Telus 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 . TELUS 2011 ANNUAL REPORT

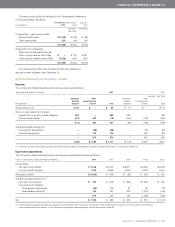

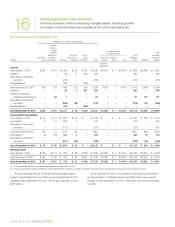

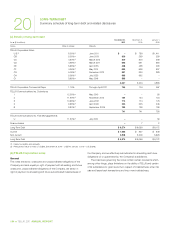

The Company’s investment in Transactel (Barbados) Inc. is summarized as follows:

Interest in Transactel (Barbados) Inc. attributable to:

Common Shares

and Non-Voting Shares Non-controlling interest(2) To ta l

Economic Economic Economic

($ in millions) interest interest interest

December 2008 tranche

Cash $ß 19

Contingent consideration 10

29 29.99%

January 2011 tranche 20 21.01%

Equity accounting adjustments through

February 1, 2011 (2)

47 51.00%

Gain on 51% interest re-measured

at acquisition-date fair value 16

Relative acquisition-date (February 1, 2011)

fair values 63 51.00% $ß60 49.00% $ß123 100.00%

May 2011 equity transaction(1) 56 44.00% (56) (44.00%) – –

$ß119 95.00% $ß 4 5.00% $ß123 100.00%

(1) The difference between the amount paid by the Company for the incremental 44% economic interest and the associated proportionate share of the non-controlling interest in the

net assets of Transactel (Barbados) Inc. was recorded as a credit to retained earnings in the Consolidated Statements of Changes in Owners’ Equity.

(2) The non-controlling interest at December 31, 2011, is included in the Consolidated Statements of Financial Position as a non-current provision due to the provision of a written put

option for the 5% economic interest not owned by the Company.

The acquisition was effected as follows:

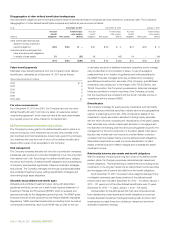

.On December 22, 2008, the Company acquired an initial 29.99%

economic interest in Transactel (Barbados) Inc. for $19 million

cash. Additional contingent consideration could become payable

depending upon Transactel (Barbados) Inc. earnings for the year

ended December 31, 2011.

Concurrent with acquiring the initial interest in Transactel

(Barbados) Inc., the Company provided two written put options

to the vendor. The first written put option became exercisable

on December 31, 2009, expiring June 30, 2011, and allowed the

vendor to put up to a further 21.01% economic interest to the

Company (the Company’s effective economic interest in Transactel

(Barbados) Inc. would become 51% assuming the written put

option was exercised in full). The second written put option became

exercisable on December 31, 2010, it had no expiry, and it allowed

the vendor to put whatever interest was not put under the first

written put option plus up to an incremental 44% economic interest

to the Company. The written put options set out the share pricing

methodology, which was dependent upon Transactel (Barbados) Inc.

future earnings.

The vendor provided the Company with two purchased call

options which substantially mirrored the written put options except

that they were only exercisable upon Transactel (Barbados) Inc.

achieving certain business growth targets.

The Company initially accounted for its investment in Transactel

(Barbados) Inc. using the equity method.

.On January 7, 2011, the Company exercised its first purchased call

option to acquire an additional 21.01% economic interest in Transactel

(Barbados) Inc. from the vendor for $20 million cash.

Upon such exercise, the Company continued to account for

its resulting direct 51% economic interest in Transactel (Barbados)

Inc. using the equity method. Transactel (Barbados) Inc.’s board

of directors “super-majority” provisions affected the Company’s

assessment of control as the continuing power to determine the

strategic operating, investing and financing policies of Transactel

(Barbados) Inc. resided with the board of directors “super-majority”.

Although the Company had the right to elect a simple majority of

the board of directors at the direct 51% economic interest level, the

vendor’s remaining direct 49% economic interest effectively had a

veto right over the strategic operating, investing and financing policies

of Transactel (Barbados) Inc. and thus the Company did not have

the control necessary to apply consolidation accounting.

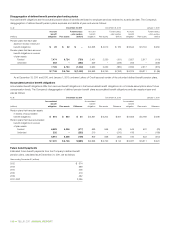

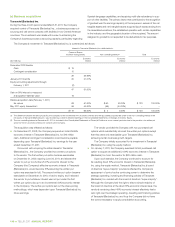

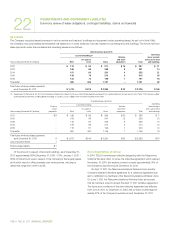

(e) Business acquisitions

Transactel (Barbados) Inc.

During the three-month period ended March 31, 2011, the Company

acquired control of Transactel (Barbados) Inc., a business process out-

sourcing and call centre company with facilities in two Central American

countries. The investment was made with a view to enhancing the

Company’s business process outsourcing capacity, particularly regarding

Spanish-language capabilities, and acquiring multi-site redundancy in sup-

port of other facilities. The primary factor that contributed to the recognition

of goodwill was the earnings capacity of the acquiree in excess of the net

tangible assets and net intangible assets acquired (such excess arising from:

the assembled workforce; the established operation with certain capabilities

in the industry; and the geographic location of the acquiree). The amount

assigned to goodwill is not expected to be deductible for tax purposes.