Telus 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 29

to continue to benefit from modestly lower financing costs

in 2012.

In November, we also entered into a new five-year $2 billion

bank credit facility with a syndicate of 15 financial institutions,

which provides TELUS with ample liquidity and backstops the

Company’s low-cost commercial paper program.

Our healthy financial position enabled us to make discretionary

contributions of $200 million in January 2011 and $100 million

in January 2012 to our defined benefit pension plans. These tax-

effective contributions positively impact earnings and help to

maintain a strong pension funding position that is among the best

in corporate Canada.

A key development in 2011 for shareholders who were

experiencing volatility and negative returns in the stock markets

due to global economic uncertainty was TELUS’ initiative to

clarify our dividend growth model. In May 2011, the Company

announced plans to continue with two dividend increases per

year to 2013, normally declared in May and November, with

an expectation that the increase would be in the range of circa

10 per cent annually. Dividend decisions will continue to be

subject to the Board’s assessment of the Company’s financial

situation and outlook on a quarterly basis.

In 2011, TELUS shareholders enjoyed a total return,

including dividends, of 32 per cent as compared to a negative

nine per cent total return for the Toronto Stock Exchange

overall com posite index.

A passion for excellence

Our disclosure practices continue to gain external recognition.

Our 2010 annual report was ranked eighth best in the world

by the Annual Report on Annual Reports, a global ranking of

1,500 companies. IR Magazine, through a survey of more than

250 investment professionals, recognized TELUS early in 2012

for having the best financial reporting and fourth best investor

relations program in Canada.

As well, the Canadian Institute of Chartered Accountants

(CICA) recognized TELUS with the Overall Award of Excellence

for Corporate Reporting, CICA’s highest award in Canada, for

the fourth time in the last five years. We also received Honourable

Mention (second) for Excellence in Sustainable Development

Reporting.

Growing value

Building on the momentum created in 2011, we are optimistic

about our future prospects while aware of the many risks we

face, whether they be competitive, need for spectrum or

otherwise. This positive outlook is reflected in our 2012 targets

and the clarity of our dividend growth model

out to 2013.

Our financial strength, unrelenting focus on our growth

strategy and disciplined adherence to our financial policies serve

to posi tion TELUS for continued success and should provide

ongoing value for investors.

Sincerely,

Robert McFarlane

Executive Vice-President and Chief Financial Officer

February 23, 2012

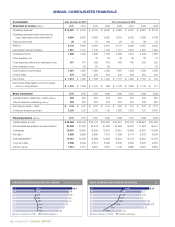

consolidated and segmented 2012 targets

and expected growth

Revenues

$10.7 to

$11.0 billion

3 to 6%

EBITDA

$3.8 to

$4.0 billion

1 to 6%

Basic earnings

per share (EPS)

$3.75 to $4.15

0 to 10%

Capital

expenditures

Approximately

$1.85 billion

no change

Wireless

revenues

$5.75 to

$5.9 billion

5 to 8%

Wireless

EBITDA

$2.3 to

$2.4 billion

5 to 10%

Wireline

revenues

$4.95 to

$5.1 billion

0 to 3%

Wireline

EBITDA

$1.5 to

$1.6 billion

(6) to 1%