Telus 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 . TELUS 2011 ANNUAL REPORT

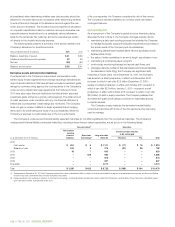

(b) Temporary differences

The Company must make significant estimates in respect of the compo-

sition of its deferred income tax liability. The operations of the Company

are complex and the related tax interpretations, regulations and legislation

are continually changing. As a result, there are usually some tax matters

in question.

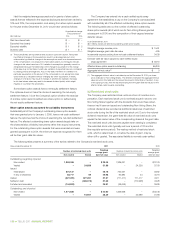

Temporary differences comprising the net deferred income tax liability and the amounts of deferred income tax expense recognized in the statements

of income and other comprehensive income for each temporary difference are estimated as follows:

Recognized in

Other Business

December 31, comprehensive acquisitions December 31,

(millions) 2010 Net income income and other 2011

(adjusted –

Note 25(d))

Property, plant and equipment and intangible assets subject to amortization $ 326 $ß 68 $ – $ – $ 394

Intangible assets with indefinite lives 1,092 19 – 2 1,113

Partnership income unallocated for income tax purposes 398 23 – – 421

Net pension and share-based compensation amounts (23) 65 (288) – (246)

Reserves not currently deductible (92) 6 – – (86)

Losses available to be carried forward(1) (36) 1 – – (35)

Other 18 23 2 (4) 39

Net deferred income tax liability $ß1,683 $ß205 $ß(286) $ß(2) $ß1,600

(1) The Company expects to be able to utilize its non-capital losses prior to expiry.

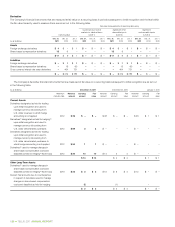

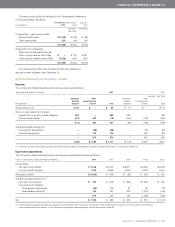

Recognized in

Other Business

January 1, comprehensive acquisitions December 31,

(millions) 2010 Net income income and other 2010

(Note 25(d)) (adjusted –

Note 25(d))

Property, plant and equipment and intangible assets subject to amortization $ 251 $ß 75 $ – $ – $ 326

Intangible assets with indefinite lives 1,047 45 – – 1,092

Partnership income unallocated for income tax purposes 437 (39) – – 398

Net pension and share-based compensation amounts (52) 99 (70) – (23)

Reserves not currently deductible (141) 49 – – (92)

Losses available to be carried forward(1) (41) 5 – – (36)

Other 21 (17) 17 (3) 18

Net deferred income tax liability $ß1,522 $ß217 $ß(53) $ß(3) $ß1,683

(1) The Company expects to be able to utilize its non-capital losses prior to expiry.

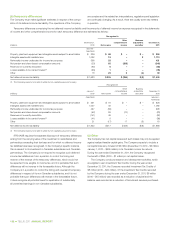

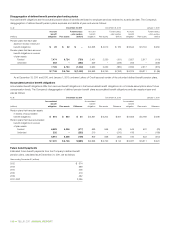

IFRS-IASB requires the separate disclosure of temporary differences

arising from the carrying value of the investment in subsidiaries and

partnerships exceeding their tax base and for which no deferred income

tax liabilities have been recognized. In the Company’s specific instance

this is relevant to its investment in Canadian subsidiaries and Canadian

partnerships. The Company is not required to recognize such deferred

income tax liabilities as it is in a position to control the timing and

manner of the reversal of the temporary differences, which would not

be expected to be exigible to income tax, and it is probable that such

differences will not reverse in the foreseeable future. Although the

Company is in a position to control the timing and reversal of temporary

differences in respect of its non-Canadian subsidiaries, and it is not

probable that such differences will reverse in the foreseeable future,

it does recognize all potential taxes for repatriation of substantially

all unremitted earnings in non-Canadian subsidiaries.

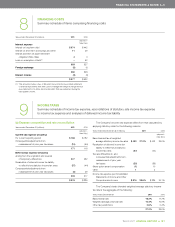

(c) Other

The Company has net capital losses and such losses may only be applied

against realized taxable capital gains. The Company expects to include a

net capital loss carry-forward of $5 million (December 31, 2010 – $5 million;

January 1, 2010 – $605 million) in its Canadian income tax returns.

During the year ended December 31, 2011, the Company recog nized

the benefit of $NIL (2010 – $1 million) in net capital losses.

The Company conducts research and development activities, which

are eligible to earn Investment Tax Credits. During the year ended

December 31, 2011, the Company recorded Investment Tax Credits of

$8 million (2010 – $20 million). Of the Investment Tax Credits recorded

by the Company during the year ended December 31, 2011, $6 million

(2010 – $15 million) was recorded as a reduction of capital and the

balance was recorded as a reduction of Goods and services purchased.