Telus 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

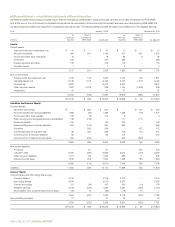

168 . TELUS 2011 ANNUAL REPORT

Topic

Amount of effect Recognition,

(increase (decrease), measurement,

in millions) presentation Presentation

January 1, December 31, and/or and/or

Line items affected 2010 2010 disclosure disclosure

Comments

Decommissioning

liabilities included

in the cost of

property, plant

and equipment

Property, plant X

and equipment $ß 12 $ß 23

Non-current liabilities

– provisions $ß 21 $ß 33

Deferred income taxes $ (2) $ (2)

Retained earnings $ (7) $ (8)

Previously, Canadian GAAP did not adjust

the pre-existing discounted asset retire-

ment obligation balance for changes in

discount rates and the associated discount

accretion was included with operations

expenses. IFRS-IASB requires that the

pre-existing discounted asset retirement

obligation balance be re-measured every

reporting period using the then current

discount rates and the associated discount

accretion is to be included as a component

of financing costs.

Employee benefits

– defined benefit

plans

Other long-term assets $ß(1,314) $ß(1,504) X

Other long-term liabilities $ß 142 $ß 200

Deferred income taxes $ (379) $ (442)

Retained earnings $ß(1,077) $ß(1,262)

Previously, Canadian GAAP required

that the accrued benefit assets (liabilities)

of defined benefit plans, rather than their

funded states, be presented in the state-

ment of financial position. IFRS-IASB

requires that the funded states of defined

benefit plans be presented in the state-

ment of financial position.

Leasing (sales

and leaseback

transactions)

Accounts payable X

and accrued liabilities $ (6) $ (7)

Other long-term liabilities $ (31) $ (18)

Deferred income taxes $ß 7 $ß 4

Retained earnings $ß 30 $ß 21

Previously, Canadian GAAP required that

gains arising on sales and leaseback trans-

actions be deferred and amortized over

the term of the resulting lease. IFRS-IASB

requires that, where the original sale was

at fair value, the gain be recognized in

income immediately.

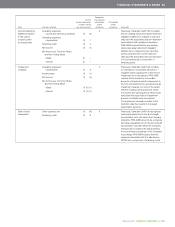

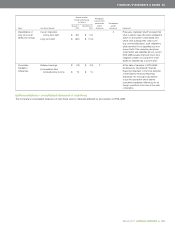

Income taxes

– deferred

Other long-term assets $ (2) $ (5) X

Income and other

taxes payable $ (9) $ (6)

Current portion of

deferred income taxes $ (294) $ (348)

Deferred income taxes $ß 296 $ß 345

Contributed surplus $ (14) $ (14)

Retained earnings $ß 19 $ß 18

Previously, Canadian GAAP classified

taxable and deductible temporary differ-

ences arising from current assets and

current liabilities as current deferred

income tax liabilities and assets, respec-

tively. IFRS-IASB requires that taxable

and deductible temporary differences

arising from current assets and current

liabilities be classified as non-current

deferred income tax liabilities and assets,

respectively.

Provisions Accounts payable X

and accrued liabilities $ (42) $ (11)

Restructuring accounts

payable and accrued

liabilities $ (135) $ (111)

Advance billings and

customer deposits $ (144) $ß –

Current liabilities

– provisions $ß 299 $ß 122

Other long-term liabilities $ (48) $ (171)

Non-current liabilities

– provisions $ß 70 $ß 171

Previously, Canadian GAAP did not

identify provisions as a specific subset

of liabilities. IFRS-IASB requires that

provisions be presented on the statement

of financial position as a distinct line

item and that the movements in each

“class” of provisions be disclosed.

Relative to previous Canadian GAAP, the

application of IFRS-IASB may result in

provisions being recognized sooner and

for differing amounts. For the periods

presented, the Company is not materially

affected by the provision recognition

and measurement differences between

previous Canadian GAAP and IFRS-IASB.