

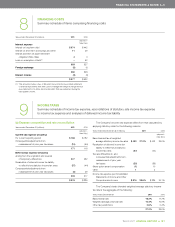

FINANCIAL STATEMENTS & NOTES: 14

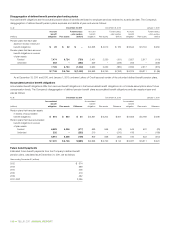

With respect to certain issuances of restricted stock units, the Company has entered into cash-settled equity forward agreements that fix the cost

to the Company; that information, as well as a schedule of the Company’s non-vested restricted stock units outstanding as at December 31, 2011, is set

out in the following table.

Number of Cost fixed to Number of Total number

fixed-cost the Company variable-cost of non-vested

restricted per restricted restricted restricted

stock units stock unit stock units stock units

Vesting in years ending December 31

2012 538,000 $ß38.13 203,125 741,125

2013 447,000 $ß50.98 283,711 730,711

985,000 486,836 1,471,836

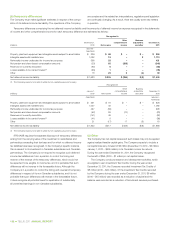

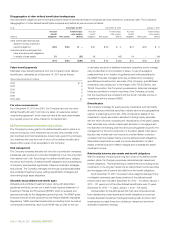

(d) Employee share purchase plan

The Company has an employee share purchase plan under which eligible

employees up to a certain job classification can purchase Common

Shares through regular payroll deductions by contributing between 1%

and 10% of their pay; for more highly compensated job classifications,

employees may contribute between 1% and up to 55% of their pay.

For every dollar contributed by an employee, up to a maximum of 6%

of eligible employee pay, the Company is required to contribute a per-

centage between 20% and 40% as designated by the Company. For the

years ended December 31, 2011 and 2010, the Company con tributed

40% for employees up to a certain job classification; for more highly

compensated job classifications, the Company contributed 35%. The

Company records its contributions as a component of Employee benefits

expense and the Company’s contribution vests on the earlier of a plan

participant’s last day in the Company’s employ or the last business day

of the calendar year of the Company’s contribution, unless the plan

participant’s employment is terminated with cause, in which case the

plan participant will forfeit their in-year Company contribution.

Years ended December 31 (millions) 2 0 11 2010

Employee contributions $ß 78 $ß 73

Company contributions 30 27

$ß108 $ß100

Under this plan, the Company has the option of offering shares from

Treasury or having the trustee acquire shares in the stock market. For the

years ended December 31, 2011 and 2010, all Common Shares issued

to employees under the plan were purchased on the market at normal

trading prices.

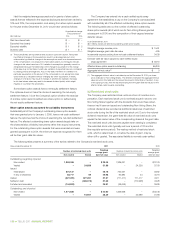

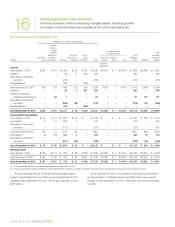

14 EMPLOYEE FUTURE BENEFITS

Summary schedules and review of employee future benefits and related disclosures

The Company has a number of defined benefit and defined contribution

plans providing pension, other retirement and post-employment benefits

to most of its employees. As at December 31, 2011, all registered defined

benefit pension plans are closed to substantially all new participants

and substantially all benefits have vested. Other employee benefit plans

include a TELUS Québec Inc. retiree healthcare plan. The benefit plan(s)

in which an employee is a participant reflects the general development

of the Company.

TELUS Corporation Pension Plan

Management and professional employees in Alberta who joined the

Company prior to January 1, 2001, and certain unionized employees who

joined the Company prior to June 9, 2011, are covered by this contributory

defined benefit pension plan, which comprises slightly more than one-

half of the Company’s total accrued benefit obligation. The plan contains

a supplemental benefit account which may provide indexation up to

70% of the annual change of a specified cost-of-living index. Pensionable

remuneration is determined by the average of the best five years in the

last ten years preceding retirement.

Pension Plan for Management and Professional

Employees of TELUS Corporation

This defined benefit pension plan which, subject to certain limited

exceptions, ceased accepting new participants on January 1, 2006,

and which comprises approximately one-quarter of the Company’s

total accrued benefit obligation, provides a non-contributory base level

of pension benefits. Additionally, on a contributory basis, employees

annually can choose increased and/or enhanced levels of pension benefits

over the base level of pension benefits. At an enhanced level of pension

benefits, the defined benefit pension plan has indexation of 100% of a

specified cost-of-living index, to an annual maximum of 2%. Pensionable

remuneration is determined by the annualized average of the best

sixty consecutive months.

TELUS Québec Defined Benefit Pension Plan

This contributory defined benefit pension plan, which ceased accepting

new participants on April 14, 2009, covers any employee not governed

by a collective agreement in Quebec who joined the Company prior

to April 1, 2006, any non-supervisory employee governed by a collective

agreement prior to September 6, 2006, and certain other unionized

employees. The plan comprises approximately one-tenth of the Company’s

total accrued benefit obligation. The plan has no indexation and pension-

able remuneration is determined by the average of the best four years.

TELUS Edmonton Pension Plan

This contributory defined benefit pension plan ceased accepting new

participants on January 1, 1998. Indexation is 60% of the annual change

of a specified cost-of-living index and pensionable remuneration is deter-

mined by the annualized average of the best sixty consecutive months.