Telus 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 167

FINANCIAL STATEMENTS & NOTES: 25

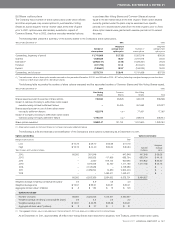

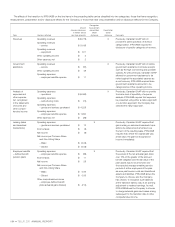

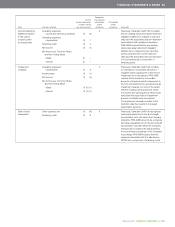

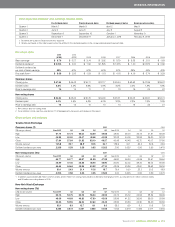

The effects of the transition to IFRS-IASB on the line items in the preceding table can be classified into two categories: those that have recognition,

measurement, presentation and/or disclosure effects for the Company, or those that have only presentation and/or disclosure effects for the Company.

Topic

Amount of effect Recognition,

(increase (decrease), measurement,

in millions) presentation Presentation

January 1, December 31, and/or and/or

Line items affected 2010 2010 disclosure disclosure

Comments

Sale of accounts

receivable

Accounts receivable $ 501 $ 401 X

Short-term borrowings $ 500 $ 400

Accounts payable

and accrued liabilities $ß (1) $ –

Income and other

taxes payable $ 1 $ –

Retained earnings $ 1 $ 1

Previously, Canadian GAAP de-recognized

trade receivables sold to the arm’s-

length securitization trust with which the

Company transacts. IFRS-IASB does not

de-recognize the trade receivables sold

to the arm’s-length securitization trust

with which the Company transacts and

considers the sale proceeds to be short-

term borrowings of the Company.

Income taxes

– current

Income and other X

taxes receivable $ – $ 6

Income and other

taxes payable $ – $ 6

Previously, Canadian GAAP permitted

offsetting current income tax assets and

current income tax liabilities if they related

to the same taxable entity and taxation

authority. IFRS-IASB permits offsetting

current income tax assets and current

income tax liabilities only if there is a legal

right of offset.

Impairment

of assets

Property, plant and equipment

$ 91 $ 86 X

Intangible assets, net $ß1,018 $ß1,018

Deferred income taxes $ 281 $ 280

Retained earnings $ 828 $ 824

Previously, Canadian GAAP did not allow

for increases in recoverable amounts of

impaired assets subsequent to the time

of impairment to be recognized. IFRS-IASB

requires that increases in recoverable

amounts of impaired assets subsequent to

the time of impairment be recognized as an

impairment reversal, but only to the extent

that the resulting carrying amount would

not exceed the carrying amount that would

have been the result had an impair ment

amount not initially been recognized.

Previously, Canadian GAAP required, given

the Company’s facts and circumstances,

that the Company’s spectrum licences

be assessed for impairment separately.

IFRS-IASB requires, given the Company’s

facts and circumstances, that the Com-

pany’s spectrum licences be assessed

for impairment as a part of the Wireless

cash-generating unit. The result is that the

$910 million impairment recorded by the

Company in 2002 would not have been

required under IFRS-IASB.

Previously, when Canadian GAAP intro-

duced impairment of assets for intangible

assets with indefinite lives, it concurrently

ceased requiring their amortization and

it did so on a prospective basis and thus

the $108 million of associated amortization

recorded to that point in time by the

Company was not reversed. IFRS-IASB

transitional rules require the amortization

cessation to be accounted for retrospec-

tively with the result being the reversal

of the amortization previously recorded

under Canadian GAAP.