Telus 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156 . TELUS 2011 ANNUAL REPORT

In addition to the ability to provide letters of credit pursuant to its

$2.0 billion bank credit facility, the Company has $115 million of letter

of credit facilities expiring mid-2013, all of which were utilized at

December 31, 2011.

(e) TELUS Communications Inc. debentures

The outstanding Series 1 through 5 debentures were issued by a pre-

decessor corporation of TELUS Communications Inc., BC TEL, under a

Trust Indenture dated May 31, 1990, and are non-redeemable.

The outstanding Series B Debentures were issued by a predecessor

corporation of TELUS Communications Inc., AGT Limited, under a Trust

Indenture dated August 24, 1994, and a supplemental trust indenture

dated September 22, 1995. They are redeemable at the option of the

Company, in whole at any time or in part from time to time, on not less

than 30 days’ notice at the higher of par and the price calculated to

provide the Government of Canada Yield plus 15 basis points.

Pursuant to an amalgamation on January 1, 2001, the Debentures

became obligations of TELUS Communications Inc. The debentures

are not secured by any mortgage, pledge or other charge and are gov-

erned by certain covenants, including a negative pledge and a limitation

on issues of additional debt, subject to a debt to capitalization ratio

and interest coverage test. Effective June 12, 2009, TELUS Corporation

guaranteed the payment of the debentures’ principal and interest.

(f) TELUS Communications Inc. first mortgage bonds

The first mortgage bonds were issued by TELUS Communications

(Québec) Inc. and were secured by an immovable hypothec and by a

movable hypothec charging specifically certain immovable and movable

property of the subsidiary TELUS Communications Inc., such as land,

buildings, equipment, apparatus, telephone lines, rights-of-way and

similar rights limited to certain assets located in the province of Quebec.

The first mortgage bonds were non-redeemable. Pursuant to a corporate

reorganization effected July 1, 2004, the outstanding first mortgage

bonds became obligations of TELUS Communications Inc. Effective

June 12, 2009, TELUS Corporation guaranteed the payment of the first

mortgage bonds’ principal and interest.

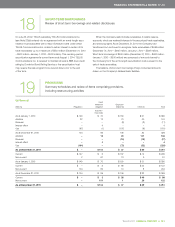

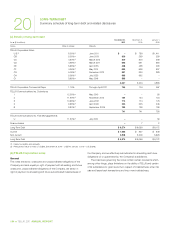

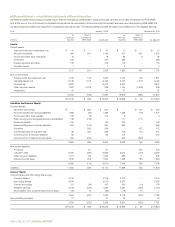

(g) Long-term debt maturities

Anticipated requirements to meet long-term debt repayments, calculated

upon such long-term debts owing as at December 31, 2011, for each of

the next five fiscal years are as follows:

Years ending December 31 (millions)

2012 $ß1,066

2013 300

2014 700

2015 625

2016 600

Thereafter 3,324

Future cash outflows in respect of

long-term debt principal repayments 6,615

Future cash outflows in respect of

associated interest and like carrying costs(1) 2,107

Undiscounted contractual maturities (Note 4(c)) $ß8,722

(1) Future cash outflows in respect of associated interest and like carrying costs for

commercial paper and amounts drawn under the Company’s credit facilities (if any)

have been calculated based upon the rates in effect as at December 31, 2011.

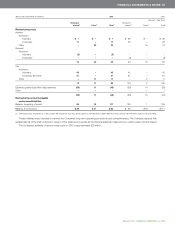

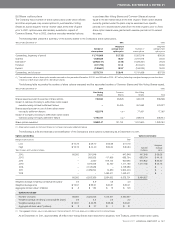

21 COMMON SHARE AND NON-VOTING SHARE EQUITY

Review of Common Share and Non-Voting Share equity items,

including share option price stratification

(a) Authorized share capital

As at December 31, 2011, December 31, 2010, and January 1, 2010, the

Company’s authorized share capital consisted of one billion no par value

shares of each of the following classes: First Preferred Shares; Second

Preferred Shares; Common Shares; and Non-Voting Shares. Only holders

of Common Shares may vote at general meetings of the Company with

each holder of Common Shares being entitled to one vote per Common

Share held at all such meetings. Non-Voting Shares have conversion

rights in certain instances, such as if there are changes in Canadian

telecommunications, radiocommunication and broadcasting regulations

so that there is no restriction on non-Canadians owning or controlling

Common Shares of the Company. In that instance, shareholders have

the right to convert their Non-Voting Shares into Common Shares on

a one-for-one basis, and the Company has the right to require conversion

on the same basis.

With respect to priority in payment of dividends and in the distribution

of assets in the event of liquidation, dissolution or winding-up of the

Company, whether voluntary or involuntary, or any other distribution of

the assets of the Company among its shareholders for the purpose of

winding-up its affairs, preferences are as follows: First Preferred Shares;

Second Preferred Shares; and finally Common Shares and Non-Voting

Shares participating equally, without preference or distinction.

Subsequent to December 31, 2011, the Company announced that

holders of its Common Shares and Non-Voting Shares will have the

opportunity to decide whether to eliminate the Company’s Non-Voting

Share class at the Company’s annual and special meeting to be held

May 9, 2012. Under the terms of the proposal, each Non-Voting Share

would be converted into a Common Share on a one-for-one basis,

effected by way of a court-approved plan of arrangement and will be

subject to the approval of two-thirds of the votes cast by the holders

of Common Shares and two-thirds of the votes cast by the holders of

Non-Voting Shares, each voting separately as a class.