Telus 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 35

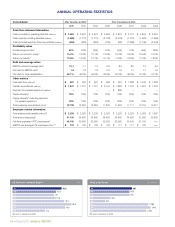

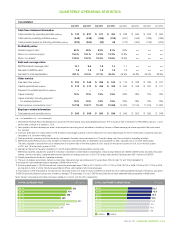

QUARTERLY OPERATING STATISTICS

456

470

311

449

397

564

512

409

CAPITAL EXPENDITURES ($ millions)

Q4 11

Q3 11

Q2 11

Q1 11

Q4 10

Q3 10

Q2 10

Q1 10

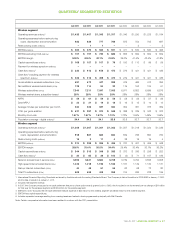

Consolidated

Q4 2011 Q3 2011 Q2 2011 Q1 2011 Q4 2010 Q3 2010 Q2 2010 Q1 2010

Cash flow statement information

Cash provided by operating activities (millions) $ 742 $ 837 $ 517 $ 454 $ 638 $ 906 $ 523 $ 603

Cash used by investing activities (millions) (548) (438) (466) (516) (501) (445) (389) (396)

Cash provided (used) by financing activities (millions) (204) (364) (53) 68 (170) (452) (139) (202)

Profitability ratios

Dividend payout ratio2 62% 59% 63% 61% 64% n.a. n.a. n.a.

Return on common equity3 15.5% 15.1% 14.3% 14.3% 13.8% n.a. n.a. n.a.

Return on assets4 12.8% 12.2% 12.5% 12.6% 13.6% n.a. n.a. n.a.

Debt and coverage ratios

EBITDA interest coverage ratio5 10.1 9.6 7.8 7.4 7.1 n.a. n.a. n.a.

Net debt to EBITDA ratio6 1.8 1.8 1.9 1.9 1.8 n.a. n.a. n.a.

Net debt to total capitalization 48.1% 47.0% 47.1% 46.4% 46.9% 46.8% 49.0% 48.9%

Other metrics

Free cash flow (millions)7 $ 204 $ 345 $ 286 $ 162 $ 115 $ 338 $ 239 $ 247

Capital expenditures (millions) $ 512 $ 470 $ 456 $ 409 $ 564 $ 449 $ 397 $ 311

Payment for wireless spectrum (millions) – – – – – – – –

Capex intensity8 19% 18% 18% 16% 22% 18% 17% 13%

Capex intensity8 including payment

for wireless spectrum 19% 18% 18% 16% 22% 18% 17% 13%

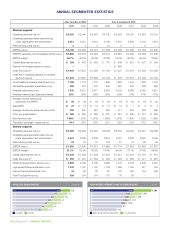

Total customer connections (000s)9 12,728 12,571 12,431 12,308 12,253 12,129 11,979 11,893

Employee-related information

Total salaries and benefits (millions) $ 595 $ 569 $ 560 $ 534 $ 546 $ 552 $ 559 $ 548

12.4

12.6

11.9

12.1

12.0

12.3

12.7

12.3

TOTAL CUSTOMER CONNECTIONS (millions)

Q4 11

Q3 11

Q2 11

Q1 11

Q4 10

Q3 10

Q2 10

Q1 10

wireless wireline

n.a. – not available; n.m. – not meaningful

1

International Financial Reporting Standards as issued by the International Accounting Standards Board. The Company’s date of transition to IFRS-IASB is January 1, 2010,

and its date of adoption is January 1, 2011.

2 Last quarterly dividend declared per share, in the respective reporting period, annualized, divided by the sum of Basic earnings per share reported in the most recent

four quarters.

3 Common share and non-voting share income divided by the average quarterly common share and non-voting share equity for the 12-month period. Quarterly ratios are

calculated on a 12-month trailing basis.

4 Cash provided by operating activities divided by total assets. Quarterly ratios are based on a 12-month trailing cash flow provided by operating activities.

5 EBITDA excluding Restructuring costs, divided by Financing costs before gains on redemption and repayment of debt, calculated on a 12-month trailing basis.

This ratio, adjusted to exclude the loss on redemption of long-term debt in the third quarter of 2010, was 8.3 in the second quarter of 2011, 8.2 in the first quarter

of 2011 and 7.9 in the fourth quarter of 2010.

6 Net debt at the end of the period divided by 12-month trailing EBITDA excluding Restructuring costs.

7 EBITDA as reported, adjusted for payments in excess of expense for share-based compensation, restructuring initiatives and defined benefit plans, and deducting cash

interest, cash income taxes, capital expenditures and payment for wireless spectrum. In 2011, TELUS also deducted the Transactel gain of $17 million from EBITDA.

8 Capital expenditures divided by Operating revenues.

9 The sum of wireless subscribers, network access lines, Internet access subscribers and TV subscribers (TELUS Optik TV and TELUS Satellite TV).

10 Includes net-cash settlement feature expenses of $169 million in 2007.

11 Excluding employees in TELUS International, total active employees were 27,800 in 2011, 26,400 in 2010, 27,700 in 2009, 28,700 in 2008, 27,500 in 2007, 27,100 in 2006

and 26,500 in 2005. In 2009, TELUS acquired Black’s Photo, which added 1,250 total employees.

12 The measure of FTE employees is not reported for fiscal year 2005, as it does not factor in effective overtime hours on staff equivalents because of the labour disruption.

13 EBITDA excluding Restructuring costs, divided by average FTE employees. For 2007, EBITDA excluded the net-cash settlement feature expense of $169 million.

Note: Certain comparative information has been restated to conform with the 2011 presentation.