Telus 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 . TELUS 2011 ANNUAL REPORT

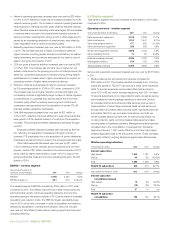

Report on 2011 financing and capital structure management plans

Use proceeds from securitized trade receivables (presented as Short-term borrowings), bank facilities, commercial paper

and dividend reinvestment, as needed, to supplement free cash flow and meet other cash requirements

In the first quarter of 2011, issued commercial paper increased by $150 million to help fund the $200 million discretionary contribution to defined benefit

pension plans, as well as acquisitions in the period. During the second quarter of 2011, commercial paper increased by $728 million and supplemented the

May 2011, $600 million five-year Note issue, which together enabled repayment of matured U.S. dollar Notes and settlement of associated cross currency

interest rate swap agreements, as well as funding an additional investment in Transactel (Barbados) Inc. In the third quarter of 2011, TELUS reduced its

commercial paper by $221 million to a balance of $761 million at September 30. In the fourth quarter of 2011, commercial paper increased by $5 million.

Maintain compliance with financial objectives, policies and guidelines

Maintain a minimum $1 billion in unutilized liquidity – The Company had unutilized credit facilities of $1.28 billion at December 31, 2011, as well as

$100 million additional availability under the trade receivables securitization program.

Net debt to EBITDA excluding restructuring costs ratio of 1.5 to 2.0 times – Actual result of 1.8 times at December 31, 2011. See Section 7.4.

Dividend payout ratio guideline of 55 to 65% of sustainable net earnings on a prospective basis – See Section 7.4.

Maintain position of fully hedging foreign exchange exposure for indebtedness

The Company’s only debt issue denominated in a foreign currency matured and was repaid on June 1, 2011, and the corresponding derivative liability was settled.

Preserve access to the capital markets at a reasonable cost by maintaining investment grade credit ratings in the range

of BBB+ to A–, or the equivalent

At February 23, 2012, investment grade credit ratings from the four rating agencies that cover TELUS were in the desired range.

2012 financing and capital structure management plans

At December 31, 2011, TELUS had access to undrawn credit facilities

of more than $1.28 billion and availability of $100 million under its trade

receivables securitization program. The Company also had access to

a shelf prospectus pursuant to which it can issue up to $2.5 billion of

debt and equity. TELUS believes that its investment grade credit ratings

contribute to reasonable access to capital markets to facilitate future

debt issuance.

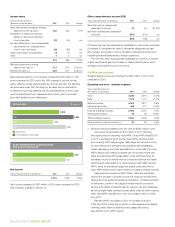

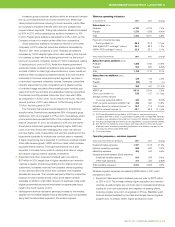

The Company’s long-term debt principal maturities are illustrated

in the chart below. At the end of 2011, 83% of TELUS’ total debt was

on a fixed-rate basis and the weighted average term to maturity was

approximately 5.6 years.

TELUS expects to generate free cash flow in 2012, which would be

available to, among other things, pay dividends to holders of Common

Shares and Non-Voting Shares. TELUS plans to continue with two

dividend increases per year to 2013, normally declared in May and

November, and expects the annual increase to be in the range of circa

10% over this timeframe. The dividend growth model is not necessarily

indicative of dividend increases beyond 2013. Notwithstanding this,

dividend decisions will continue to be subject to the Board’s assessment

and determination of the Company’s financial situation and outlook

on a quarterly basis. TELUS is maintaining its long-term dividend payout

ratio guideline of 55 to 65% of prospective sustainable net earnings.

While anticipated cash flow is expected to be more than sufficient

to meet current requirements and remain in compliance with TELUS’

financial policies, these intentions could constrain TELUS’ ability to invest

in its operations for future growth. As described in Section 1.5, payment

of cash income taxes, funding of defined benefit pension plans and,

potentially, capital expenditures for wireless spectrum, will reduce the

after-tax cash flow otherwise available to return capital to the Company’s

shareholders. If actual results are different from TELUS’ expectations,

there can be no assurance that TELUS will not need to change its

financing plans, or its intention to pay dividends according to the target

payout guideline. For the related risk discussion, see Section 10.6

Financing and debt requirements.

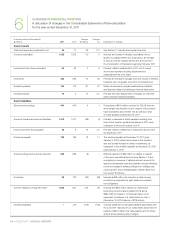

4.4 Disclosure controls and procedures

and internal control over financial reporting

Disclosure controls and procedures

Disclosure controls and procedures are designed to provide reasonable

assurance that all relevant information is gathered and reported to senior

management, including the President and Chief Executive Officer (CEO)

and the Executive Vice-President and Chief Financial Officer (CFO),

on a timely basis so that appropriate decisions can be made regarding

public disclosure.

The CEO and the CFO have evaluated the effectiveness of the

Company’s disclosure controls and procedures related to the preparation

of the MD&A and the Audited consolidated financial statements dated

December 31, 2011. They have concluded that the Company’s disclosure

controls and procedures were effective, at a reasonable assurance

level, to ensure that material information relating to the Company and

its consolidated subsidiaries would be made known to them by others

within those entities, particularly during the period in which the MD&A

LONG-TERM DEBT PRINCIPAL MATURITIES

AS AT DECEMBER 31, 2011 ($ millions)

The average term to maturity is 5.6 years at December 31, 2011.

700

625

1,066

300

300 766

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016 600

2015

2013

2014

2012

700

1,000

1,000

175

249

200

Commercial paper