Telus 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 125

FINANCIAL STATEMENTS & NOTES: 4

The income tax expenses, which are reflected net in the sensitivity analysis, reflect the applicable weighted average statutory income tax rates for

the reporting periods.

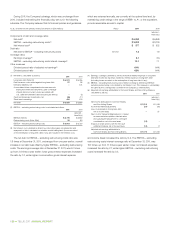

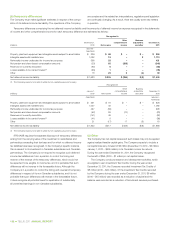

Years ended December 31 Net income Other comprehensive income Comprehensive income

($ increase (decrease) in millions) 2 0 11 2010 2 0 11 2010 2 0 11 2010

Reasonably possible changes in market risks(1)

10% change in Cdn.$: U.S.$ exchange rate

Canadian dollar appreciates $ß(6) $ß(7) $ß(7) $ß(10) $ß(13) $ß(17)

Canadian dollar depreciates $ 6 $ 7 $ 7 $ 10 $ 13 $ 17

25 basis point change in market interest rate

Rate increases $ß(2) $ß(1) $ – $ – $ß (2) $ß (1)

Rate decreases $ 2 $ 1 $ – $ – $ 2 $ 1

25%(2) change in Common Share

and Non-Voting Share prices(3)

Price increases $ß(2) $ß(2) $ 5 $ 4 $ 3 $ 2

Price decreases $ 2 $ 1 $ß(5) $ß (4) $ß (3) $ß (3)

(1) These sensitivities are hypothetical and should be used with caution. Changes in net income and/or other comprehensive income generally cannot be extrapolated because

the relationship of the change in assumption to the change in net income and/or other comprehensive income may not be linear. In this table, the effect of a variation in a particular

assumption on the amount of net income and/or other comprehensive income is calculated without changing any other assumption; in reality, changes in one factor may result

in changes in another (for example, increases in market interest rates may result in more favourable foreign exchange rates (increased strength of the Canadian dollar)), which might

magnify or counteract the sensitivities.

The sensitivity analysis assumes that changes in exchange rates and market interest rates would be realized by the Company; in reality, the competitive marketplace in which

the Company operates would impact this assumption.

No consideration has been made for a difference in the notional number of shares associated with share-based compensation awards made during the reporting period that

may have arisen due to a difference in the Non-Voting Share price.

(2) To facilitate ongoing comparison of sensitivities, a constant variance of approximate magnitude has been used. Reflecting a 4.25-year data period and calculated on a monthly basis,

which is consistent with the current assumptions and methodology set out in Note 13(b), the volatility of the Company’s Non-Voting Share price as at December 31, 2011, was 24.1%

(2010 – 4.50-year data period, 26.7%); reflecting the twelve-month data period ended December 31, 2011, the volatility was 13.5% (2010 – 14.2%).

(3) The hypothetical effects of changes in the prices of the Company’s Common Shares and Non-Voting Shares are restricted to those which would arise from the Company’s share-

based compensation items that are accounted for as liability instruments and the associated cash-settled equity swap agreements.

The Company is exposed to other price risks in respect of its financial instruments, as discussed further in (f).

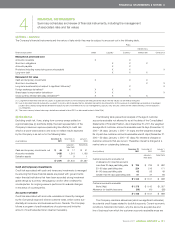

(h) Fair values

General

The carrying values of cash and temporary investments, accounts

receiv able, short-term obligations, short-term borrowings, accounts

payable and certain provisions (including restructuring accounts payable)

approximate their fair values due to the immediate or short-term maturity

of these financial instruments. The carrying values of the Company’s

investments accounted for using the cost method do not exceed their

fair values.

The carrying value of short-term investments, if any, equals their fair

value as they are classified as held for trading. The fair value is determined

directly by reference to quoted market prices in active markets.

The fair values of the Company’s long-term debt are based on quoted

market prices in active markets.

The fair values of the Company’s derivative financial instruments used

to manage exposure to interest rate and currency risks are estimated

based on quoted market prices in active markets for the same or similar

financial instruments or on the current rates offered to the Company for

financial instruments of the same maturity as well as the use of discounted

future cash flows using current rates for similar financial instruments

subject to similar risks and maturities (such fair values being largely based

on Canadian dollar: U.S. dollar forward exchange rates and interest rate

yield curves as at the statement of financial position dates).

The fair values of the Company’s derivative financial instruments used

to manage exposure to increases in compensation costs arising from

certain forms of share-based compensation are based upon fair value

estimates of the related cash-settled equity forward agreements provided

by the counterparty to the transactions (such fair value estimates being

largely based upon the Company’s Common Share and Non-Voting Share

prices as at the statement of financial position dates).