Telus 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 . TELUS 2011 ANNUAL REPORT

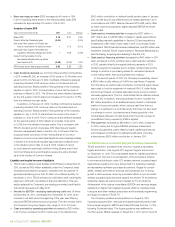

9.8

10.4

8.7

8.1

9.7

9.1

9.6

9.8

36.3

37.3

37.3

36.3

41.6

40.8

41.4

39.1

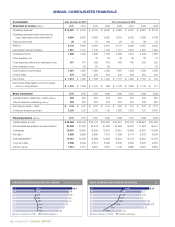

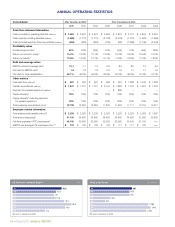

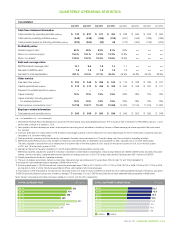

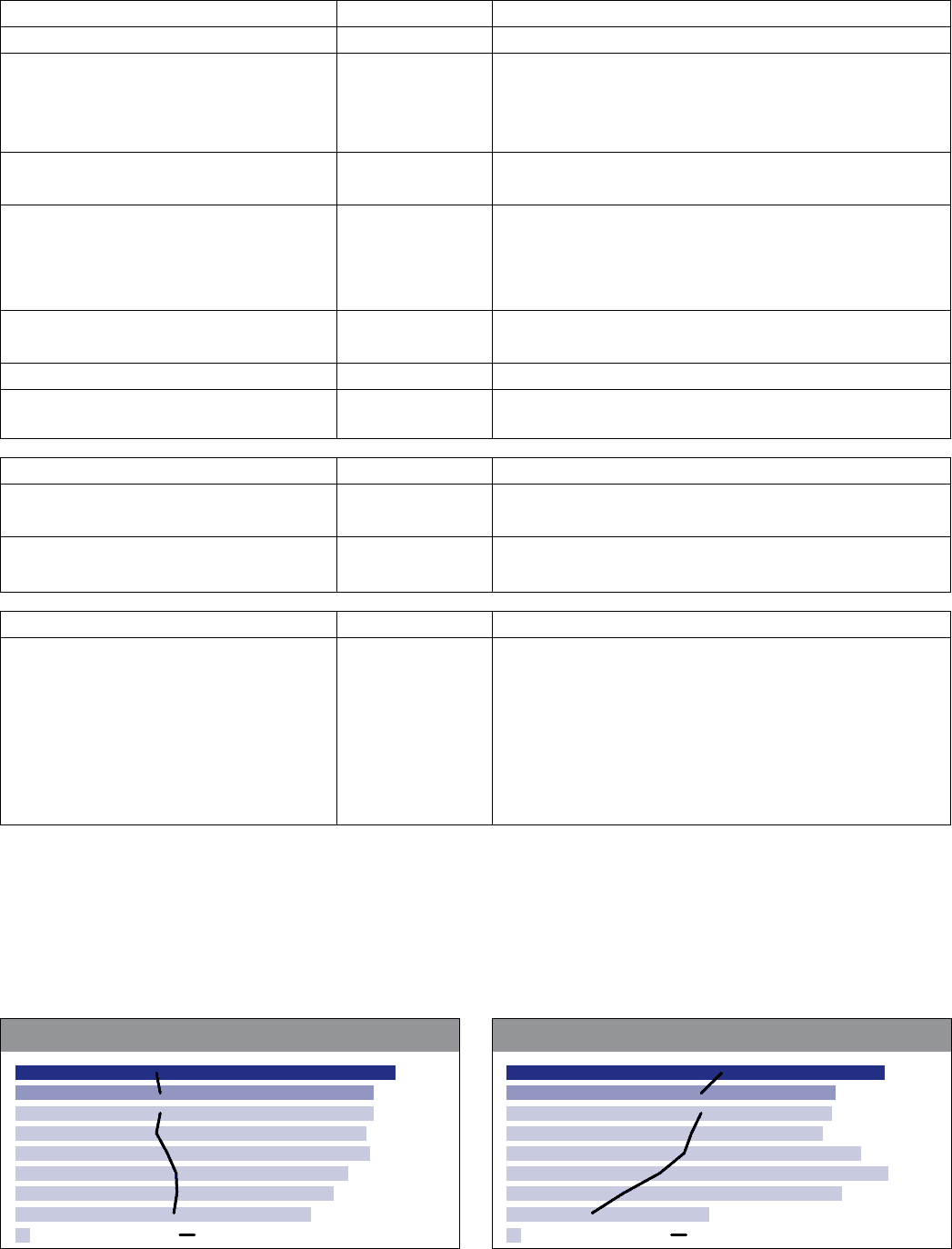

OPERATING REVENUES AND EBITDA8 MARGIN ($ billions and %)

EBITDA margin (%)

11

10

10

09

08

07

06

05

prior to transition to IFRS

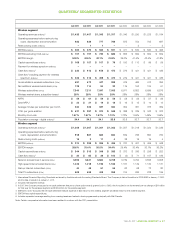

ANNUAL CONSOLIDATED FINANCIALS

Consolidated After transition to IFRS1 Prior to transition to IFRS

Statement of income (millions) 2 0 11 2010 2010 2009 2008 2007 2006 2005

Operating revenues2 $ß10,397 $ß 9,792 $ß 9,779 $ß 9,606 $ß 9,653 $ß 9,074 $ß 8,681 $ß 8,143

Operating expenses before restructuring

costs, depreciation and amortization3 6,584 6,062 6,062 5,925 5,815 5,465 4,998 4,769

Restructuring costs 35 80 74 190 59 20 68 54

EBITDA 3,778 3,650 3,643 3,491 3,779 3,589 3,615 3,320

Depreciation and amortization 1,810 1,741 1,735 1,722 1,713 1,615 1,576 1,624

Operating income 1,968 1,909 1,908 1,769 2,066 1,974 2,039 1,696

Other expense, net – – 32 32 36 36 28 18

Financing costs before debt redemption loss 377 470 458 433 463 440 505 590

Debt redemption loss – 52 52 99 – – – 33

Income before income taxes 1,591 1,387 1,366 1,205 1,567 1,498 1,506 1,055

Income taxes 376 335 328 203 436 233 353 330

Net income $ß 1,215 $ß 1,052 $ß 1,038 $ß 1,002 $ß 1,131 $ß 1,265 $ß 1,153 $ 725

Net income attributable to common shares

and non-voting shares $ß 1,219 $ß 1,048 $ß 1,034 $ 998 $ß 1,128 $ß 1,258 $ß 1,145 $ 717

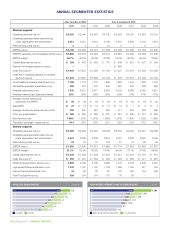

Share information4 2 0 11 2010 2010 2009 2008 2007 2006 2005

Average shares outstanding – basic (millions) 324 320 320 318 320 332 344 357

Year-end shares outstanding (millions) 325 322 322 318 318 324 338 350

Earnings per share – basic $ß 3.76 $ß 3.27 $ß 3.23 $ß 3.14 $ß 3.52 $ß 3.79 $ß 3.33 $ß 2.01

Dividends declared per share 2.205 2.00 2.00 1.90 1.825 1.575 1.20 0.875

Financial position (millions) 2 0 11 2010 2010 2009 2008 2007 2006 2005

Capital assets, at cost5 $ß36,586 $ß35,203 $ß35,100 $ß34,357 $ß32,581 $ß30,129 $ß28,661 $ß27,456

Accumulated depreciation and amortization5 22,469 21,220 22,244 21,480 20,098 19,007 17,679 16,514

Total assets 19,931 19,624 19,599 19,219 19,021 16,849 16,522 16,208

Net debt6 6,959 6,869 6,869 7,312 7,286 6,141 6,278 6,294

Total capitalization7 14,461 14,649 15,088 14,959 14,524 13,100 13,253 13,190

Long-term debt 5,508 5,209 5,313 6,090 6,348 4,584 3,475 4,616

Owners’ equity 7,513 7,781 8,201 7,575 7,108 6,855 6,975 6,896

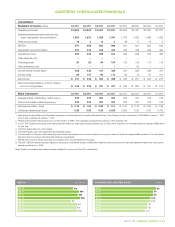

3.27

3.76

3.33

3.52

3.79

3.14

3.23

1. 90

2.00

2.00

2.205

2.01

1.20

0.875

1. 575

1. 825

BASIC EARNINGS AND DIVIDENDS PER SHARE ($)

11

10

10

09

08

07

06

05

dividends per share

prior to transition to IFRS